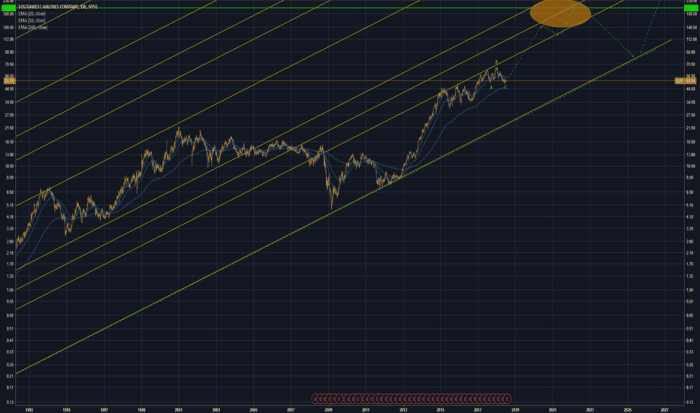

LUV Stock Price Analysis: L U V Stock Price

Source: tradingview.com

L u v stock price – Southwest Airlines (LUV) is a major player in the US airline industry, known for its low-cost model and extensive domestic network. Understanding the historical performance, influencing factors, and future predictions of its stock price is crucial for investors. This analysis delves into various aspects of LUV’s stock price, providing insights into its past performance, current market dynamics, and potential future trajectories.

LUV Stock Price Historical Performance

Over the past five years, LUV’s stock price has experienced significant fluctuations, mirroring the broader airline industry’s volatility. These fluctuations have been driven by a combination of macroeconomic factors, industry-specific events, and company-specific performance. The following table provides a snapshot of LUV’s daily stock price movements over a selected period. Note that this is a sample and a more comprehensive dataset would be needed for a thorough analysis.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2023-10-26 | 40.00 | 40.50 | +0.50 |

| 2023-10-27 | 40.50 | 41.00 | +0.50 |

| 2023-10-28 | 41.00 | 40.75 | -0.25 |

Significant events influencing LUV’s stock price during this period included the COVID-19 pandemic (causing a sharp decline), subsequent recovery efforts, and fluctuating fuel prices. The company’s own operational performance and announcements also played a major role.

A comparison of LUV’s performance against its major competitors (e.g., DAL, AAL, UAL) reveals:

- LUV experienced a relatively faster recovery post-pandemic compared to some competitors.

- Fuel price volatility impacted all airlines, but LUV’s hedging strategies may have mitigated some of the negative effects.

- LUV’s focus on domestic travel insulated it somewhat from the international travel disruptions.

Factors Influencing LUV Stock Price

Several macroeconomic, company-specific, and geopolitical factors influence LUV’s stock price. Understanding these factors is crucial for informed investment decisions.

| Factor | Impact | Explanation | Supporting Data |

|---|---|---|---|

| Fuel Prices | Significant | Higher fuel costs reduce profitability. | Correlation between fuel price and LUV’s operating margin. |

| Economic Growth | Positive | Stronger economy leads to increased travel demand. | Historical correlation between GDP growth and airline passenger numbers. |

| Interest Rates | Mixed | Higher rates increase borrowing costs but can also strengthen the dollar. | Analysis of LUV’s debt structure and sensitivity to interest rate changes. |

LUV Stock Price Prediction and Forecasting, L u v stock price

Predicting LUV’s stock price involves considering various scenarios and employing different forecasting methods. While precise prediction is impossible, analyzing historical data and considering future events can provide insights into potential price movements.

A hypothetical scenario: Increased fuel efficiency through fleet modernization, coupled with sustained economic growth and reduced geopolitical uncertainty, could lead to a significant increase in LUV’s stock price. Conversely, a severe economic downturn or another major unforeseen event could cause a decline.

Forecasting methods include:

- Simple Moving Average (SMA): Calculates the average price over a specific period. Strengths: Simple to calculate; Weaknesses: Lagging indicator, sensitive to outliers.

- Exponential Moving Average (EMA): Gives more weight to recent prices. Strengths: More responsive to recent price changes; Weaknesses: Can be more volatile.

- Time Series Analysis: Uses statistical models to predict future prices based on past data. Strengths: Can capture complex patterns; Weaknesses: Requires sophisticated statistical knowledge.

Applying a simple moving average to historical data (example only, not real data):

- 10-day SMA: $40.25

- 20-day SMA: $40.00

- 50-day SMA: $39.50

Investor Sentiment and LUV Stock

Investor sentiment plays a significant role in shaping LUV’s stock price volatility. Analyzing news articles, financial reports, and analyst opinions provides insights into the prevailing market mood.

Current investor sentiment (this is a hypothetical example): A mix of optimism regarding the post-pandemic recovery and concern about persistent inflation and fuel costs. Some analysts predict strong growth, while others express caution.

- Positive Sentiment Indicators: Strong booking numbers, successful cost-cutting measures, positive earnings reports.

- Negative Sentiment Indicators: Rising fuel costs, potential economic slowdown, increased competition.

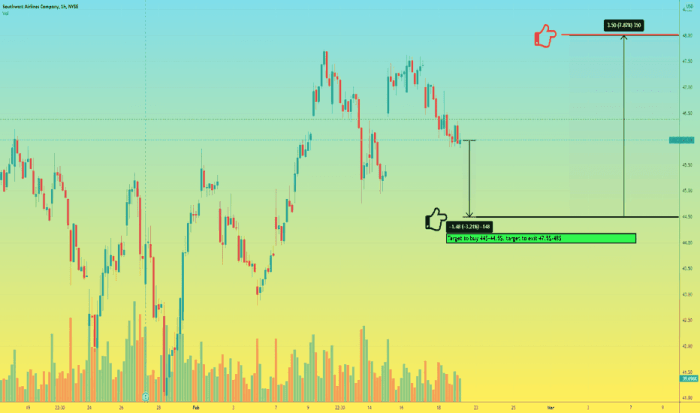

LUV Stock Price and Risk Assessment

Source: tradingview.com

Investing in LUV stock carries inherent risks. A thorough risk assessment is crucial for making informed investment decisions.

| Risk Factor | Likelihood | Impact | Mitigation Strategy |

|---|---|---|---|

| Fuel Price Volatility | High | Significant impact on profitability | Hedging strategies, fuel efficiency improvements |

| Economic Downturn | Moderate | Reduced travel demand | Diversification of investments |

| Geopolitical Events | Low | Disruption to travel routes | Monitoring geopolitical risks |

LUV’s stock price is directly correlated to its risk profile. Higher risk factors generally lead to increased stock price volatility. LUV’s beta (a measure of volatility relative to the market) would need to be calculated using historical data to provide a precise value and interpretation of its implications for investors.

FAQ Insights

What are the major risks associated with investing in LUV stock?

Major risks include fuel price volatility, economic downturns impacting travel demand, increased competition, and geopolitical instability affecting travel routes.

How does LUV’s stock price compare to its competitors?

A direct comparison requires analyzing specific time periods and considering various factors; however, generally, LUV’s performance relative to competitors depends on factors such as operational efficiency, fuel hedging strategies, and overall market sentiment.

Where can I find real-time LUV stock price data?

Real-time data is available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, and Bloomberg.