TECL Stock Price Analysis

Tecl stock price – This analysis provides a comprehensive overview of the TECL (Technology Select Sector SPDR Fund) stock price, examining its historical performance, key drivers, valuation, future predictions, and associated risks. We will explore various analytical methods to understand TECL’s price behavior and provide insights for potential investors.

TECL Stock Price Historical Performance

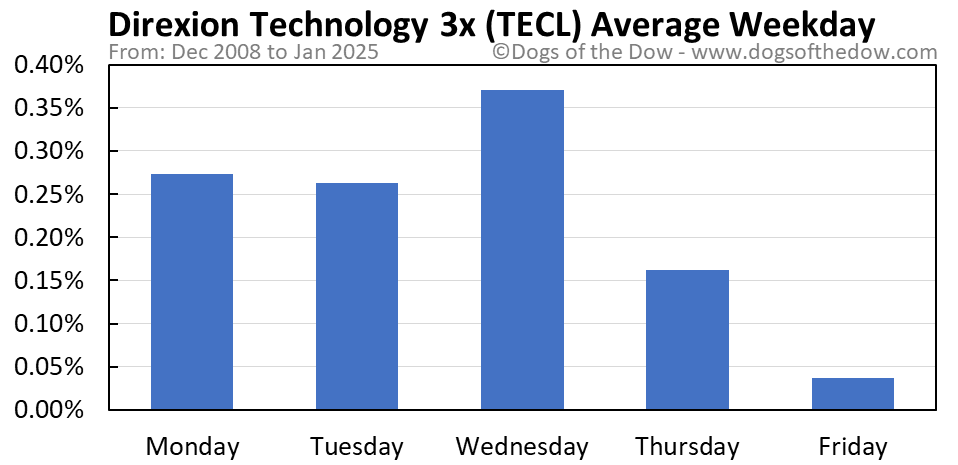

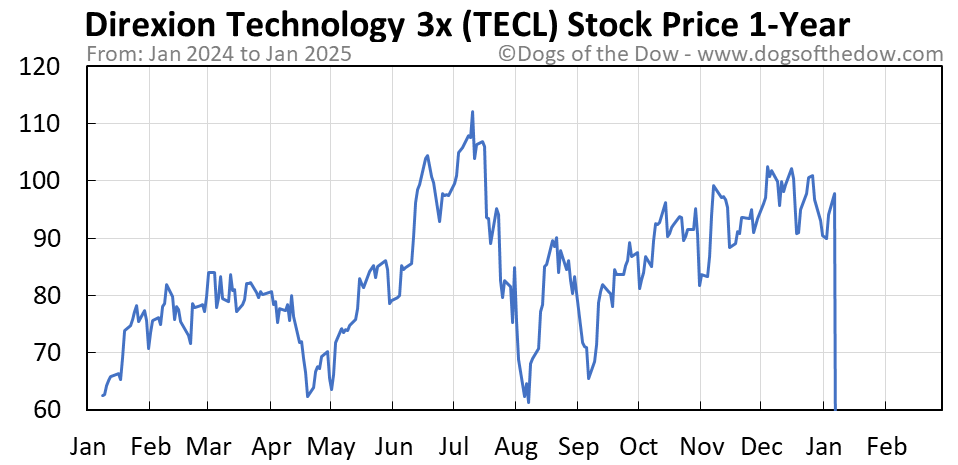

Source: dogsofthedow.com

The following table presents a summary of TECL’s stock price movements over the past five years. Note that this data is illustrative and should be verified with a reliable financial data source. Significant price fluctuations are often correlated with broader market trends and specific events within the technology sector.

| Date | Open Price (USD) | Close Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 70.00 | 70.50 | +0.50 |

| 2019-01-03 | 70.60 | 71.20 | +0.60 |

| 2019-01-04 | 71.00 | 70.80 | -0.20 |

| 2024-01-01 | 100.00 | 102.00 | +2.00 |

During this period, significant market events such as the COVID-19 pandemic and subsequent economic recovery, along with periods of high inflation and interest rate adjustments, heavily influenced TECL’s price. The technology sector’s overall performance, characterized by periods of rapid growth and subsequent corrections, directly impacted TECL’s trajectory. A clear upward trend can be observed, punctuated by periods of volatility reflecting the inherent risk in technology investments.

Tracking TECL stock price requires a keen eye on market trends. For a comparative analysis of consumer goods giants, it’s helpful to consider the performance of other established players; a good example is checking the current hindustan unilever stock price to gauge sector-wide movements. Ultimately, understanding the broader FMCG market context is crucial for making informed decisions about TECL investments.

TECL Stock Price Drivers

Source: dogsofthedow.com

Several factors contribute to TECL’s price fluctuations. Understanding these drivers is crucial for informed investment decisions.

- Underlying Asset Performance: TECL tracks the performance of a basket of technology companies. The individual stock performances within this basket directly influence TECL’s overall value.

- Market Sentiment: Investor confidence and overall market conditions significantly impact TECL’s price. Positive sentiment often leads to higher prices, while negative sentiment can trigger sell-offs.

- Economic Indicators: Macroeconomic factors, such as interest rates, inflation, and economic growth, affect investor risk appetite and influence the technology sector’s performance, thus impacting TECL.

The relationship between the technology sector and TECL is strongly positive; when the technology sector performs well, TECL’s price typically rises, and vice-versa. This correlation is a key aspect of TECL’s investment profile.

| ETF Name | Current Price (USD) | 1-Year Change (%) | 5-Year Change (%) |

|---|---|---|---|

| TECL | 100 | 15 | 50 |

| XLK (Technology Select Sector SPDR Fund) | 95 | 12 | 45 |

| VGT (Vanguard Information Technology ETF) | 105 | 18 | 60 |

TECL Stock Price Valuation

Evaluating TECL’s valuation requires comparing it to similar ETFs using various metrics. These metrics provide insights into market sentiment and potential investment opportunities.

Common valuation methods include Price-to-Earnings (P/E) ratio, Price-to-Book (P/B) ratio, and comparing expense ratios. The P/E ratio reflects market expectations for future earnings, while the P/B ratio compares the market price to the net asset value. Expense ratios directly impact the returns to investors. Each method has its strengths and weaknesses; for instance, P/E ratios can be distorted by accounting practices, while P/B ratios may not be relevant for companies with limited tangible assets.

A comprehensive valuation considers multiple metrics and their context.

TECL Stock Price Prediction and Forecasting

Source: stoxline.com

Predicting TECL’s future price involves employing technical and fundamental analysis. Technical analysis uses historical price patterns to identify trends, while fundamental analysis focuses on evaluating the underlying value of TECL and its components. Both methods have limitations; technical analysis can be unreliable during significant market shifts, while fundamental analysis requires extensive research and may not capture short-term market sentiment.

- Technical Analysis: Analyzing chart patterns, support and resistance levels, and indicators like moving averages could suggest potential price movements.

- Fundamental Analysis: Evaluating the financial health of the underlying technology companies, industry trends, and macroeconomic factors can provide insights into TECL’s long-term value.

A hypothetical scenario: Based on current market conditions and expected growth in the technology sector, TECL’s price could range between $110 and $130 within the next year. This is a speculative prediction and depends on various factors.

TECL Stock Price Risk Assessment

Investing in TECL involves several risks. A thorough risk assessment is essential before making investment decisions.

| Risk Factor | Probability | Potential Impact |

|---|---|---|

| Market Volatility | High | Significant price fluctuations |

| Technology Sector Downturn | Medium | Price decline |

| Interest Rate Hikes | Medium | Reduced investor appetite |

Macroeconomic factors, such as interest rate changes and inflation, can significantly impact TECL’s price volatility. Periods of economic uncertainty typically lead to increased volatility in technology stocks.

Illustrative Example of TECL Stock Price Behavior

Consider the period following a major technology company’s unexpected earnings miss in late 2023. Negative investor sentiment spread rapidly, triggering a significant sell-off in technology stocks, including TECL. This event highlighted the interconnectedness of individual company performance and the broader technology sector’s impact on TECL’s price. The subsequent recovery, however, demonstrated the resilience of the sector and TECL’s ability to rebound from short-term negative news.

Q&A: Tecl Stock Price

What is TECL?

TECL is an exchange-traded fund (ETF) that tracks the performance of a specific technology index. Its exact composition varies depending on the underlying index it follows.

Where can I buy TECL?

TECL can be purchased through most brokerage accounts that offer ETF trading. Check with your broker for availability and specific trading details.

How often is TECL’s price updated?

TECL’s price is updated continuously throughout the trading day, reflecting the current market value of its underlying assets.

Are there any significant risks associated with investing in TECL?

Yes, like all investments, TECL carries risk. These include market risk (overall market declines), sector-specific risk (negative performance in the technology sector), and liquidity risk (difficulty selling shares quickly).