Defining Closing Price

Source: ifxdb.com

Is closing price the same as price for stocks – The closing price of a stock represents the final traded price of that stock at the end of a trading day. Understanding this price is crucial for investors and traders as it serves as a benchmark for various financial calculations and analyses. This section will detail the concept, its determination, and the influence of market conditions.

The Closing Price Concept

Source: gabenelsonfinancial.com

The closing price is the last price at which a stock was traded before the market closes for the day. It’s a significant data point because it reflects the culmination of all buying and selling activity during that trading session. It’s used to calculate daily returns, assess market trends, and inform investment decisions.

Determining the Closing Price

The exact method for determining the closing price varies slightly depending on the exchange, but generally involves the final trade executed before the market’s official closing time. If there’s a flurry of activity right at the close, the average of the last few trades might be used. However, the principle remains the same: it’s the price reflecting the most recent market sentiment at the end of the trading day.

Market Conditions and Closing Price

Market conditions significantly impact the closing price. A day with high trading volume and strong buying pressure might result in a closing price significantly higher than the opening price. Conversely, a day dominated by selling pressure could lead to a lower closing price. News events, economic data releases, and overall market sentiment all play a role.

Comparison with Intraday Prices

The closing price is just one data point among several throughout the trading day. Others include the opening price (the first price at which the stock traded), the high price (the highest price reached during the day), and the low price (the lowest price reached during the day). Comparing these provides a comprehensive picture of the stock’s price movement.

Understanding Stock Prices Throughout the Day

Stock prices are dynamic and fluctuate constantly throughout a trading day. This section will explore the reasons behind these fluctuations and the role of supply and demand.

Intraday Price Fluctuations

A stock’s price can move significantly throughout a single trading day, driven by a multitude of factors. These factors can include news releases, analyst ratings, changes in investor sentiment, and trading activity from both institutional and individual investors. Even seemingly minor events can trigger price swings.

Reasons for Price Changes

Numerous factors contribute to intraday price changes. News impacting the company, broader market trends, economic indicators, and even rumors can all influence a stock’s price. Furthermore, algorithmic trading and high-frequency trading can contribute to rapid and sometimes unpredictable price movements.

Supply and Demand’s Role

The fundamental principle driving price movements is the interplay of supply and demand. When demand exceeds supply, the price tends to rise. Conversely, when supply outweighs demand, the price falls. This dynamic interaction is constantly at play throughout the trading day, leading to price fluctuations.

Hypothetical Scenario

Imagine a technology company announces unexpectedly strong quarterly earnings. The stock opens at $100. The positive news creates a surge in buying, pushing the price to a high of $115 midday. However, profit-taking later in the day leads to some selling, bringing the price down to $108 by the close. This illustrates how a stock’s price can vary significantly within a single day.

Differences Between Closing Price and Other Prices

While the closing price is important, it’s crucial to understand its relationship to other price points throughout the day. This section will compare and contrast the closing price with the opening, high, and low prices.

Comparing Price Points

The opening price indicates the starting point for the day’s trading. The high and low prices represent the extremes of the day’s price range. The closing price, as discussed, is the final traded price. Each price point offers valuable insights into the stock’s performance and market sentiment.

Key Differences and Significance

The key difference lies in their timing and significance for various analyses. The opening price provides a starting point, the high and low show volatility, and the closing price provides the final valuation for the day. Investors use these price points to calculate daily returns, assess risk, and make informed trading decisions.

Price Point Comparison Table

| Price Point | Description | Significance | Example |

|---|---|---|---|

| Opening Price | The first traded price of the day. | Indicates the initial market sentiment. | $100 |

| High Price | The highest price reached during the day. | Shows the day’s peak value. | $115 |

| Low Price | The lowest price reached during the day. | Shows the day’s trough value. | $105 |

| Closing Price | The last traded price of the day. | Used for daily return calculations and trend analysis. | $108 |

The Significance of the Closing Price

The closing price holds significant importance for investors and traders, serving as a key metric in various financial calculations and analyses. This section details its key applications.

Importance for Investors and Traders

The closing price is a critical benchmark for evaluating daily performance, calculating returns, and assessing overall market trends. It’s frequently used in portfolio valuations and performance reporting.

Use in Financial Calculations

The closing price is essential for calculating daily returns, annualized returns, and other performance metrics. It forms the basis for many investment strategies and risk management techniques.

Impact on Investment Strategies

Many investment strategies, including those focused on value investing, growth investing, or momentum trading, rely heavily on the closing price. Long-term investors may focus less on daily fluctuations, while short-term traders may actively use closing prices to make quick decisions.

Key Applications of the Closing Price, Is closing price the same as price for stocks

- Calculating daily returns

- Portfolio valuation

- Performance benchmarking

- Technical analysis

- Investment strategy formulation

- Risk management

Illustrative Examples

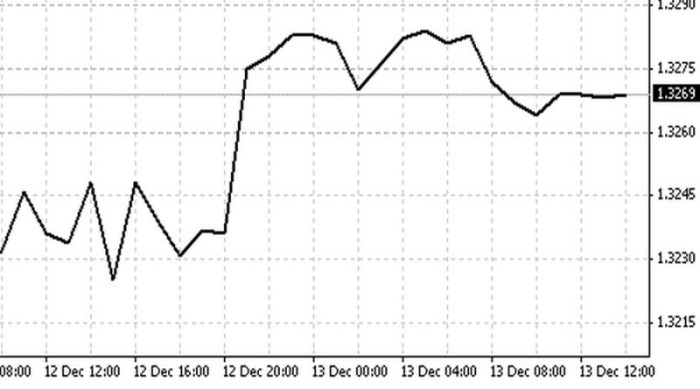

This section provides a detailed example to illustrate how a stock’s price can differ significantly from its closing price throughout the day, along with a visual representation (description only).

Detailed Example of Price Movement

Source: cheggcdn.com

Let’s consider a hypothetical scenario where Company XYZ announces a new product launch. The stock opens at $50. Early trading sees a surge in buying, pushing the price to $65 within the first hour. However, some analysts express concerns about the product’s market viability, leading to a sell-off that drops the price to $55 by midday. The price fluctuates throughout the afternoon, eventually closing at $58.

This example showcases significant intraday volatility, despite a relatively small difference between the opening and closing prices.

Visual Representation of Price Movement

A line graph would effectively illustrate this. The X-axis would represent time (throughout the trading day), and the Y-axis would represent the stock price. The graph would show the price starting at $50, rising to $65, falling to $55, fluctuating throughout the afternoon, and finally settling at $58 at the close. This visual would clearly depict the intraday price variations compared to the final closing price.

Real-World Applications of Closing Prices: Is Closing Price The Same As Price For Stocks

This section explores real-world examples of how investors and traders utilize the closing price in their decision-making processes.

Investor Decision-Making

Mutual funds and other investment vehicles typically use the closing price to determine the net asset value (NAV) of their holdings. This NAV is then used to calculate daily returns for investors. Long-term investors might view the closing price as one data point among many, focusing more on long-term trends and fundamental analysis. Short-term traders, on the other hand, might pay closer attention to daily price movements and closing prices to make quick trades.

Daily Returns and Portfolio Performance

The closing price is the fundamental data point used to calculate daily returns on investments. By comparing the closing price of a stock on consecutive days, investors can determine the percentage change in their investment value. This data is crucial for tracking portfolio performance and making informed investment decisions.

Different Investor Perspectives

Long-term investors often prioritize fundamental analysis and long-term growth, paying less attention to daily fluctuations and closing prices. Short-term traders, however, might focus heavily on daily price movements and use closing prices as signals for entering or exiting trades. This difference in perspective highlights the multifaceted nature of the closing price’s significance.

Commonly Asked Questions

What factors influence a stock’s intraday price?

Numerous factors impact intraday prices, including news events, economic reports, analyst ratings, company announcements, and overall market sentiment. Supply and demand also play a crucial role.

How is the closing price calculated?

The closing price is typically the last traded price before the market closes. However, the exact method may vary slightly depending on the exchange.

Is it better to buy or sell at the closing price?

There’s no universally “better” time. The optimal time to buy or sell depends on your investment strategy, risk tolerance, and market analysis.

What is the significance of the opening price?

The opening price reflects the initial market sentiment for the stock at the start of the trading day. It’s often used as a reference point to assess early price movements.