Understanding Price Delta in Stock Trading

Price delta stock – Price delta, a crucial concept in finance, quantifies the expected change in an option’s or other derivative’s price for a one-unit change in the underlying asset’s price. This article delves into the multifaceted nature of price delta, exploring its implications across various trading scenarios and strategies.

Defining Price Delta in Stocks

Price delta represents the sensitivity of a derivative’s price to changes in the underlying asset’s price. For options, it indicates the probability of the option finishing in the money. A delta of 0.50 suggests a 50% chance of the option expiring in the money. For stocks, delta can be interpreted as the expected price change in the stock per unit change in a related asset.

The calculation can vary based on the context.

Option Pricing Example: The Black-Scholes model, a widely used options pricing model, incorporates delta as a key parameter. While the full formula is complex, a simplified understanding is that delta reflects the rate of change of the option price with respect to the underlying asset’s price.

Δ = ∂V/∂S

Where Δ represents delta, V represents the option price, and S represents the price of the underlying asset.

Factors influencing delta fluctuations include time to expiration, volatility of the underlying asset, the current price of the underlying asset relative to the strike price (for options), and interest rates.

Price Delta and Market Volatility

Market volatility significantly impacts price delta. Higher volatility generally leads to larger price deltas, implying greater sensitivity to price movements in the underlying asset. Conversely, stable markets result in smaller deltas.

High volatility amplifies the impact of price changes on delta. For instance, during periods of market uncertainty, a small price movement in the underlying asset can cause a substantial change in the derivative’s price, leading to significant delta fluctuations.

In stable markets, price delta tends to be more predictable and less volatile, reflecting the smaller price swings in the underlying asset.

| Stock Price (Start) | Stock Price Change | Volatility (Implied) | Price Delta Change |

|---|---|---|---|

| $100 | +$5 | Low | +0.05 |

| $100 | +$5 | High | +0.20 |

| $100 | -$2 | Low | -0.02 |

| $100 | -$2 | High | -0.08 |

Price Delta in Options Trading, Price delta stock

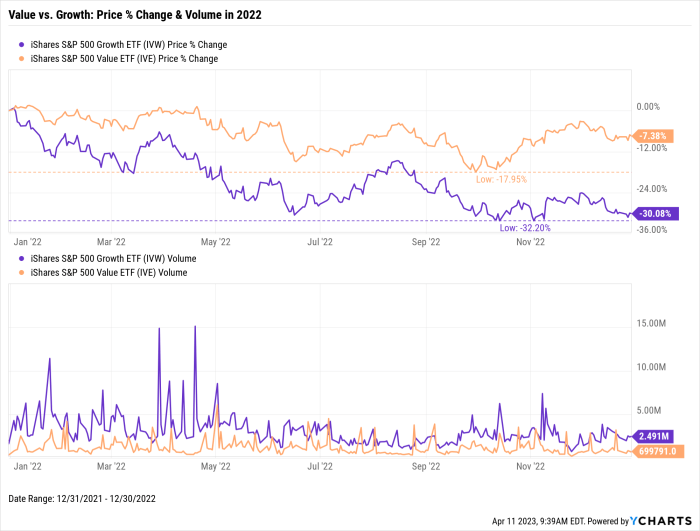

Source: ycharts.com

In options trading, delta plays a vital role in pricing and risk management. The Black-Scholes model utilizes delta to determine the theoretical price of an option. Call options have positive deltas (as the underlying asset price rises, so does the call price), while put options have negative deltas (as the underlying asset price rises, the put price falls).

As an option approaches expiration, its delta moves towards 1 for in-the-money call options and -1 for in-the-money put options, or 0 for out-of-the-money options. This rapid change in delta near expiration makes options highly sensitive to price movements during this period.

Practical Applications of Price Delta

Traders use price delta to manage risk and construct various trading strategies. Delta-neutral hedging, for instance, aims to minimize exposure to price fluctuations in the underlying asset.

- Risk Management: Traders can adjust their positions to maintain a desired level of delta exposure, thereby controlling their risk profile.

- Delta-Neutral Hedging: This strategy involves offsetting the delta of a long position with a short position to reduce risk.

- Directional Trading: High-delta strategies are used when traders expect a significant price movement in the underlying asset.

Incorporating price delta into a trading plan involves monitoring delta changes, adjusting positions accordingly, and setting risk tolerance levels based on delta exposure.

Price Delta and Hedging Strategies

Price delta is instrumental in constructing hedging strategies designed to mitigate risk. Delta hedging aims to reduce or eliminate the sensitivity of a portfolio to changes in the underlying asset’s price.

Delta hedging involves dynamically adjusting the portfolio’s positions to maintain a neutral delta exposure. Other hedging strategies, such as gamma hedging (managing changes in delta), also utilize delta calculations.

Different hedging techniques vary in their complexity and effectiveness, depending on market conditions and the specific instruments involved.

Visualizing Price Delta

Source: vskills.in

A graph depicting the relationship between stock price and price delta would have the stock price on the x-axis and the price delta on the y-axis. The graph would typically show a sigmoid curve for options, starting near zero for deep out-of-the-money options, rising to 1 (or -1 for puts) as the option moves in-the-money, and leveling off near 1 or -1 for deep in-the-money options.

The steepness of the curve reflects the sensitivity of the delta to price changes. Traders interpret the graph to understand the sensitivity of their positions to changes in the underlying asset price and adjust their positions accordingly.

Price Delta and Algorithmic Trading

Source: stockprice.com

Algorithmic trading systems frequently utilize price delta for automated decision-making and risk management. Delta values are incorporated into trading algorithms to dynamically adjust positions based on real-time market data.

The advantages of using price delta in algorithmic trading include faster execution speeds and the ability to manage large numbers of trades simultaneously. However, limitations include the potential for errors in delta calculations and the risk of over-reliance on a single metric.

Limitations of Using Price Delta

While price delta provides valuable insights, relying solely on it for trading decisions can be misleading. Other factors, such as gamma (rate of change of delta), vega (sensitivity to volatility), and theta (time decay), should also be considered.

Inaccurate delta calculations, due to factors like model limitations or unexpected market events, can lead to incorrect trading decisions. Therefore, a comprehensive approach incorporating multiple factors is crucial for effective risk management and successful trading.

Questions Often Asked: Price Delta Stock

What is the difference between delta in call and put options?

Call option delta represents the probability of the option expiring in the money, ranging from 0 to 1. Put option delta ranges from -1 to 0, with a similar interpretation but indicating a negative correlation with the underlying asset’s price.

How often should price delta be recalculated?

Price delta is dynamic and changes constantly due to market fluctuations. It should be monitored frequently, ideally in real-time, or at minimum, throughout the trading day.

Can price delta predict future price movements with certainty?

No, price delta indicates the

-potential* change in option price for a one-unit change in the underlying asset’s price. It’s not a predictor of future price movements with certainty and should be used in conjunction with other analytical tools.

What are some common mistakes traders make when using price delta?

Over-reliance on delta without considering other factors (volatility, time decay, etc.), misinterpreting delta as a precise prediction of price movement, and failing to adjust delta-based strategies in response to changing market conditions are common mistakes.