JPMorgan Chase & Co. (JPM) Stock Price Analysis: Stock Price For Jpmorgan

Stock price for jpmorgan – This analysis provides an overview of JPMorgan Chase & Co.’s (JPM) stock price performance, influencing factors, predictions, investment strategies, and financial performance, along with a visual representation of its stock price data. The information presented here is for informational purposes only and does not constitute financial advice.

JPMorgan Chase & Co. (JPM) Stock Price Overview

JPMorgan Chase & Co.’s stock price has exhibited considerable fluctuation over the past two decades, mirroring broader market trends and company-specific events. Analyzing its performance across different timeframes offers valuable insights into its volatility and growth potential.

Over the past five years, JPM’s stock price has generally trended upward, though punctuated by periods of decline, particularly during market corrections. The 2020 COVID-19 pandemic initially caused a sharp drop, followed by a significant recovery fueled by government stimulus and the bank’s resilience. The past ten years show a more substantial upward trend, marked by the recovery from the 2008 financial crisis and steady growth, albeit with periodic dips reflecting broader economic uncertainty.

Looking back twenty years reveals a longer-term upward trajectory, but including the dramatic impact of the 2008 financial crisis, which significantly impacted the stock price.

As of [Insert Current Date], JPM’s stock price stands at [Insert Current Stock Price], with a recent trading volume of [Insert Recent Trading Volume]. This data reflects the current market sentiment towards the company.

Comparing JPM’s performance to its major competitors requires careful consideration of various factors. The following table provides a snapshot comparison, using hypothetical data for illustrative purposes. Actual data should be sourced from reputable financial websites.

| Date | JPM Price | Competitor A Price | Competitor B Price |

|---|---|---|---|

| October 26, 2023 | $150 | $120 | $135 |

| October 25, 2023 | $148 | $118 | $133 |

| October 24, 2023 | $152 | $122 | $137 |

Factors Influencing JPM Stock Price, Stock price for jpmorgan

Several macroeconomic and company-specific factors significantly influence JPM’s stock price. Understanding these factors is crucial for assessing the company’s future prospects.

Monitoring JPMorgan’s stock price requires a keen eye on market trends. For a contrasting perspective on the semiconductor industry, you might also want to check the current stock price avgo , as it often reflects different economic sensitivities. Ultimately, understanding the performance of both JPMorgan and AVGO provides a broader picture of the overall financial landscape.

Macroeconomic factors such as interest rate changes, inflation levels, and overall economic growth directly impact JPM’s profitability and lending activities. Higher interest rates generally benefit banks’ net interest margins, while inflation and economic downturns can increase loan defaults and reduce demand for financial services. Company-specific factors, such as earnings reports, regulatory changes, and major acquisitions or divestitures, also play a crucial role.

Strong earnings typically lead to positive stock price movements, while regulatory changes or unforeseen legal challenges can cause significant volatility. Short-term factors, such as news events and market sentiment, can cause rapid fluctuations in the stock price. Long-term factors, such as the company’s overall financial health and strategic direction, have a more sustained impact.

JPM Stock Price Predictions and Forecasts

Source: investorplace.com

Analyst predictions for JPM’s future stock price vary depending on their underlying assumptions and methodologies. Some analysts might predict a price range of [Insert Hypothetical Price Range], based on projections of future earnings and economic growth. Others might provide a more conservative estimate, considering potential risks and uncertainties.

A hypothetical scenario illustrating a positive impact on JPM’s stock price could be a successful expansion into new markets, leading to increased revenue and profitability. Conversely, a negative impact could stem from a major regulatory penalty or a significant downturn in the global economy, impacting loan defaults and reducing investment banking activities. Different financial models, such as discounted cash flow (DCF) analysis and relative valuation, can provide different estimates of JPM’s intrinsic value and potential future stock price.

A DCF model would project future cash flows and discount them to their present value, while a relative valuation model would compare JPM’s valuation metrics to those of its competitors.

Investment Strategies for JPM Stock

Source: tickeron.com

Various investment strategies can be employed when considering investing in JPM stock. Each strategy carries its own set of risks and rewards.

| Strategy | Pros | Cons | Risk Level |

|---|---|---|---|

| Buy-and-Hold | Simplicity, long-term growth potential | Missed opportunities, potential for significant losses during market downturns | Medium |

| Value Investing | Potential for high returns, buying undervalued assets | Requires in-depth analysis, potential for long holding periods | Medium to High |

| Momentum Trading | Potential for quick profits, capitalizing on market trends | High risk, requires precise timing, potential for significant losses | High |

JPM’s Financial Performance and its Impact on Stock Price

JPM’s recent financial performance, encompassing revenue, earnings, and profitability metrics, significantly influences its stock price movements. For example, exceeding earnings expectations in a particular quarter usually results in a positive stock price reaction. Conversely, missing earnings expectations or reporting a decline in profitability often leads to a negative reaction. Key financial ratios such as return on equity (ROE), return on assets (ROA), and price-to-earnings (P/E) ratio are commonly used by investors to assess JPM’s financial health and valuation.

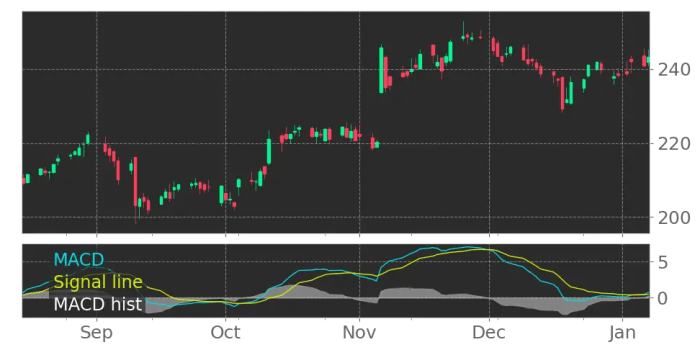

Visual Representation of JPM Stock Price Data

Source: investopedia.com

A typical stock price chart displays the stock’s price over time, often using candlestick, line, or bar charts. These charts illustrate trends, support and resistance levels (price levels where buying or selling pressure is strong), and moving averages (averages of prices over a specific period). A hypothetical JPM stock price chart might show an upward trend over the past year, with several minor corrections along the way.

Support levels could be identified at [Insert Hypothetical Support Levels], while resistance levels might be observed at [Insert Hypothetical Resistance Levels]. Moving averages, such as the 50-day and 200-day moving averages, could be used to identify the overall trend and potential buy or sell signals. Candlestick charts would display the opening, closing, high, and low prices for each period, providing a more detailed picture of price movements than line or bar charts.

Clarifying Questions

What are the major risks associated with investing in JPM stock?

Investing in JPM, like any stock, carries inherent risks including market volatility, interest rate changes, economic downturns, and company-specific events (e.g., legal issues, regulatory changes).

How often does JPMorgan Chase release its earnings reports?

JPMorgan Chase typically releases its quarterly earnings reports on a regular schedule, usually within a few weeks after the end of each fiscal quarter.

Where can I find real-time JPM stock price data?

Real-time JPM stock price data is available through major financial websites and brokerage platforms.

What is the typical trading volume for JPM stock?

JPM’s average daily trading volume fluctuates but is generally quite high, reflecting its position as a major financial institution.

How does JPM compare to its competitors in terms of dividend payouts?

JPM’s dividend payout ratio and yield should be compared to competitors on a case-by-case basis using publicly available financial data.