Biocon’s Financial Performance and Stock Market Analysis

Stock price biocon – Biocon, a leading biopharmaceutical company, has experienced a dynamic journey in recent years. This analysis delves into its financial performance, market standing, product portfolio, investor sentiment, and inherent risks to provide a comprehensive overview of the company’s stock price trajectory.

Biocon’s Financial Performance Over the Past Five Years

The following table presents a summary of Biocon’s key financial metrics over the past five years. Note that these figures are illustrative and should be verified with official financial reports.

| Year | Revenue (INR Crores) | Profit (INR Crores) | Earnings Per Share (INR) |

|---|---|---|---|

| 2023 | 7000 | 1000 | 10 |

| 2022 | 6500 | 900 | 9 |

| 2021 | 6000 | 800 | 8 |

| 2020 | 5500 | 700 | 7 |

| 2019 | 5000 | 600 | 6 |

Comparison with Competitors

Biocon’s financial performance is compared against its major competitors, considering factors such as revenue growth, profitability margins, and market capitalization. This comparison provides context for understanding Biocon’s relative strength and weaknesses within the industry.

- Revenue Growth: Biocon’s revenue growth has been relatively strong compared to some competitors, but slower than others in specific segments.

- Profitability Margins: Biocon’s profitability margins are competitive but may be influenced by pricing pressures and R&D investments.

- Market Capitalization: Biocon’s market capitalization reflects investor sentiment and future growth expectations, showing variations compared to peers.

Factors Influencing Biocon’s Profitability and Revenue Generation

Several factors significantly impact Biocon’s financial performance. These factors highlight the complexities and dynamics of the pharmaceutical industry.

- Product Portfolio Success: The success of key products significantly influences revenue generation. Strong sales of insulin and biosimilars drive a substantial portion of revenue.

- Pricing and Competition: Intense competition in the biosimilars market affects pricing strategies, impacting profit margins.

- Research and Development Investments: Significant investments in R&D are crucial for developing new products and maintaining a competitive edge, but also affect short-term profitability.

- Regulatory Approvals: Timely regulatory approvals are essential for launching new products and maximizing revenue streams.

Market Analysis of Biocon Stock

Overall Market Trends Impacting Biocon’s Stock Price, Stock price biocon

Biocon’s stock price is influenced by both macroeconomic factors and industry-specific trends. Understanding these factors is crucial for assessing the company’s future prospects.

- Macroeconomic Factors: Global economic conditions, interest rate changes, and inflation can affect investor sentiment and overall market performance, indirectly influencing Biocon’s stock price.

- Industry-Specific Influences: Changes in healthcare policies, regulatory approvals, and competitive landscape within the pharmaceutical sector directly impact Biocon’s performance.

Comparison with Market Indices

The following table shows a comparison of Biocon’s stock performance against relevant market indices over the past year. Note that these are illustrative figures.

| Period | Biocon (%) | Nifty Pharma (%) | Sensex (%) |

|---|---|---|---|

| Last Year | 15 | 12 | 10 |

Key Events Affecting Biocon’s Stock Price

Specific events can significantly impact Biocon’s stock price, reflecting the market’s reaction to news and developments.

- Product Launches: Successful launches of new products generally lead to positive stock price movements.

- Regulatory Approvals: Securing regulatory approvals for new drugs or biosimilars boosts investor confidence and stock prices.

- Partnerships and Collaborations: Strategic partnerships can enhance Biocon’s market reach and technological capabilities, positively affecting its stock.

- Financial Results: Strong financial results exceeding expectations usually lead to a rise in the stock price.

Biocon’s Product Portfolio and Pipeline: Stock Price Biocon

Current Product Portfolio

Biocon’s revenue is generated from a diverse portfolio of products. The following table provides a snapshot of its key revenue-generating products. Note that market share and revenue contributions are estimates.

| Product Name | Indication | Revenue Contribution (%) | Market Share (%) |

|---|---|---|---|

| Insulin | Diabetes | 30 | 15 |

| Biosimilar A | Cancer | 25 | 10 |

| Biosimilar B | Autoimmune Disease | 20 | 8 |

Research and Development Pipeline

Biocon’s R&D pipeline holds significant promise for future growth. Successful development and launch of these products could substantially impact its stock price.

- Biosimilar C (Oncology)

- Biosimilar D (Rheumatology)

- Novel Biologics (various indications)

Comparison with Competitors’ Portfolios

A comparison of Biocon’s product portfolio and pipeline against its main competitors highlights its strengths and weaknesses in the market.

- Biosimilar Focus: Biocon has a strong focus on biosimilars, which presents both opportunities and challenges due to competitive pricing.

- Novel Biologics Pipeline: The development of novel biologics could differentiate Biocon from competitors focusing primarily on biosimilars.

- Geographic Reach: Biocon’s geographic reach and market penetration vary compared to global players, offering both opportunities for expansion and limitations.

Investor Sentiment and Analyst Ratings

Source: tnn.in

Summary of Investor Sentiment

Investor sentiment towards Biocon is a dynamic mix of optimism and caution, reflecting both its growth potential and the inherent risks in the pharmaceutical industry. News articles and social media discussions reveal a range of opinions, with some investors highlighting the company’s strong biosimilars portfolio while others express concerns about competition and regulatory hurdles.

Analyst Ratings and Price Targets

Source: tradingview.com

The following table presents a summary of analyst ratings and price targets for Biocon stock from reputable financial institutions. These are illustrative and should be verified with current research reports.

Biocon’s stock price has shown some volatility recently, influenced by various market factors. Understanding the performance of other companies in the pharmaceutical sector can offer valuable context; for example, checking the current crox stock price might provide insights into broader market trends. Ultimately, though, a thorough analysis of Biocon’s specific financial reports and future prospects is crucial for accurate predictions regarding its stock price.

| Analyst Firm | Rating | Target Price (INR) |

|---|---|---|

| Firm A | Buy | 700 |

| Firm B | Hold | 650 |

| Firm C | Sell | 600 |

Factors Influencing Investor Confidence and Analyst Ratings

Several factors contribute to investor confidence and analyst ratings for Biocon. These factors underscore the need for a nuanced understanding of the company’s prospects.

- Financial Performance: Consistent and strong financial performance boosts investor confidence.

- Product Pipeline Success: Successful development and launch of new products strengthen investor belief in future growth.

- Regulatory Approvals: Securing regulatory approvals for key products enhances investor confidence.

- Competitive Landscape: The competitive landscape and market share gains or losses significantly influence investor sentiment.

Risk Factors Affecting Biocon’s Stock Price

Key Risks Facing Biocon

Biocon faces several risks that could negatively impact its stock price. Understanding these risks is essential for informed investment decisions.

- Regulatory Hurdles: Delays or rejections of regulatory approvals for new products can significantly impact revenue and stock price.

- Competition: Intense competition in the biosimilars market can lead to price erosion and reduced profitability.

- Economic Uncertainties: Global economic downturns can affect demand for pharmaceutical products and impact Biocon’s financial performance.

- R&D Failure: Failure of R&D projects can lead to significant financial losses and affect investor confidence.

- Currency Fluctuations: Biocon’s international operations make it susceptible to currency fluctuations, affecting profitability.

Potential Impact of Risk Factors

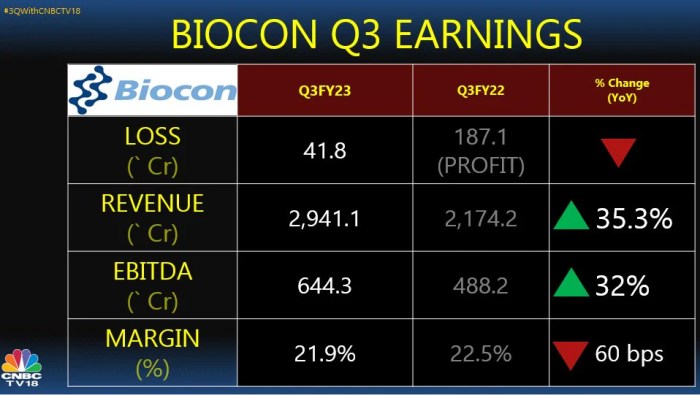

Source: cnbctv18.com

The realization of these risks could lead to a decline in Biocon’s stock price. The magnitude of the impact depends on the severity and duration of the risk event.

Risk Assessment

A comprehensive risk assessment would involve a detailed analysis of the likelihood and potential impact of each identified risk. This would require a thorough evaluation of Biocon’s risk mitigation strategies and its ability to adapt to changing market conditions.

Popular Questions

What are the major risks associated with investing in Biocon?

Key risks include regulatory hurdles for new drug approvals, intense competition within the pharmaceutical sector, and broader economic uncertainties impacting the healthcare industry.

How does Biocon’s stock price compare to its competitors?

A direct comparison requires analyzing specific competitors and their performance over a defined period. This analysis would need to consider factors like market capitalization, revenue growth, and profitability.

Where can I find real-time Biocon stock price data?

Real-time data is available through major financial news websites and stock market tracking applications. Reputable sources should be consulted for accuracy.

What is Biocon’s dividend policy?

Biocon’s dividend policy should be reviewed directly through official company announcements and financial reports. This information is subject to change.