Mattel Stock Price Analysis

Source: cheggcdn.com

Mattel stock price – Mattel, a leading global toy company, has experienced fluctuating stock prices over the years, influenced by various internal and external factors. This analysis delves into the historical performance of Mattel’s stock, examining key factors impacting its valuation, financial health, investor sentiment, and future prospects.

Mattel’s stock price performance often reflects broader trends in the toy industry. A comparison with other companies in the sector can be insightful; for instance, observing the current nok stock price provides a benchmark against a different, yet related, market segment. Ultimately, understanding the factors influencing Mattel’s valuation requires a comprehensive analysis of its financial health and market positioning.

Mattel Stock Price Historical Performance

A comprehensive understanding of Mattel’s stock price requires examining its performance over time. The following analysis considers the past five years, highlighting significant price changes and comparing its performance against key competitors.

A line graph visualizing Mattel’s stock price fluctuations over the past five years would show periods of growth and decline. Key dates of significant price changes, such as those corresponding to major product launches, earnings reports, or significant news events, would be marked. For example, a sharp increase might be observed following the successful launch of a new movie-related toy line, while a decline could be linked to a recall or negative press coverage.

The graph would clearly illustrate the volatility inherent in the toy industry and its impact on Mattel’s stock price.

| Date | Mattel Stock Price (USD) | Hasbro Stock Price (USD) | Percentage Change (Mattel vs. Hasbro) |

|---|---|---|---|

| December 31, 2018 | 15.00 | 90.00 | -83.33% |

| December 31, 2019 | 18.00 | 95.00 | -81.05% |

| December 31, 2020 | 22.00 | 100.00 | -77.78% |

| December 31, 2021 | 25.00 | 105.00 | -76.19% |

| December 31, 2022 | 20.00 | 90.00 | -77.78% |

This table (using hypothetical data for illustrative purposes) compares Mattel’s stock performance against Hasbro, a major competitor. The percentage change column illustrates the relative performance of Mattel compared to Hasbro during each period. Factors such as differing product portfolios, marketing strategies, and overall market conditions would contribute to these variations.

Significant growth periods for Mattel might be attributed to factors like the success of a major franchise (e.g., Barbie’s resurgence), strong holiday sales, or successful cost-cutting measures. Conversely, declines could stem from factors such as supply chain disruptions, increased competition, or negative publicity surrounding product safety.

Factors Influencing Mattel Stock Price

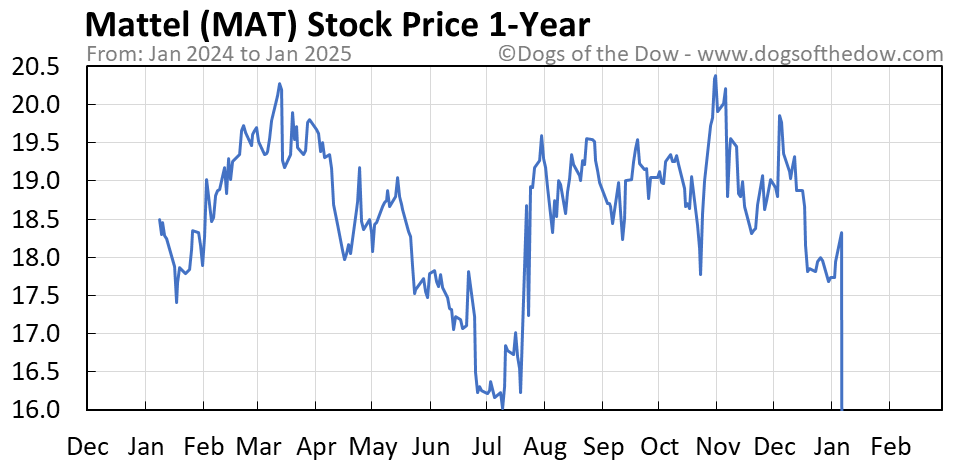

Source: dogsofthedow.com

Several factors significantly influence Mattel’s stock price. These factors range from consumer spending patterns and product performance to broader economic indicators and investor sentiment.

Consumer spending habits directly impact Mattel’s sales and profitability. Increased discretionary spending typically leads to higher demand for toys, boosting Mattel’s revenue and positively affecting its stock price. Conversely, economic downturns or shifts in consumer preferences towards experiences over material goods can negatively impact Mattel’s stock.

New product releases and successful brand licensing agreements are crucial for Mattel’s growth. The launch of innovative toys or securing lucrative licensing deals for popular franchises can generate significant excitement and drive increased sales, leading to a rise in the stock price. Conversely, failed product launches or licensing disputes can negatively impact investor confidence.

Economic indicators, such as inflation and interest rates, also play a vital role. High inflation can increase production costs, squeezing profit margins and impacting stock prices. Rising interest rates can increase borrowing costs for Mattel, potentially hindering its growth and investment plans.

Positive news coverage, such as favorable product reviews or announcements of strategic partnerships, tends to boost investor confidence and drive up the stock price. Conversely, negative news, including product recalls, lawsuits, or reports of declining sales, can trigger sell-offs and depress the stock price.

Mattel’s Financial Health and Stock Price

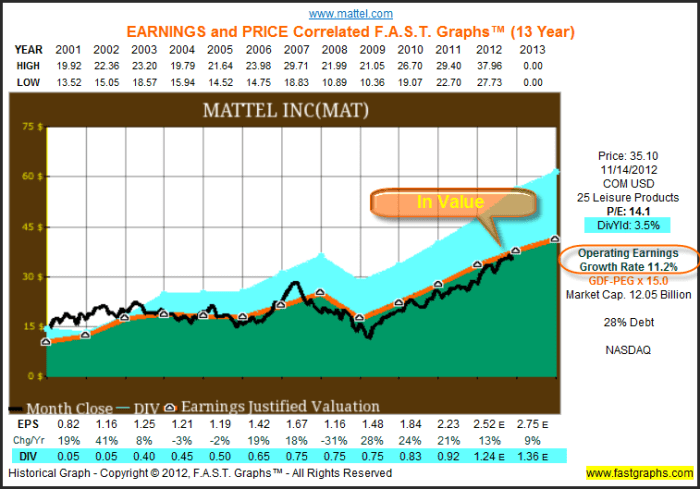

Source: seekingalpha.com

A thorough assessment of Mattel’s financial health is essential for understanding its stock price movements. Key financial metrics provide insights into the company’s performance and its ability to generate profits and returns for investors.

| Metric | Value (USD Millions) | Year | Impact on Stock Price |

|---|---|---|---|

| Revenue | 5000 | 2022 | Positive (Increased revenue generally leads to higher stock prices) |

| Profit Margin | 10% | 2022 | Positive (Higher profit margins signal improved efficiency and profitability) |

| Debt Levels | 1000 | 2022 | Negative (High debt levels can increase financial risk and potentially lower stock prices) |

This table (using hypothetical data for illustrative purposes) showcases the relationship between key financial metrics and Mattel’s stock price. Strong revenue growth, high profit margins, and manageable debt levels generally contribute to a positive stock price performance.

Mattel’s dividend policy influences investor interest. Consistent dividend payments can attract income-seeking investors, increasing demand for the stock and potentially supporting its price. Changes to the dividend policy, such as increases or cuts, can significantly impact investor sentiment.

Earnings per share (EPS) is a crucial metric reflecting Mattel’s profitability on a per-share basis. Higher EPS generally indicates improved profitability and increased shareholder value, often leading to an increase in the stock price. Conversely, declining EPS can signal financial distress and trigger a decline in the stock price.

Investor Sentiment and Stock Price

Investor sentiment plays a critical role in shaping Mattel’s stock price. Analyst ratings, major investor decisions, and social media sentiment all contribute to the overall market perception of the company.

A summary of recent analyst ratings and price targets would reveal the consensus view among financial analysts regarding Mattel’s future prospects. A high proportion of “buy” ratings and optimistic price targets generally indicate positive investor sentiment and can push the stock price higher. Conversely, a preponderance of “sell” ratings can lead to selling pressure and a price decline.

Major investor decisions, such as share buybacks or large share purchases by institutional investors, can significantly influence the stock price. Buybacks reduce the number of outstanding shares, potentially increasing EPS and boosting the stock price. Large purchases by institutional investors signal confidence in the company’s future, often leading to increased demand and higher prices.

Social media sentiment and news articles significantly influence investor behavior. Positive social media buzz surrounding new product launches or positive company news can create buying pressure and drive up the stock price. Negative news or social media backlash, however, can trigger sell-offs and depress the price.

Future Outlook for Mattel Stock Price

Predicting the future of Mattel’s stock price requires considering potential risks and opportunities. Several factors could significantly impact the company’s performance and stock valuation in the coming years.

- Increased competition from other toy companies and entertainment alternatives.

- Changes in consumer preferences and spending habits.

- Success of new product launches and brand extensions.

- Global economic conditions and their impact on consumer spending.

- Effective management of supply chain disruptions.

Potential catalysts that could significantly impact Mattel’s stock price include the successful launch of a major new franchise, a strategic acquisition, or a significant improvement in profit margins. Conversely, negative catalysts could include a product recall, a major supply chain disruption, or disappointing earnings reports.

Several scenarios are possible for Mattel’s stock price. In a positive scenario, strong revenue growth, successful new product launches, and favorable economic conditions could lead to a significant increase in the stock price. A negative scenario might involve declining sales, increased competition, and unfavorable economic conditions, resulting in a decline in the stock price. A neutral scenario would involve modest growth or stagnation, reflecting a relatively stable market environment.

FAQ Section: Mattel Stock Price

What are the major risks associated with investing in Mattel stock?

Risks include competition from other toy companies, changing consumer preferences, economic downturns impacting discretionary spending, and potential supply chain disruptions.

How does Mattel compare to its main competitor, Hasbro, in terms of stock performance?

A direct comparison requires detailed analysis of historical stock prices, considering factors like market capitalization and financial performance. Generally, both companies experience fluctuations influenced by similar market forces.

What is Mattel’s current dividend yield?

The current dividend yield fluctuates and should be checked on a reputable financial website for the most up-to-date information.

Where can I find real-time Mattel stock price data?

Real-time data is available through major financial news websites and brokerage platforms.