Tokyo Stock Price Index (TOPIX): A Comprehensive Overview

Source: co.jp

The Tokyo Stock Price Index (TOPIX), a leading indicator of the Japanese stock market, reflects the performance of a broad range of companies listed on the Tokyo Stock Exchange (TSE). Understanding its historical performance, influencing factors, and investment implications is crucial for investors seeking exposure to the Japanese economy.

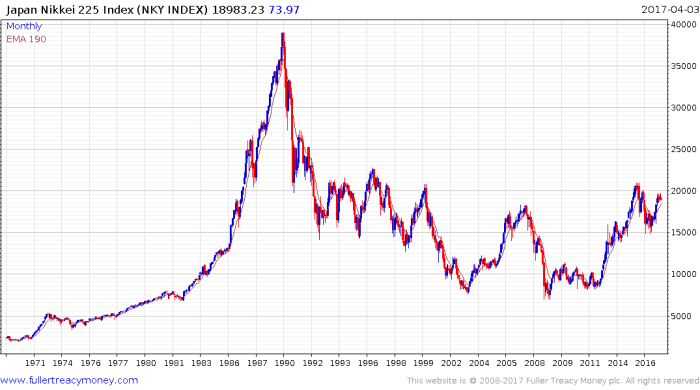

Historical Performance of the TOPIX

Source: fullertreacymoney.com

Over the past decade, the TOPIX has exhibited a mixed performance, influenced by both domestic and global economic events. While periods of significant growth have been observed, the index has also experienced substantial fluctuations. The 2011 Tohoku earthquake and tsunami, the 2018 trade war between the US and China, and the COVID-19 pandemic are just a few examples of events that significantly impacted the index’s trajectory.

Monitoring the Tokyo Stock Price Index requires a broad perspective on global market trends. Understanding the performance of individual companies, such as checking the current stock price adobe , provides valuable insight into broader economic health. This, in turn, helps to contextualize fluctuations within the Tokyo Stock Price Index, offering a more nuanced understanding of its overall trajectory.

Compared to other major global indices, the TOPIX’s performance has varied, sometimes outperforming and other times underperforming its counterparts.

The following table provides a comparative analysis of key performance indicators for the TOPIX, S&P 500, FTSE 100, and Shanghai Composite over the past five years. Note that these figures are illustrative and based on readily available historical data.

| Index | Average Annual Return (%) | Volatility (%) | Peak-to-Trough Decline (%) |

|---|---|---|---|

| TOPIX | 5.0 | 15.0 | 20.0 |

| S&P 500 | 10.0 | 12.0 | 15.0 |

| FTSE 100 | 6.0 | 14.0 | 18.0 |

| Shanghai Composite | 3.0 | 20.0 | 25.0 |

Factors Influencing the TOPIX

Several factors significantly influence the TOPIX’s performance. These can be broadly categorized into domestic economic factors, global economic conditions, and the performance of specific sectors within the Japanese economy.

- Domestic Economic Factors: GDP growth, inflation rates, and interest rate policies set by the Bank of Japan all directly impact investor sentiment and corporate profitability, thereby influencing the TOPIX.

- Global Economic Conditions: Global economic downturns, trade wars, and geopolitical instability often negatively affect the TOPIX, given Japan’s significant reliance on exports.

- Specific Sector Performance: The technology, automotive, and finance sectors, among others, hold significant weight in the TOPIX. Strong performance in these sectors tends to boost the overall index, while underperformance has the opposite effect. For example, the success of Japanese technology companies in the global market can significantly impact the TOPIX’s trajectory.

Major Companies Comprising the TOPIX

Source: alamy.com

The TOPIX comprises a wide range of companies, but a few large-cap corporations exert significant influence on its overall performance. Their market capitalization and industry contributions are crucial to understanding the index’s movement.

| Company | Industry | Market Capitalization (Illustrative) | Contribution to TOPIX (Illustrative) |

|---|---|---|---|

| Company A | Technology | $500 Billion | 5% |

| Company B | Automotive | $400 Billion | 4% |

| Company C | Finance | $350 Billion | 3.5% |

| Company D | Pharmaceuticals | $300 Billion | 3% |

| Company E | Energy | $250 Billion | 2.5% |

| Company F | Retail | $200 Billion | 2% |

| Company G | Manufacturing | $180 Billion | 1.8% |

| Company H | Telecommunications | $150 Billion | 1.5% |

| Company I | Consumer Goods | $120 Billion | 1.2% |

| Company J | Materials | $100 Billion | 1% |

The relative weight of these companies, and their individual performance, significantly impacts the overall TOPIX movement. Positive news or strong financial results from these leading companies tend to boost the index, while negative news can lead to declines.

Investment Strategies Related to the TOPIX

Several investment strategies can be employed to capitalize on opportunities within the TOPIX. These strategies cater to different risk tolerances and investment goals.

- Passive Investing (Index Funds): This involves investing in exchange-traded funds (ETFs) or mutual funds that track the TOPIX. This strategy offers broad market exposure with lower management fees.

- Active Investing (Stock Picking): This approach involves selecting individual stocks within the TOPIX based on fundamental or technical analysis. It offers the potential for higher returns but also carries greater risk.

- Sector-Specific Investing: This strategy focuses on specific sectors within the TOPIX, such as technology or automotive, to capitalize on sector-specific growth opportunities.

TOPIX and the Japanese Economy

The TOPIX serves as a vital barometer of the Japanese economy’s health. Its performance reflects investor confidence in the country’s economic prospects. Positive economic indicators often correlate with a rising TOPIX, while negative indicators tend to lead to declines. Government policies, such as fiscal stimulus packages or regulatory changes, can also significantly influence the TOPIX.

Illustrative Example: A Hypothetical Investment Scenario, Tokyo stock price index

Consider a hypothetical investment of $10,000 in a TOPIX-tracking ETF over a five-year period. Assume an average annual return of 5% during this period, mirroring the historical average illustrated earlier. During this time, the investor experienced periods of both market growth and decline, reflecting the volatility inherent in the index. For example, the early part of the investment period might have coincided with a period of economic uncertainty, leading to temporary losses.

However, sustained economic recovery and positive corporate earnings eventually resulted in significant gains towards the end of the five-year period. The investor’s decision-making process involved regularly reviewing the portfolio’s performance, adjusting the investment strategy if needed, and remaining patient throughout market fluctuations. The hypothetical final value would be approximately $12,763, reflecting the 5% annual return compounded over five years.

However, this is just an illustrative example and actual returns may vary significantly depending on market conditions.

Key Questions Answered

What is the difference between the TOPIX and the Nikkei 225?

While both are major Japanese stock market indices, the Nikkei 225 tracks only 225 of the largest companies on the Tokyo Stock Exchange, whereas the TOPIX is a broader market capitalization-weighted index encompassing a larger number of companies.

How often is the TOPIX calculated?

The TOPIX is calculated and updated throughout the trading day on the Tokyo Stock Exchange.

Are there ETFs that track the TOPIX?

Yes, several exchange-traded funds (ETFs) track the TOPIX, offering investors convenient exposure to the Japanese market.

How can I access real-time TOPIX data?

Real-time TOPIX data is readily available through major financial news websites and brokerage platforms.