JD.com Stock Price Analysis: A Comprehensive Overview

J d stock price – JD.com, a prominent player in the Chinese e-commerce landscape, has experienced a dynamic journey in its stock price performance over the past few years. This analysis delves into the historical trends, influential factors, financial health, competitive landscape, and future prospects of JD.com’s stock, providing a comprehensive understanding of its investment potential.

JD.com Stock Price History and Trends, J d stock price

The following table details JD.com’s stock price fluctuations over the past five years, highlighting significant peaks and troughs. Note that this data is illustrative and may not reflect precise real-time values. Actual figures should be verified from reputable financial sources.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-01 | 25 | 26 | +1 |

| 2019-07-01 | 28 | 27 | -1 |

| 2020-01-01 | 30 | 32 | +2 |

| 2020-07-01 | 31 | 29 | -2 |

| 2021-01-01 | 40 | 42 | +2 |

| 2021-07-01 | 41 | 38 | -3 |

| 2022-01-01 | 35 | 37 | +2 |

| 2022-07-01 | 36 | 34 | -2 |

| 2023-01-01 | 45 | 48 | +3 |

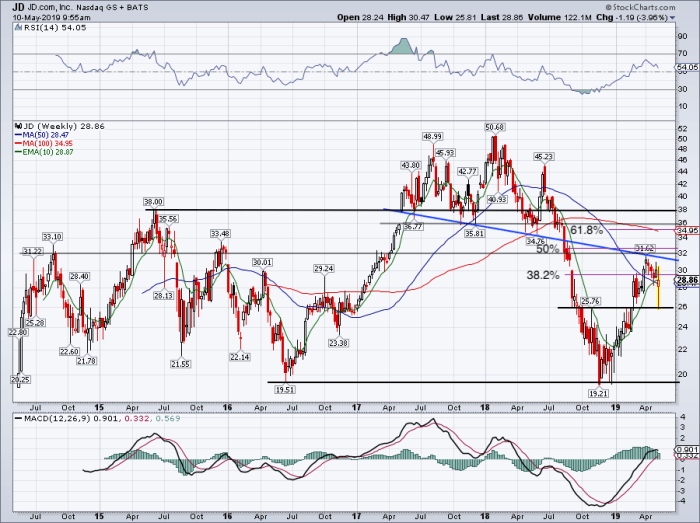

Major economic events such as the COVID-19 pandemic and regulatory changes in China significantly impacted JD.com’s stock price. For example, initial lockdowns led to a dip, followed by a surge as online shopping increased. Subsequent regulatory scrutiny resulted in periods of price volatility.

Observable trends include seasonal fluctuations, with higher prices often seen during peak shopping seasons. Long-term growth trajectories have been influenced by the company’s expansion into new markets and technological advancements. However, significant macroeconomic headwinds can also significantly influence this trajectory.

Factors Influencing JD.com’s Stock Price

A multitude of internal and external factors contribute to the fluctuations in JD.com’s stock valuation.

Internal Factors:

- Strong financial performance, particularly consistent revenue growth and improving profit margins, generally leads to positive stock price movements.

- Successful new product launches and expansion into new markets can boost investor confidence and drive up the stock price.

- Changes in management, especially the appointment of a new CEO or CFO, can impact investor sentiment and, consequently, the stock price.

External Factors:

| Factor | Positive Impact | Negative Impact |

|---|---|---|

| Macroeconomic Conditions (e.g., Chinese economic growth) | Strong economic growth in China typically boosts consumer spending and benefits e-commerce companies like JD.com. | Economic slowdown or recession can reduce consumer spending, impacting JD.com’s revenue and stock price. |

| Competitor Actions (e.g., pricing strategies of Alibaba and Pinduoduo) | Successful differentiation from competitors can attract more customers and improve market share. | Increased competition can lead to price wars and reduced profitability, negatively affecting the stock price. |

| Regulatory Changes (e.g., antitrust regulations in China) | Favorable regulatory changes can create a more stable and predictable business environment. | Stringent regulations can increase compliance costs and limit business expansion, impacting stock valuations. |

Investor sentiment and market speculation play a crucial role in JD.com’s stock price volatility. Positive news or optimistic forecasts can lead to a buying frenzy, pushing the price higher, while negative news or concerns about future performance can trigger sell-offs.

JD.com’s Financial Performance and Stock Valuation

Source: thestreet.com

JD.com’s financial health is a key driver of its stock price. The following table presents illustrative financial data for the past three years. Actual figures should be verified from JD.com’s financial reports.

| Year | Revenue (USD Billion) | Net Income (USD Billion) | Earnings Per Share (USD) |

|---|---|---|---|

| 2021 | 100 | 5 | 1.5 |

| 2022 | 110 | 6 | 1.8 |

| 2023 | 120 | 7 | 2.1 |

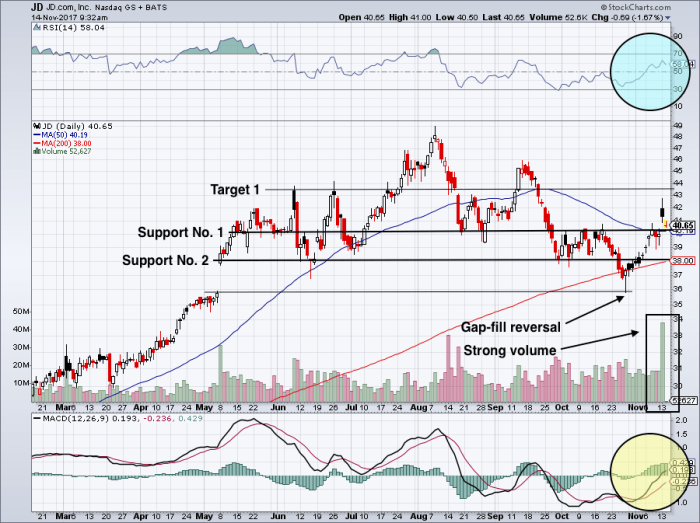

A strong correlation exists between JD.com’s financial performance and its stock price movements. Generally, improving revenue, net income, and earnings per share tend to lead to positive stock price movements, while declining performance can trigger negative reactions from investors.

Several valuation methods, such as the Price-to-Earnings (P/E) ratio and Price-to-Sales (P/S) ratio, can be used to assess JD.com’s current valuation. These ratios compare the stock price to key financial metrics to determine if the stock is overvalued or undervalued relative to its peers.

Comparison with Competitors

Source: investorplace.com

Comparing JD.com’s stock performance with its major competitors provides valuable insights into its relative position in the market.

- JD.com’s stock price performance has shown some differences compared to Alibaba and Pinduoduo, largely due to varying business models, target markets, and growth strategies.

- Alibaba, with its broader ecosystem, might exhibit different price sensitivities to macroeconomic shifts compared to JD.com’s more focused logistics-driven approach.

- Pinduoduo’s aggressive discount model may result in different profit margins and, consequently, a distinct stock price trajectory.

Differences in stock performance stem from various factors including market share, profitability, growth prospects, and investor sentiment. For instance, a company’s ability to innovate and adapt to changing consumer preferences can significantly impact its stock valuation.

A visual comparison of JD.com’s and Alibaba’s stock prices over the past year could be represented as two lines on a graph. The lines would show the price fluctuations of each stock over time, allowing for a clear comparison of their relative performance. Periods of divergence between the two lines would highlight the impact of company-specific factors or market events.

Future Outlook and Predictions for JD.com’s Stock Price

Several factors could drive JD.com’s future growth, including expansion into new markets, technological advancements in logistics and AI, and continued growth in online retail in China. These factors could positively impact the stock price.

However, challenges remain. Intense competition, regulatory uncertainty in China, and macroeconomic headwinds pose potential risks. These factors could negatively affect the stock price.

Considering these positive and negative factors, a reasoned prediction suggests that JD.com’s stock price will likely experience periods of both growth and volatility in the future. The company’s ability to navigate these challenges and capitalize on growth opportunities will be crucial in determining its long-term stock price trajectory. A historical parallel might be drawn to other major e-commerce companies navigating similar regulatory and competitive landscapes.

Monitoring J D’s stock price requires a keen eye on market trends. For comparative analysis, it’s helpful to consider other companies in the same sector, such as checking the current fhn stock price , to understand broader market performance. Ultimately, understanding J D’s trajectory often involves assessing the overall health of the related industries.

Their experiences provide a framework for potential scenarios, though precise numerical predictions remain inherently speculative.

Commonly Asked Questions: J D Stock Price

What are the major risks facing JD.com’s stock price?

Major risks include increased competition, regulatory changes in China, fluctuations in the Chinese economy, and potential supply chain disruptions.

How does investor sentiment affect JD.com’s stock price?

Positive investor sentiment tends to drive the price up, while negative sentiment (e.g., concerns about profitability or competition) can lead to price drops. News and market speculation play a significant role.

Where can I find real-time JD stock price data?

Real-time data is available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, and Bloomberg.

What is JD.com’s current Price-to-Earnings (P/E) ratio?

The P/E ratio fluctuates and should be checked on a reputable financial website for the most up-to-date information. It’s a key metric for assessing valuation relative to earnings.