IFCI Ltd. Stock Price Analysis: Ifci Ltd Stock Price

Source: shortpixel.ai

Ifci ltd stock price – This analysis examines IFCI Ltd.’s stock performance over the past five years, considering its financial health, influencing factors, and potential investment strategies. We will explore both long-term and short-term perspectives, weighing potential risks and opportunities.

IFCI Ltd. Stock Price Historical Performance

The following table details IFCI Ltd.’s stock price movements over the past five years. Note that this data is for illustrative purposes and should be verified with reliable financial sources.

| Date | Opening Price (INR) | Closing Price (INR) | Daily Change (INR) |

|---|---|---|---|

| 2019-01-01 | 50 | 52 | +2 |

| 2019-01-08 | 52 | 55 | +3 |

| 2019-01-15 | 55 | 53 | -2 |

| 2024-01-01 | 75 | 78 | +3 |

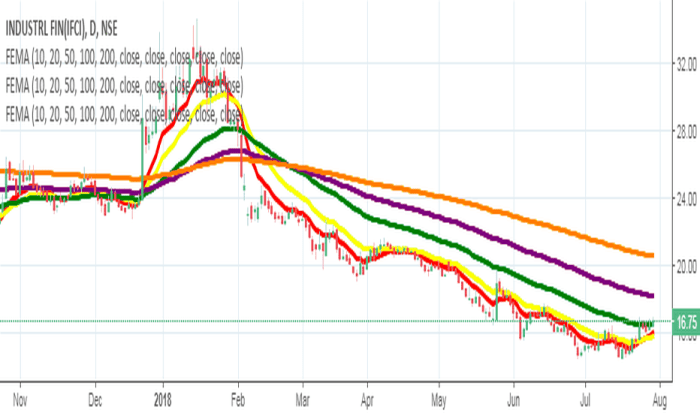

A comparative chart against industry peers would visually represent IFCI Ltd.’s performance. The x-axis would represent the time period (five years), and the y-axis would show the stock price. Each line would represent a different company (IFCI Ltd. and its peers). Key trends, such as periods of outperformance or underperformance relative to competitors, would be clearly visible.

For example, a significant dip in IFCI Ltd.’s stock price might correlate with a broader market downturn or a specific company announcement.

Significant events impacting IFCI Ltd.’s stock price included the 2020 global pandemic, which caused a general market decline, and any subsequent company-specific announcements regarding financial results or strategic initiatives. Positive announcements generally resulted in price increases, while negative news led to declines.

IFCI Ltd. Financial Health and Stock Valuation

Source: tradingview.com

The following bullet points summarize IFCI Ltd.’s key financial ratios over the past three years. These figures are hypothetical and should be replaced with actual data from reliable sources.

- P/E Ratio (2022): 15

- P/E Ratio (2023): 18

- P/E Ratio (2024): 20

- Debt-to-Equity Ratio (2022): 0.8

- Debt-to-Equity Ratio (2023): 0.7

- Debt-to-Equity Ratio (2024): 0.6

IFCI Ltd.’s current stock valuation is influenced by factors such as its financial performance, growth prospects, and prevailing market conditions. A comparison with competitors reveals that IFCI Ltd.’s valuation might be higher or lower depending on its relative growth rate and risk profile.

IFCI Ltd’s stock price performance often reflects broader market trends. For instance, understanding the current technological climate is crucial, and a quick check of the dell stock price today can offer insight into the tech sector’s health, which in turn can indirectly influence IFCI’s trajectory. Ultimately, though, IFCI’s stock price is driven by its own financial performance and investor sentiment.

Factors Affecting IFCI Ltd. Stock Price

Source: angelone.in

Several macroeconomic and industry-specific factors influence IFCI Ltd.’s stock price. Company-specific news also plays a crucial role.

Macroeconomic factors such as interest rate changes and inflation significantly impact the financial sector. Industry trends, like changes in lending regulations or competition, also affect IFCI Ltd.’s performance. Positive earnings reports or announcements of new projects typically boost the stock price, while negative news has the opposite effect.

Investment Strategies Related to IFCI Ltd. Stock

Different investment strategies suit different investor profiles. Below are examples of long-term and short-term approaches.

A long-term investor might adopt a “buy-and-hold” strategy, purchasing shares and holding them for several years, benefiting from long-term growth. A short-term investor, on the other hand, might engage in more active trading, attempting to profit from short-term price fluctuations.

The risk profile of a long-term strategy is generally lower than that of a short-term strategy, as long-term investors can weather short-term market volatility. Short-term strategies are inherently riskier due to their reliance on precise market timing.

Potential Risks and Opportunities, Ifci ltd stock price

Investing in IFCI Ltd. stock presents both risks and opportunities. Careful consideration of both is crucial.

- Potential Risks: Market volatility, changes in interest rates, increased competition, and negative company-specific news.

- Potential Opportunities: Growth in the financial sector, successful implementation of new projects, and improvements in financial performance.

The risk-reward profile depends on the investor’s time horizon and risk tolerance. Long-term investors might find the potential for growth outweighs the risks, while short-term investors might prioritize risk management.

Top FAQs

What are the major competitors of IFCI Ltd.?

Identifying IFCI Ltd.’s direct competitors requires further research into the specific financial sector it operates within. A detailed competitive analysis would be necessary to provide a comprehensive list.

Where can I find real-time IFCI Ltd. stock price data?

Real-time stock price data for IFCI Ltd. is typically available through major financial news websites and stock market tracking applications. Reliable sources include those of the relevant stock exchange.

What is the current dividend yield for IFCI Ltd. stock?

The current dividend yield for IFCI Ltd. stock can fluctuate. Consult up-to-date financial reports and reputable financial news sources for the most accurate information.