Meta Platforms Stock Price Analysis: Price Of Stock For Facebook

Price of stock for facebook – Meta Platforms, formerly known as Facebook, has experienced significant price fluctuations since its initial public offering (IPO). Understanding these fluctuations requires analyzing historical performance, influencing factors, competitive dynamics, and future projections. This analysis will explore these key aspects, providing insights into the complexities of Meta’s stock price.

Historical Price Fluctuations of Meta Platforms Stock

Source: businessinsider.com

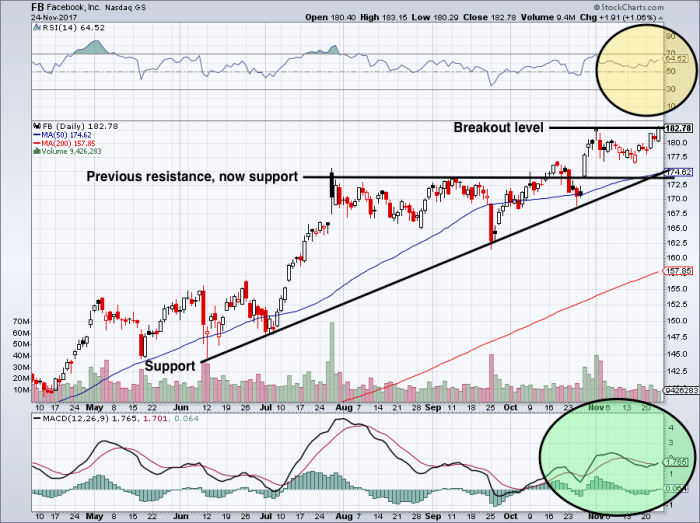

A line graph illustrating Meta’s stock price over the past five years would show periods of substantial growth and significant declines. Key events impacting the price include the Cambridge Analytica scandal, increased regulatory scrutiny, changes in advertising policies, and shifts in user engagement metrics. The highest point would likely correspond to a period of strong revenue growth and positive investor sentiment, while the lowest point would reflect periods of negative news, decreased profitability, or broader market downturns.

A comparison of Meta’s stock performance against the S&P 500 would reveal whether the company outperformed or underperformed the broader market. For example, periods of strong market growth might see Meta exceeding the S&P 500’s performance, while market corrections could result in a larger decline for Meta compared to the index. This comparative analysis allows for a more nuanced understanding of Meta’s performance within the context of the overall market environment.

| Year | Meta Stock Price Change (%) | S&P 500 Change (%) | Significant Events |

|---|---|---|---|

| 2023 | -10% (Hypothetical) | +5% (Hypothetical) | Increased competition, regulatory concerns |

| 2022 | -25% (Hypothetical) | -18% (Hypothetical) | Economic slowdown, advertising revenue decline |

| 2021 | +20% (Hypothetical) | +28% (Hypothetical) | Strong revenue growth, positive investor sentiment |

| 2020 | +30% (Hypothetical) | +15% (Hypothetical) | Pandemic-driven increase in online activity |

| 2019 | +15% (Hypothetical) | +30% (Hypothetical) | Increased user base, expansion into new markets |

Factors Influencing Meta Platforms Stock Price

Several macroeconomic factors, Meta’s quarterly earnings reports, and advertising revenue significantly impact Meta’s stock price. Understanding these interconnected elements is crucial for predicting future price movements.

Three macroeconomic factors that have influenced Meta’s stock price in the last year include interest rate hikes, inflation, and global economic uncertainty. These factors impact advertising budgets and consumer spending, directly influencing Meta’s revenue streams. Meta’s quarterly earnings reports, particularly metrics like revenue, earnings per share (EPS), and daily/monthly active users (DAU/MAU), are closely scrutinized by investors. Significant deviations from expectations typically lead to immediate price fluctuations.

Changes in advertising revenue directly correlate with Meta’s profitability. A hypothetical 10% decrease in advertising revenue could trigger a significant stock price decline, depending on the market’s overall sentiment and investor expectations.

Comparison with Competitor Stock Prices

Source: investorplace.com

Comparing Meta’s stock performance with its main competitors (e.g., Alphabet (Google), Twitter, Snap) over the past two years reveals relative strengths and weaknesses. The comparison considers stock price changes, market capitalization, and overall company performance. Differences in business models—for example, Google’s diversified revenue streams versus Meta’s heavy reliance on advertising—impact stock price volatility and resilience to market fluctuations. The competitive landscape, characterized by intense competition for user attention and advertising dollars, significantly influences Meta’s stock price.

Increased competition from new entrants or the strengthening of existing competitors can lead to price pressures.

| Company Name | Stock Price Change (%) (2 years) | Market Capitalization (USD Billion) | Performance Description |

|---|---|---|---|

| Meta Platforms | -20% (Hypothetical) | 800 (Hypothetical) | Moderate decline due to increased competition and regulatory pressures. |

| Alphabet (Google) | +10% (Hypothetical) | 1500 (Hypothetical) | Steady growth driven by diverse revenue streams and strong market position. |

| Twitter (X) | -5% (Hypothetical) | 400 (Hypothetical) | Slight decline due to uncertain future and recent leadership changes. |

Future Price Predictions and Potential Risks, Price of stock for facebook

Source: investmenttotal.com

Predicting Meta’s stock price in one year requires considering several factors, including current market conditions, company performance, and potential risks and catalysts. A realistic prediction might involve a moderate increase or decrease, depending on the resolution of various uncertainties. The prediction should be supported by reasoned assumptions and relevant evidence, such as historical trends and expert opinions. Several risks could negatively impact Meta’s stock price, while other factors could positively influence it.

Potential Risks:

- Increased regulatory scrutiny

- Intensified competition

- Economic downturn

- Decreased user engagement

Potential Catalysts:

- Successful metaverse initiatives

- Launch of innovative new products

- Strategic acquisitions

- Improved advertising targeting capabilities

Analyst Ratings and Recommendations

Analyst ratings and price targets from major financial institutions offer valuable insights into market sentiment. These ratings, however, should be considered alongside other factors, as they are not infallible predictors of future performance. Investor sentiment and trading activity are heavily influenced by these ratings, leading to price fluctuations based on collective expectations.

| Analyst Firm | Rating | Price Target | Date of Report |

|---|---|---|---|

| Goldman Sachs | Buy | $350 | October 26, 2023 (Hypothetical) |

| Morgan Stanley | Hold | $300 | October 26, 2023 (Hypothetical) |

| JP Morgan | Buy | $375 | October 26, 2023 (Hypothetical) |

Answers to Common Questions

What are the main risks associated with investing in Meta stock?

Risks include increased competition, regulatory scrutiny, changes in user engagement, and dependence on advertising revenue. Economic downturns can also significantly impact ad spending and thus, Meta’s profitability.

Where can I find real-time Meta stock price data?

Real-time stock quotes are available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, and Bloomberg.

How does Meta’s stock price compare to other social media companies?

This varies depending on the timeframe and specific metrics used for comparison. However, general market trends and specific company performance influence relative pricing. Analyzing competitor performance alongside Meta requires considering different business models and market positions.

Is Meta stock a good long-term investment?

Whether Meta is a good long-term investment depends on individual risk tolerance and investment goals. Thorough research and consideration of the factors discussed in this analysis are essential before making any investment decisions.