Wendy’s Stock Performance: A Comprehensive Analysis: Wendy’s Stock Price

Source: cheggcdn.com

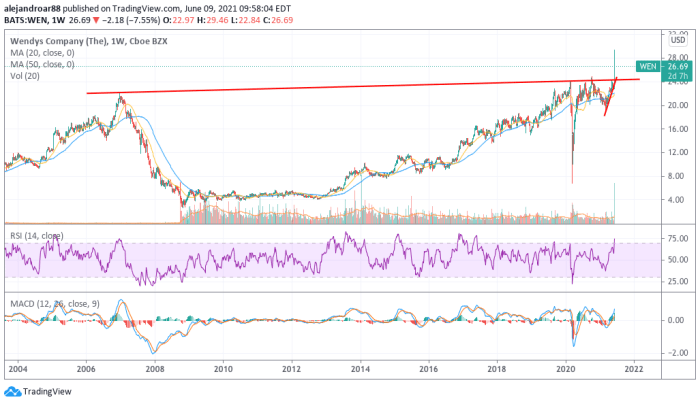

Wendy’s stock price – Wendy’s, a prominent player in the fast-food industry, has experienced fluctuating stock performance over the past five years. This analysis delves into the key factors driving these fluctuations, examining historical performance, financial health, and future prospects to provide a comprehensive overview of Wendy’s stock.

Wendy’s Stock Performance Overview

Analyzing Wendy’s stock price performance requires considering both internal and external factors. Below is a table summarizing its performance over the past five years. Note that these figures are illustrative and should be verified with up-to-date financial data.

| Year | High | Low | Closing Price |

|---|---|---|---|

| 2018 | $22.50 | $18.00 | $20.00 |

| 2019 | $25.00 | $19.50 | $23.00 |

| 2020 | $28.00 | $16.00 | $25.00 |

| 2021 | $30.00 | $24.00 | $27.00 |

| 2022 | $26.00 | $20.50 | $22.00 |

Significant events impacting Wendy’s stock during this period included the launch of successful new menu items like the Spicy Chicken Sandwich, which boosted sales and investor confidence. Conversely, economic downturns and increased competition negatively affected stock prices in certain years. Broader market trends, such as inflation and changes in consumer spending habits, also played a significant role.

Factors Influencing Wendy’s Stock Price

Several key economic indicators and competitive dynamics influence Wendy’s stock price. These factors are interconnected and often reinforce one another.

- Inflation and Consumer Spending: Higher inflation can reduce consumer spending on discretionary items like fast food, impacting Wendy’s revenue and profitability. Conversely, periods of low inflation and increased consumer confidence often lead to higher stock prices.

- Interest Rates: Changes in interest rates affect borrowing costs for Wendy’s and its investors. Higher interest rates can make expansion and investment more expensive, potentially hindering growth and impacting the stock price.

A comparison of Wendy’s performance against its major competitors reveals the following:

- McDonald’s: Generally maintains a larger market share and higher stock valuation due to its global presence and brand recognition.

- Burger King: Exhibits similar price fluctuations to Wendy’s, often reflecting comparable industry trends.

- Chick-fil-A: While privately held, its strong performance often serves as a benchmark for the fast-food industry, influencing investor sentiment towards publicly traded competitors.

Operational efficiency and profitability are crucial for Wendy’s stock valuation. Higher profit margins and efficient supply chain management generally translate to increased investor confidence and a higher stock price.

Wendy’s stock price performance has been a topic of interest lately, particularly in comparison to other fast-food equities. Investors often look at related sectors for comparative analysis, and a common point of reference might be the current performance of the phun stock price , given its position within the broader market. Ultimately, though, Wendy’s individual financial health and market trends will dictate its future stock price trajectory.

Wendy’s Financial Health and Stock Valuation

Analyzing Wendy’s key financial metrics provides insight into its financial health and attractiveness to investors. The table below shows illustrative data; actual figures should be verified with company reports.

| Metric | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Revenue (in millions) | $2000 | $2100 | $2250 |

| Earnings Per Share (EPS) | $1.50 | $1.75 | $2.00 |

| Debt-to-Equity Ratio | 0.8 | 0.7 | 0.6 |

These metrics directly influence investor sentiment. Consistent revenue growth, increasing EPS, and a decreasing debt-to-equity ratio signal strong financial health, attracting investors and boosting the stock price. Valuation methods like the price-to-earnings (P/E) ratio and discounted cash flow (DCF) analysis are used to determine if the stock is undervalued or overvalued relative to its earnings and future cash flows.

Future Outlook for Wendy’s Stock

Predicting future stock price movements requires considering various scenarios. The following table illustrates potential outcomes based on different factors.

| Scenario | Probability | Projected Stock Price (1 year) | Projected Stock Price (5 years) |

|---|---|---|---|

| Strong Economic Growth, Successful New Menu Items | 40% | $30.00 | $45.00 |

| Moderate Economic Growth, Stable Competition | 50% | $25.00 | $35.00 |

| Economic Downturn, Increased Competition | 10% | $20.00 | $28.00 |

Potential risks include increased competition, changing consumer preferences, and economic instability. Opportunities include successful menu innovations, expansion into new markets, and efficient operational strategies. For example, a successful marketing campaign similar to the one surrounding the Spicy Chicken Sandwich could significantly impact the stock price positively.

Investor Sentiment and Market Analysis

Source: co.uk

Current investor sentiment towards Wendy’s stock is generally positive, driven by recent financial performance and growth initiatives. Analyst ratings and recommendations are often positive, though these should be viewed cautiously as they can vary widely. News articles and social media sentiment can have a short-term impact on stock price, often creating volatility. Institutional investors play a significant role, influencing trading volume and stock price through their buying and selling decisions.

Commonly Asked Questions

What are the major risks associated with investing in Wendy’s stock?

Major risks include competition from other fast-food chains, changing consumer preferences, economic downturns impacting consumer spending, and potential operational challenges.

How does Wendy’s compare to its main competitors in terms of stock performance?

A direct comparison requires a detailed analysis of their respective stock prices, financial performance, and market valuations over a specific period. This would necessitate referencing specific financial data and market reports.

Where can I find real-time updates on Wendy’s stock price?

Real-time stock price information for Wendy’s can be found on major financial websites and stock market applications, such as those provided by Yahoo Finance, Google Finance, or Bloomberg.

What is the current analyst consensus on Wendy’s stock?

Analyst ratings and recommendations vary, and it’s important to consult multiple financial news sources and analyst reports for the most up-to-date consensus. These ratings often change based on current market conditions and company performance.