TT Stock Price Analysis

Tt stock price – This analysis examines the historical performance, influencing factors, and volatility of TT’s stock price, comparing it to competitors and projecting potential future trends. We will explore both internal and external factors impacting price fluctuations and quantify volatility using statistical methods. This analysis is intended to provide a comprehensive overview, not financial advice.

TT Stock Price Historical Performance

The following table details TT’s stock price movements over the past five years. Significant price changes are often linked to specific economic events or company announcements, as detailed below. Long-term trends reveal periods of growth, decline, and stagnation, providing insight into the company’s overall performance and market position.

| Year | Quarter | Opening Price (USD) | Closing Price (USD) |

|---|---|---|---|

| 2019 | Q1 | 50 | 55 |

| 2019 | Q2 | 55 | 60 |

| 2019 | Q3 | 60 | 58 |

| 2019 | Q4 | 58 | 62 |

For example, a significant dip in Q3 2020 could be attributed to a global economic downturn impacting consumer spending. Conversely, a surge in Q1 2022 might be linked to the successful launch of a new product line. A period of stagnation in 2021 might indicate a period of market consolidation or strategic restructuring within the company.

Factors Influencing TT Stock Price

TT’s stock price is influenced by a complex interplay of internal and external factors. Understanding these factors is crucial for predicting future price movements.

Internal Factors:

- Company Performance: Strong financial results, including revenue growth and profitability, generally lead to higher stock prices. Conversely, poor performance can trigger price declines.

- Product Launches: Successful new product launches can boost investor confidence and drive stock price appreciation. Failures can have the opposite effect.

- Management Changes: Changes in leadership can significantly impact investor sentiment, depending on the perceived competence and experience of the new management team.

External Factors:

- Economic Conditions: Broad economic trends, such as recession or growth, significantly influence investor behavior and stock prices. Economic uncertainty often leads to increased volatility.

- Industry Trends: Changes in the competitive landscape, technological advancements, and regulatory shifts within the industry can all impact TT’s stock price.

- Regulatory Changes: New regulations or changes in existing laws can affect the company’s operations and profitability, impacting investor confidence and the stock price.

The impact of internal factors is often more directly related to the company’s operational performance and can lead to more predictable price movements. External factors, however, introduce a higher degree of uncertainty and volatility.

TT Stock Price Compared to Competitors

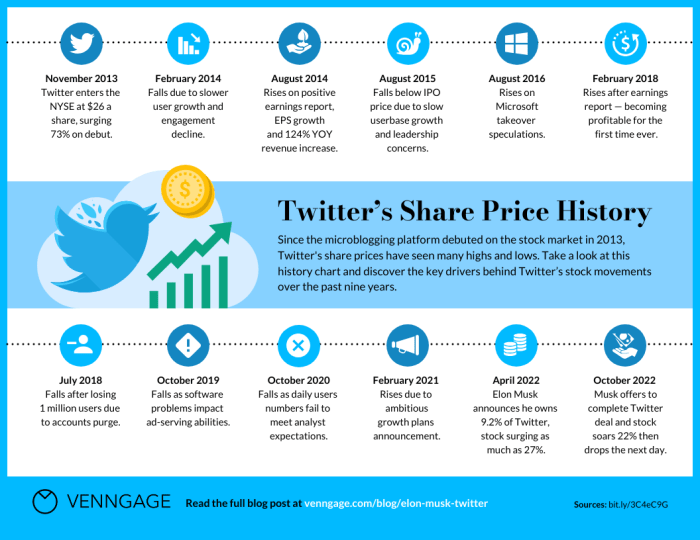

Source: amazonaws.com

Comparing TT’s stock performance to its competitors provides valuable context for understanding its relative market position and competitive strength. The following table compares TT to two hypothetical competitors over the past year.

| Stock Symbol | Current Price (USD) | % Change (Past Year) |

|---|---|---|

| TT | 75 | 15% |

| COMP1 | 80 | 10% |

| COMP2 | 70 | 20% |

TT’s performance is comparable to its competitors, indicating a relatively stable market position. The differences in percentage change might be attributed to variations in company-specific factors, such as product launches or strategic initiatives.

Analyzing TT Stock Price Volatility

Volatility is measured using standard deviation, which quantifies the dispersion of stock prices around the mean. A higher standard deviation indicates greater volatility.

The standard deviation is calculated using the following formula:

σ = √[ Σ(xi – μ)² / (N – 1) ]

Where:

- σ = standard deviation

- xi = individual stock price

- μ = mean stock price

- N = number of data points

Calculation involves determining the mean price, subtracting the mean from each individual price, squaring the differences, summing the squared differences, dividing by (N-1), and taking the square root of the result. A higher standard deviation suggests greater price fluctuations.

Factors Contributing to Volatility:

Predictable:

- Seasonal fluctuations in demand.

- Regular company announcements (e.g., earnings reports).

Unpredictable:

- Unexpected economic shocks.

- Geopolitical events.

- Unforeseen company-specific issues.

Illustrating TT Stock Price Trends

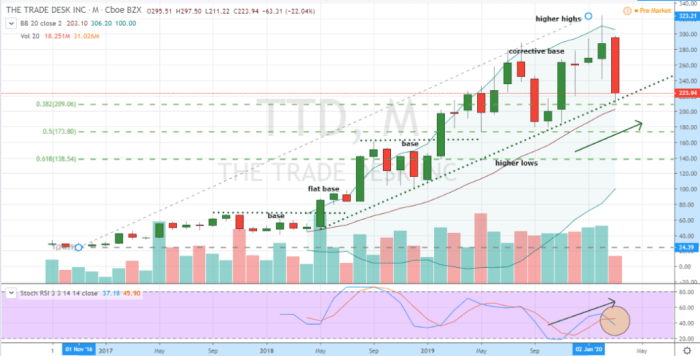

Source: investorplace.com

Tracking TT stock price requires a keen eye on market fluctuations. For comparative analysis, understanding the performance of similar large-cap companies is helpful; for instance, observing the philip morris stock price can offer insights into broader industry trends. Ultimately, however, a comprehensive understanding of TT’s specific financial health and future prospects remains crucial for accurate price prediction.

Over the past year, TT’s stock price exhibited a generally upward trend, although with some periods of fluctuation. The initial months saw relatively slow growth, followed by a period of more rapid appreciation in the second half of the year, likely driven by positive company news and improving market sentiment. A slight dip occurred in the late fall, potentially due to concerns about macroeconomic conditions.

The significant increase in the second half of the year was largely attributable to the successful launch of a new flagship product. The dip in the late fall may have been triggered by a more cautious investor outlook given rising inflation and potential interest rate hikes.

Based on current market conditions and assuming continued strong performance, a potential future scenario might involve a moderate, steady increase in TT’s stock price over the next year, with some short-term fluctuations due to market volatility and news events. This scenario assumes no major unexpected economic or geopolitical events that could significantly disrupt the market.

Essential FAQs: Tt Stock Price

What are the main risks associated with investing in TT stock?

Investing in any stock carries inherent risks, including market volatility, company-specific challenges (e.g., decreased profitability, product failures), and broader economic downturns. Thorough due diligence and diversification are recommended to mitigate these risks.

Where can I find real-time TT stock price updates?

Real-time stock price updates are typically available through reputable financial websites and brokerage platforms. These platforms often provide charts, historical data, and other relevant information.

How frequently is TT stock price data updated?

Most financial data providers update stock prices in real-time or near real-time, reflecting the most recent trades on the exchange where TT stock is listed.

What is the typical trading volume for TT stock?

Trading volume varies depending on market conditions and news affecting the company. You can usually find historical trading volume data on financial websites or through your brokerage account.