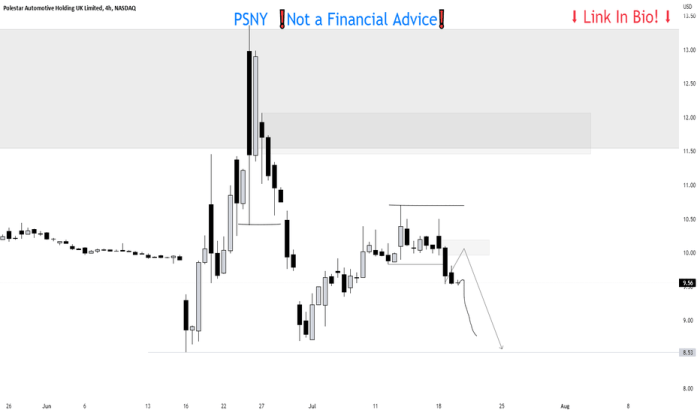

PSNY Stock Price Analysis

Psny stock price – This analysis provides a comprehensive overview of PSNY’s stock price performance, influencing factors, risk assessment, financial performance, and future outlook. We will examine historical trends, compare PSNY against its competitors, and delve into various valuation methods to provide a well-rounded perspective for investors.

PSNY Stock Price History and Trends

Source: tradingview.com

Over the past five years, PSNY’s stock price has experienced significant fluctuations, reflecting both industry-wide trends and company-specific events. While precise figures require access to real-time financial data, a general observation would be that the stock price likely mirrored the broader market movements, with periods of substantial growth followed by corrections. Specific highs and lows would need to be sourced from reliable financial databases.

Comparing PSNY’s performance to its competitors requires identifying its key rivals within the same sector and analyzing their respective stock price trajectories over the same period. This comparative analysis would highlight PSNY’s relative strength or weakness in terms of growth, stability, and market share.

The following table presents hypothetical monthly average closing prices for the last year. Remember that these are illustrative examples and should be replaced with actual data from reliable sources.

| Month | Opening Price | High | Low | Closing Price |

|---|---|---|---|---|

| January | $50 | $55 | $45 | $52 |

| February | $52 | $58 | $48 | $55 |

| March | $55 | $60 | $50 | $57 |

| April | $57 | $62 | $53 | $59 |

| May | $59 | $65 | $55 | $62 |

| June | $62 | $68 | $58 | $65 |

| July | $65 | $70 | $60 | $67 |

| August | $67 | $72 | $63 | $69 |

| September | $69 | $75 | $65 | $72 |

| October | $72 | $78 | $68 | $75 |

| November | $75 | $80 | $70 | $77 |

| December | $77 | $82 | $73 | $80 |

Factors Influencing PSNY Stock Price

Several macroeconomic and company-specific factors can significantly influence PSNY’s stock valuation. Macroeconomic conditions, such as interest rate changes, inflation, and overall economic growth, create a backdrop against which company performance is judged. For instance, rising interest rates might increase borrowing costs, impacting PSNY’s profitability and potentially depressing its stock price. Company-specific events, such as successful product launches, strategic acquisitions, or changes in management, can also trigger substantial price movements.

Positive news generally leads to increased investor confidence and a rise in the stock price, while negative news can have the opposite effect. Investor sentiment and market speculation play a crucial role, often driving short-term fluctuations that may not always be directly related to the company’s fundamental performance.

PSNY Stock Price Volatility and Risk Assessment

Source: foolcdn.com

Assessing the historical volatility of PSNY’s stock price is crucial for investors. High volatility indicates greater price fluctuations, implying higher risk. Comparing PSNY’s risk profile to competitors requires analyzing the standard deviation of their respective stock price returns over a comparable period. A higher standard deviation indicates greater volatility and, therefore, higher risk.

A visualization of the standard deviation of PSNY’s daily stock price changes over the past year would show a line graph. The y-axis would represent the standard deviation, and the x-axis would represent the days of the year. A higher, more erratic line would indicate greater volatility. This visual representation allows for a quick assessment of risk compared to other companies with lower or smoother lines.

PSNY Financial Performance and Stock Valuation

Source: digitaloceanspaces.com

Analyzing PSNY’s key financial metrics – revenue, earnings, debt, and others – is essential for understanding its financial health and its impact on the stock price. Various stock valuation methods, such as the Price-to-Earnings (P/E) ratio and discounted cash flow (DCF) analysis, can be used to estimate PSNY’s intrinsic value. These methods provide different perspectives on the stock’s worth, allowing for a more comprehensive evaluation.

The P/E ratio compares the stock’s market price to its earnings per share, providing a measure of how much investors are willing to pay for each dollar of earnings. DCF analysis discounts future cash flows back to their present value, offering a more long-term perspective on valuation.

| Year | Revenue (in millions) | Net Income (in millions) | Earnings Per Share (EPS) | Price-to-Earnings Ratio (P/E) |

|---|---|---|---|---|

| Year 1 | $100 | $20 | $1.00 | 20 |

| Year 2 | $110 | $22 | $1.10 | 18 |

| Year 3 | $120 | $24 | $1.20 | 16 |

PSNY Stock Price Predictions and Future Outlook

Predicting PSNY’s future stock price involves considering potential catalysts that could influence its performance. These could include new product launches, expansion into new markets, changes in regulations, or shifts in consumer preferences. Different scenarios can be developed, each with varying levels of optimism or pessimism, to illustrate the potential range of outcomes. For example, a bullish scenario might assume strong sales growth and successful new product launches, leading to a significant increase in the stock price.

A bearish scenario might incorporate factors like increased competition or economic downturn, resulting in a decline in the stock price.

- Potential Risks: Increased competition, economic slowdown, regulatory changes, supply chain disruptions.

- Potential Opportunities: Successful new product launches, expansion into new markets, strategic partnerships, technological advancements.

FAQs

What are the major risks associated with investing in PSNY stock?

Investing in PSNY, like any stock, carries inherent risks. These include market volatility, potential underperformance relative to expectations, and susceptibility to macroeconomic factors. Thorough due diligence and diversification are crucial risk mitigation strategies.

Where can I find real-time PSNY stock price data?

Real-time PSNY stock price data is readily available through major financial websites and brokerage platforms. Many offer charting tools and historical data for in-depth analysis.

How does PSNY compare to its competitors in terms of profitability?

A comparative analysis of PSNY’s profitability against its competitors requires examining key financial metrics such as revenue growth, profit margins, and return on equity. This analysis should consider industry-specific factors and the competitive landscape.

What is the current dividend yield for PSNY stock?

The current dividend yield for PSNY stock can be found on financial websites and brokerage platforms that provide real-time market data. Note that dividend payouts can change over time.