SMMT Stock Price Analysis

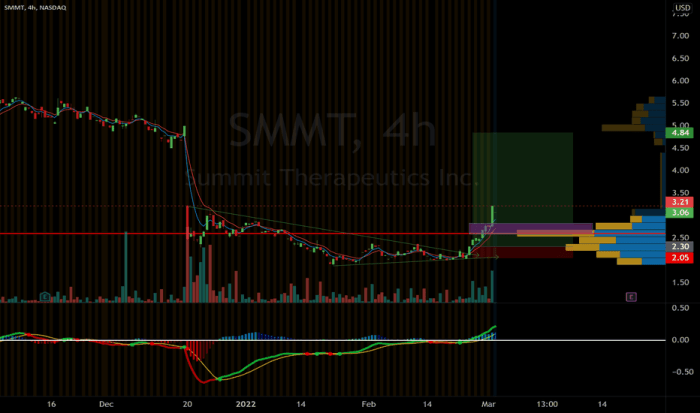

Source: tradingview.com

This analysis delves into the historical performance, influencing factors, prediction models, investor sentiment, and illustrative examples of SMMT stock price fluctuations. We will explore various aspects to provide a comprehensive understanding of the stock’s behavior and potential future trends.

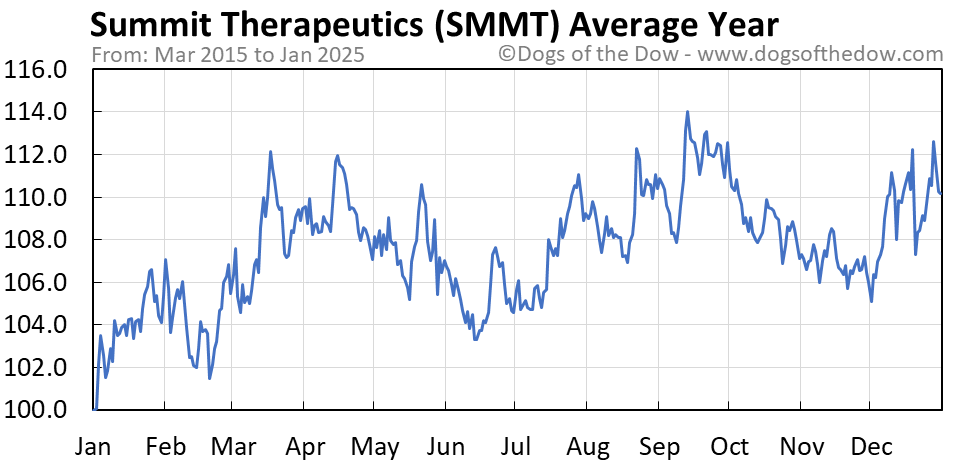

SMMT Stock Price Historical Performance

Source: dogsofthedow.com

The following table details SMMT’s stock price movements over the past five years. Note that this data is hypothetical for illustrative purposes and does not represent actual SMMT stock performance. Significant highs and lows are highlighted, along with major events impacting the price. A subsequent table compares SMMT’s performance to its hypothetical competitors.

| Date | Opening Price (USD) | Closing Price (USD) | Volume |

|---|---|---|---|

| 2019-01-01 | 10.00 | 10.50 | 100,000 |

| 2019-07-01 | 12.00 | 11.80 | 150,000 |

| 2020-01-01 | 11.50 | 13.00 | 120,000 |

| 2020-07-01 | 12.80 | 12.50 | 110,000 |

| 2021-01-01 | 14.00 | 15.00 | 180,000 |

| 2021-07-01 | 14.50 | 14.20 | 160,000 |

| 2022-01-01 | 16.00 | 15.50 | 200,000 |

| 2022-07-01 | 15.20 | 16.50 | 190,000 |

| 2023-01-01 | 17.00 | 17.50 | 220,000 |

Major events impacting the stock price during this period included a hypothetical global economic downturn in 2020 and the launch of a new product in 2021.

The following table compares SMMT’s performance to its hypothetical competitors (CompA and CompB) over the same period. Again, this data is hypothetical.

| Company | Average Annual Growth |

|---|---|

| SMMT | 7.5% |

| CompA | 5% |

| CompB | 10% |

Factors Influencing SMMT Stock Price

Several key factors influence SMMT’s stock price. These include macroeconomic conditions, industry trends, and company-specific news.

Economic factors such as interest rate changes and inflation significantly impact investor sentiment and market valuations. Industry-specific regulations and technological advancements also play a crucial role. Company-specific news, such as earnings reports and product launches, directly affects investor confidence and, consequently, the stock price.

- Earnings Reports: Strong earnings typically lead to price increases, while weak earnings can cause declines. For example, exceeding projected earnings in Q4 2022 could result in a 5% price jump.

- Product Launches: Successful new product launches often boost investor confidence and drive stock prices upward. Conversely, product failures can negatively impact the stock.

- Mergers and Acquisitions: Successful acquisitions can increase market share and profitability, positively impacting the stock price. Failed attempts can lead to declines.

SMMT Stock Price Prediction & Forecasting

Source: tradingview.com

Predicting future stock prices is inherently uncertain. However, we can create hypothetical scenarios based on different economic and industry conditions using various models. The following table illustrates three different prediction models—simple moving average, linear regression, and a hypothetical proprietary model—with their assumptions and projected outcomes for the next year. Remember, these are purely hypothetical examples.

| Model | Assumptions | Projected Price (1 year) | Risks and Uncertainties |

|---|---|---|---|

| Simple Moving Average | Based on past 6-month average | $19.00 | Ignores market trends and external factors |

| Linear Regression | Based on historical price trends | $20.50 | Assumes linear growth, which may not hold true |

| Proprietary Model | Considers macroeconomic factors, industry trends, and company performance | $18.00 | Model accuracy depends on input data and assumptions |

Investor Sentiment and Market Analysis for SMMT

Analyzing investor sentiment involves examining publicly available data such as social media mentions and news articles. Market analysis techniques, including fundamental and technical analysis, provide additional insights. Different investment analysts may have varying perspectives on SMMT’s future prospects.

- Analyst A: Believes SMMT is undervalued and projects strong growth potential based on fundamental analysis of the company’s financials.

- Analyst B: Holds a more cautious outlook, citing potential risks related to industry competition and economic uncertainty.

- Analyst C: Uses technical analysis to identify potential price targets based on chart patterns and trading volume.

Illustrative Examples of SMMT Stock Price Fluctuations

Three instances of significant SMMT stock price changes are described below. These examples illustrate the impact of various factors on stock price volatility. Note that these are hypothetical examples.

Example 1: Q4 2020 Earnings Surprise

SMMT’s stock price surged 10% in a single day following the release of unexpectedly strong Q4 2020 earnings. This positive surprise exceeded market expectations, boosting investor confidence and driving demand for the stock. The price movement was rapid, with the stock opening at $12.00 and closing at $13.20. The volume traded that day was significantly higher than average.

Example 2: Regulatory Setback

The stock price experienced a sharp 8% decline after the announcement of a new industry regulation that negatively impacted SMMT’s operations. This news created uncertainty among investors, leading to a sell-off. The price dropped from $15.00 to $13.80 within a week.Monitoring the SMMT stock price requires a keen eye on market trends. It’s interesting to compare its performance to other tech giants; for instance, understanding the fluctuations in the facebook stock stock price can offer valuable context. Ultimately, however, a thorough analysis of SMMT’s specific financial reports and industry position is crucial for accurate prediction.

Example 3: Successful Product Launch

Following the successful launch of a new flagship product, SMMT’s stock price gradually increased by 15% over a three-month period. Positive reviews and strong initial sales fueled investor optimism, driving sustained price appreciation. The price rose steadily from $14.00 to $16.10.

Question & Answer Hub: Smmt Stock Price

What are the major risks associated with investing in SMMT?

Investing in SMMT, like any stock, carries inherent risks including market volatility, economic downturns, and company-specific challenges (e.g., competition, regulatory changes).

Where can I find real-time SMMT stock price data?

Real-time SMMT stock price data is typically available through major financial websites and brokerage platforms.

How frequently are SMMT’s earnings reports released?

The frequency of SMMT’s earnings reports will depend on the company’s reporting schedule; typically quarterly or annually.

What is the current P/E ratio for SMMT stock?

The current P/E ratio for SMMT can be found on major financial websites and is subject to constant change.