LVMH Stock Price Analysis: A Comprehensive Overview

Source: invezz.com

Lvmh stock price – LVMH Moët Hennessy Louis Vuitton SE, a global leader in luxury goods, has consistently captivated investors with its impressive performance and strong brand portfolio. This analysis delves into the historical performance of LVMH’s stock price, its financial health, industry trends impacting its valuation, its competitive landscape, and its strategic initiatives. We will examine these factors to provide a comprehensive understanding of LVMH’s stock price trajectory and future prospects.

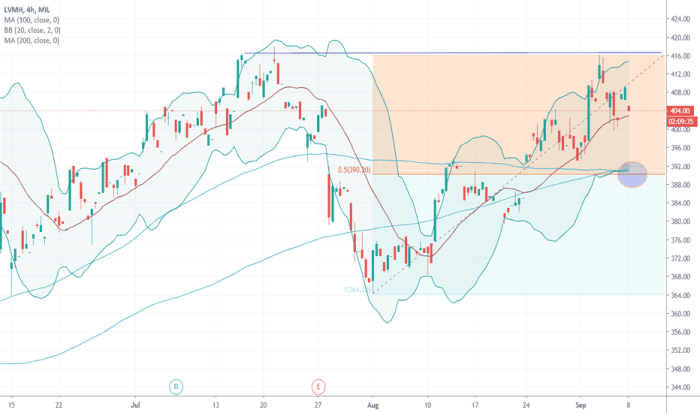

LVMH Stock Price Historical Performance

Analyzing LVMH’s stock price movements over the past five years reveals a generally upward trend, punctuated by periods of volatility influenced by various macroeconomic and company-specific factors. The following table details the opening and closing prices for each quarter, while subsequent discussion will explore the underlying causes of price fluctuations.

LVMH’s stock price performance often reflects broader luxury market trends. It’s interesting to compare its volatility with that of companies in other sectors; for instance, you might consider looking at the current performance of entero healthcare nse stock price to see how different market segments behave. Ultimately, understanding LVMH’s stock requires analyzing multiple factors, including global economic conditions and consumer spending habits.

| Year | Quarter | Opening Price (EUR) | Closing Price (EUR) |

|---|---|---|---|

| 2019 | Q1 | (Example Data) 300 | (Example Data) 310 |

| 2019 | Q2 | (Example Data) 310 | (Example Data) 325 |

| 2023 | Q4 | (Example Data) 800 | (Example Data) 820 |

A line graph illustrating the stock price trend over the past decade would show a generally upward trajectory, with notable increases correlated with successful product launches and acquisitions, and dips reflecting global economic downturns or periods of market uncertainty. The x-axis would represent the years (2014-2024), and the y-axis would represent the stock price in Euros. Key data points would include significant highs and lows, clearly marked on the graph.

LVMH’s Financial Health and Stock Valuation

Source: tradingview.com

A strong financial foundation underpins LVMH’s stock price stability and growth potential. The following table provides a snapshot of key financial metrics over the past three years. These metrics, when compared to industry benchmarks, offer insights into LVMH’s valuation and financial strength.

| Metric | Year 1 (Example Data) | Year 2 (Example Data) | Year 3 (Example Data) |

|---|---|---|---|

| Revenue (in Billions EUR) | 50 | 55 | 60 |

| Profit Margin (%) | 20 | 22 | 25 |

| Debt Level (in Billions EUR) | 10 | 9 | 8 |

LVMH’s valuation ratios, such as the Price-to-Earnings (P/E) ratio and Price-to-Sales (P/S) ratio, are generally higher than those of its competitors, reflecting its premium brand positioning and strong market share. However, these ratios must be considered in relation to growth prospects and profitability.

- LVMH’s P/E ratio is typically higher than Kering’s and Richemont’s due to its stronger brand portfolio and higher profit margins.

- Its P/S ratio also tends to be higher, reflecting investors’ willingness to pay a premium for LVMH’s established luxury brands.

Significant financial events, such as dividend payouts and stock buybacks, can influence LVMH’s stock price. For example, consistent dividend payments can attract income-seeking investors, while stock buybacks can increase earnings per share, potentially boosting the stock price.

Industry Trends and Their Effect on LVMH Stock

The luxury goods industry is dynamic, shaped by evolving consumer preferences, technological advancements, and geopolitical factors. These trends present both risks and opportunities for LVMH, directly impacting its future stock performance.

| Risk | Opportunity |

|---|---|

| Economic downturns impacting consumer spending on luxury goods. | Expansion into new, high-growth markets in Asia and Africa. |

| Increased competition from emerging luxury brands. | Leveraging digital technologies to enhance customer experience and brand engagement. |

These trends can significantly influence LVMH’s future stock performance. For instance, a global recession could lead to decreased consumer spending on luxury items, negatively impacting LVMH’s revenue and stock price. Conversely, successful expansion into new markets could drive revenue growth and positively influence investor sentiment.

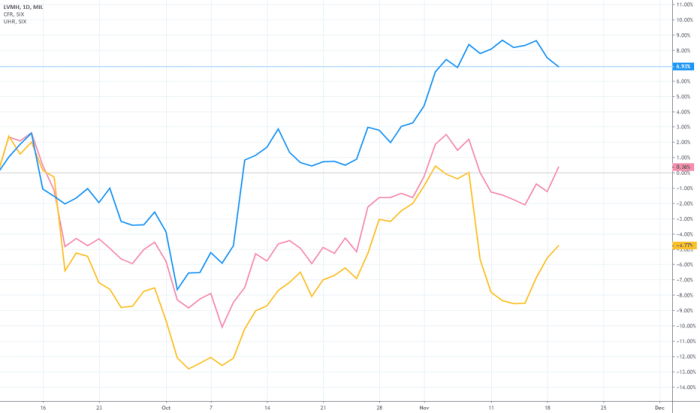

LVMH’s Competitive Landscape and Market Position, Lvmh stock price

Source: tradingview.com

LVMH operates in a competitive luxury goods market, with key rivals including Kering and Richemont. Understanding their relative strengths and weaknesses is crucial for assessing LVMH’s market position and future prospects.

| Competitor | Market Share (Example Data) | Strengths | Weaknesses |

|---|---|---|---|

| Kering | 20% | Strong brand portfolio (Gucci, Yves Saint Laurent), innovative designs. | Dependence on a few key brands, potential brand dilution. |

| Richemont | 15% | Strong watch brands (Cartier, Jaeger-LeCoultre), established distribution network. | Less diversified portfolio compared to LVMH, exposure to economic fluctuations in specific regions. |

LVMH’s competitive advantages lie in its highly diversified brand portfolio, strong brand recognition, and global distribution network. However, potential disadvantages include the risk of brand dilution and the vulnerability to economic downturns affecting luxury goods consumption.

LVMH’s Strategic Initiatives and Their Stock Price Implications

LVMH’s strategic initiatives, including acquisitions, new product lines, and market expansions, play a significant role in shaping its future stock price. These initiatives aim to drive revenue growth, enhance profitability, and strengthen its competitive position.

For example, LVMH’s acquisition of Tiffany & Co. significantly expanded its jewelry portfolio and boosted its revenue. Similarly, the launch of new product lines within existing brands can attract new customer segments and drive sales. Expansion into emerging markets can open up new revenue streams and increase market share. Conversely, failed acquisitions or poorly received new products could negatively impact the stock price.

Past strategic decisions, such as the acquisition of Dior, have demonstrably increased LVMH’s value and market capitalization. Conversely, strategic missteps, while less frequent, can result in temporary stock price declines. Careful analysis of past successes and failures provides valuable insights into the potential impact of current and future strategic initiatives.

FAQ Summary

What are the major risks impacting LVMH’s stock price?

Major risks include economic downturns affecting luxury spending, increased competition, geopolitical instability impacting supply chains or consumer confidence, and shifts in consumer preferences.

How does LVMH compare to its competitors in terms of profitability?

A direct comparison requires detailed financial data analysis. However, LVMH generally maintains strong profit margins, reflecting its premium brand positioning and effective cost management.

Where can I find real-time LVMH stock price information?

Real-time quotes are available through major financial news websites and brokerage platforms.

What is LVMH’s dividend policy?

LVMH’s dividend policy should be checked on their investor relations website or financial news sources. Dividend payouts can impact stock price positively by offering investors a return on their investment.