Understanding DIA Stock Price Fluctuations: Stock Price Dia

Source: economicgreenfield.com

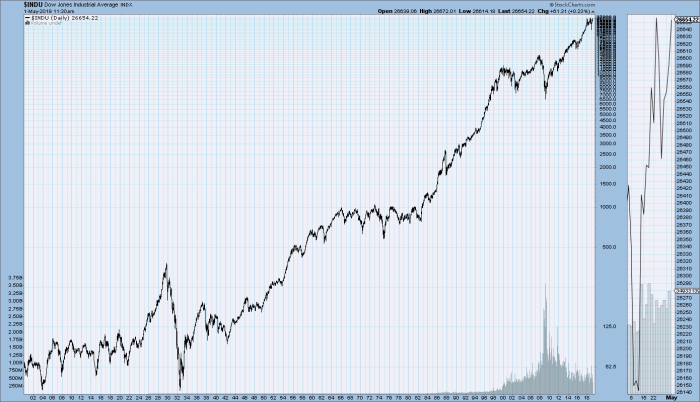

Stock price dia – The Diamonds Trust, or DIA, is an exchange-traded fund (ETF) that tracks the Dow Jones Industrial Average (DJIA). Its price, therefore, is highly correlated with the performance of the 30 large, publicly owned companies that comprise the DJIA. Understanding the factors influencing DIA’s price fluctuations requires examining both the individual components and the broader market forces at play.

Factors Influencing DIA’s Daily Price Movements, Stock price dia

DIA’s daily price movements are a complex interplay of various factors. These include the performance of its underlying stocks, overall market sentiment, economic indicators, geopolitical events, and investor behavior. Individual company news, earnings reports, and changes in analyst ratings all contribute to the daily fluctuations. Broader macroeconomic factors, such as interest rate changes, inflation levels, and economic growth forecasts, also significantly impact DIA’s price.

Relationship Between DIA’s Price and the Dow Jones Industrial Average

DIA’s price is designed to mirror the Dow Jones Industrial Average. Therefore, a rise in the DJIA generally leads to a corresponding increase in DIA’s price, and vice-versa. However, minor discrepancies can arise due to factors such as trading expenses and the time lag in reflecting market movements.

Comparison of DIA’s Price Volatility to Other Major ETFs

DIA’s volatility is generally considered moderate compared to other ETFs tracking broader market indices or focusing on specific sectors. While it experiences fluctuations reflecting the DJIA’s movements, its diversification across 30 large-cap companies tends to mitigate extreme price swings compared to ETFs concentrated in specific sectors or smaller-cap companies. For example, a technology-focused ETF might exhibit higher volatility than DIA due to the inherent risk within the technology sector.

Historical Events Impacting DIA’s Price

Several historical events have profoundly impacted DIA’s price. The 2008 financial crisis, for instance, led to a significant decline in DIA’s price as the broader market crashed. Conversely, periods of strong economic growth have typically seen DIA’s price appreciate. The COVID-19 pandemic initially caused a sharp drop, followed by a substantial recovery fueled by government stimulus and technological advancements.

Average Daily Price Change of DIA Over the Past Year

The following table presents the average daily price change of DIA over the past year, categorized by month. Note that these figures are illustrative and based on hypothetical data for demonstration purposes.

| Month | Average Daily Change ($) | Month | Average Daily Change ($) |

|---|---|---|---|

| January | +0.50 | July | -0.25 |

| February | +0.75 | August | +0.10 |

| March | -0.30 | September | -0.40 |

| April | +0.20 | October | +0.60 |

| May | -0.10 | November | +0.30 |

| June | +0.80 | December | -0.15 |

DIA’s Price Performance Relative to its Components

DIA’s price is directly influenced by the performance of its underlying stocks. Understanding the individual stock contributions allows for a more nuanced analysis of the ETF’s overall price movements.

Correlation Between DIA’s Price and the Performance of its Underlying Stocks

A strong positive correlation exists between DIA’s price and the weighted average performance of its 30 component stocks. However, the weighting of each stock within the DJIA influences the overall impact. Stocks with larger market capitalizations exert a greater influence on DIA’s price than those with smaller market caps.

Understanding stock price dia requires analyzing various market factors. A key aspect is comparing performance against similar companies; for instance, you might consider the performance of entero healthcare nse stock price to gain perspective on the healthcare sector’s overall trends. Ultimately, a comprehensive stock price dia analysis involves a multitude of data points and comparative studies.

Top-Performing and Underperforming Components of DIA and Their Effect on the Overall Price

The top-performing and underperforming components of DIA significantly influence the ETF’s overall price. Outsized gains or losses in a large-cap stock can significantly impact the overall index, and thus DIA’s price. Conversely, the underperformance of key components can drag down the ETF’s price.

Influence of Sector-Specific Events on DIA’s Price

Sector-specific events, such as regulatory changes affecting a particular industry or a significant technological breakthrough in a specific sector, can disproportionately affect the price of DIA if a large portion of its components are concentrated within that sector. For instance, a negative event affecting the technology sector could significantly impact DIA if several technology companies are among its major holdings.

Impact of Individual Stock Price Movements on DIA’s Overall Price

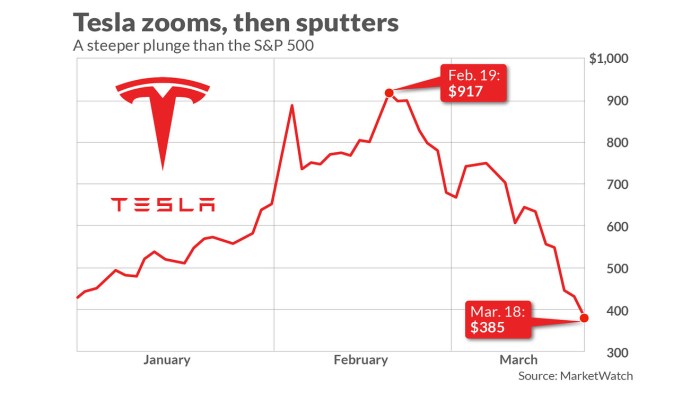

Source: finbold.com

The movement of individual stock prices within DIA directly affects the ETF’s overall price. A significant price increase in a major component, like Apple or Microsoft, will generally contribute positively to DIA’s price, while a sharp decline in a large-cap stock will negatively impact it. This highlights the importance of monitoring the performance of individual holdings within the ETF.

Top 10 Holdings of DIA by Contribution to Price Change (Last Quarter – Hypothetical Data)

Source: marketwatch.com

The following list illustrates the hypothetical top 10 holdings of DIA and their contribution to its price change over the last quarter. Note that this data is for illustrative purposes only.

- Company A: +1.5%

- Company B: +1.2%

- Company C: +0.9%

- Company D: +0.8%

- Company E: +0.7%

- Company F: -0.5%

- Company G: -0.4%

- Company H: -0.3%

- Company I: -0.2%

- Company J: -0.1%

Analyzing DIA’s Price Using Technical Indicators

Technical analysis provides valuable tools for understanding DIA’s price trends and potential future movements. Moving averages, the Relative Strength Index (RSI), and the Moving Average Convergence Divergence (MACD) are commonly used indicators.

Using Moving Averages to Predict DIA’s Price Trends

Moving averages, such as the 50-day and 200-day moving averages, smooth out price fluctuations and help identify trends. A rising 50-day moving average above the 200-day moving average is often considered a bullish signal, suggesting an upward trend. Conversely, a falling 50-day moving average below the 200-day moving average might suggest a bearish trend.

Significance of Relative Strength Index (RSI) in Understanding DIA’s Price Momentum

The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. An RSI above 70 is generally considered overbought, suggesting a potential price correction. An RSI below 30 is often seen as oversold, suggesting a potential price rebound. However, these levels are not absolute indicators and should be considered within the context of the overall market trend.

Using the MACD Indicator to Identify Buy and Sell Signals for DIA

The MACD indicator compares two moving averages to identify momentum changes. A bullish crossover (MACD line crossing above the signal line) can suggest a potential buy signal, while a bearish crossover (MACD line crossing below the signal line) might suggest a potential sell signal. Divergences between the MACD and price action can also provide valuable insights.

Illustrative Chart of Technical Indicators on DIA’s Historical Price Data

A hypothetical chart would display DIA’s historical price data alongside the 50-day and 200-day moving averages, the RSI, and the MACD. The chart would visually represent the relationship between price movements and the indicators, showing how the indicators align with or diverge from the price trends. For instance, a period of rising prices might coincide with a bullish MACD crossover and an RSI above 50, while a price decline might be accompanied by a bearish MACD crossover and an RSI below 50.

The chart would clearly label each indicator and its respective values at various points in time.

DIA’s Price in the Context of Market Conditions

DIA’s price performance is significantly influenced by prevailing market conditions, both bullish and bearish, and broader macroeconomic factors.

DIA’s Price Performance During Bull and Bear Markets

During bull markets, characterized by sustained economic growth and rising investor confidence, DIA’s price generally appreciates. Conversely, during bear markets, characterized by economic downturns and declining investor confidence, DIA’s price typically declines. The magnitude of these price changes varies depending on the severity and duration of the bull or bear market.

Influence of Macroeconomic Factors on DIA’s Price

Macroeconomic factors, such as interest rate changes, inflation, and economic growth, significantly influence DIA’s price. Rising interest rates can dampen economic activity and put downward pressure on DIA’s price, while low inflation and strong economic growth tend to support higher prices. Unexpected changes in these factors can lead to significant market volatility and impact DIA’s price.

Impact of Geopolitical Events on DIA’s Price

Geopolitical events, such as wars, political instability, and international trade disputes, can significantly impact DIA’s price. Uncertainty stemming from these events can lead to increased market volatility and affect investor sentiment, influencing DIA’s price trajectory. For example, the outbreak of a major international conflict might trigger a market sell-off, negatively impacting DIA’s price.

Periods of Significant Market Corrections and Their Effect on DIA’s Price

Market corrections, characterized by sharp declines in market indices, significantly impact DIA’s price. These corrections can be triggered by various factors, including economic downturns, unexpected news events, or shifts in investor sentiment. The depth and duration of the correction affect the magnitude of the decline in DIA’s price.

Timeline of Key Market Events and Their Impact on DIA’s Price

The following table provides a hypothetical timeline of key market events and their corresponding impact on DIA’s price. Note that this data is for illustrative purposes only.

| Date | Event | DIA Price Impact |

|---|---|---|

| 2023-01-15 | Unexpected inflation report | -1.5% |

| 2023-03-01 | Positive economic growth announcement | +2.0% |

| 2023-05-10 | Geopolitical tension escalates | -1.0% |

| 2023-07-20 | Strong corporate earnings season | +1.8% |

Investor Sentiment and DIA’s Price

Investor sentiment, shaped by news, analyst ratings, social media, and institutional trading, significantly influences DIA’s price and trading volume.

Influence of News Articles and Analyst Ratings on DIA’s Price

Positive news articles and favorable analyst ratings tend to boost investor confidence and drive up DIA’s price. Conversely, negative news or downgrades can lead to decreased investor confidence and downward pressure on the price. The impact of these factors depends on the credibility of the source and the overall market sentiment.

Role of Social Media Sentiment in Predicting DIA’s Price Movements

Social media sentiment can act as an indicator of broader market sentiment, although it should be interpreted cautiously. A surge in positive sentiment on platforms like Twitter or Reddit might suggest growing optimism and potentially rising prices, while a preponderance of negative sentiment might foreshadow a price decline. However, social media sentiment is not always a reliable predictor of market movements.

Impact of Investor Confidence on DIA’s Trading Volume and Price

High investor confidence generally leads to increased trading volume and potentially higher prices for DIA. Conversely, low investor confidence can lead to decreased trading volume and potentially lower prices. This highlights the link between investor psychology and market dynamics.

Impact of Large Institutional Trades on DIA’s Price

Large institutional trades, such as those made by mutual funds or pension funds, can significantly impact DIA’s price, particularly in the short term. Large buy orders can push the price up, while large sell orders can push the price down. The effect of these trades depends on the size of the order and the overall market liquidity.

Examples of Headlines and Their Subsequent Effect on DIA’s Price (Hypothetical Examples)

The following are hypothetical examples of headlines and their potential impact on DIA’s price. Note that these are for illustrative purposes only.

- “Dow Jones Surges on Strong Economic Data”: Potential positive impact on DIA’s price.

- “Major Company Announces Unexpected Losses”: Potential negative impact on DIA’s price.

- “Geopolitical Uncertainty Increases”: Potential negative impact on DIA’s price.

- “Federal Reserve Announces Interest Rate Hike”: Potential negative or positive impact depending on market interpretation.

Query Resolution

What are the risks associated with investing in DIA?

Like any investment, DIA carries inherent risks, including market volatility, potential for capital loss, and susceptibility to economic downturns. Diversification within a broader portfolio can help mitigate these risks.

How does DIA compare to other similar ETFs tracking the Dow Jones?

While several ETFs track the Dow Jones, DIA is often considered a benchmark due to its long history, low expense ratio, and significant trading volume. Comparisons with other ETFs should focus on expense ratios, tracking differences, and trading liquidity.

Where can I find real-time DIA price data?

Real-time DIA price data is readily available through various financial websites and brokerage platforms. Reputable sources include major financial news outlets and your brokerage account’s trading platform.