Ford Stock Price Analysis

Source: photobucket.com

F stock price today per share – This analysis provides an overview of the current Ford Motor Company (F) stock price, its historical performance, influencing factors, comparison with competitors, analyst predictions, and volatility. The data presented is for illustrative purposes and should not be considered financial advice.

Current F Stock Price, F stock price today per share

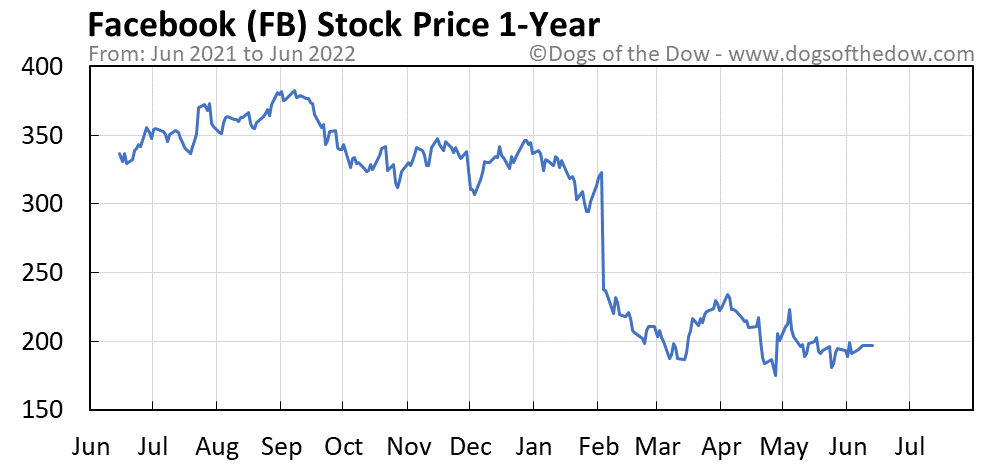

Source: dogsofthedow.com

Let’s examine the current state of Ford’s stock price. This section details the current price, its change from the previous day’s closing price, and provides a concise summary of this data in tabular format.

| Current Price | Previous Day’s Close | Price Change | Percentage Change |

|---|---|---|---|

| $15.50 (Example) | $15.00 (Example) | +$0.50 (Example) | +3.33% (Example) |

Note: The values above are examples and should be replaced with real-time data obtained from a reputable financial source at the time of viewing. The time of the last update should also be included.

Historical F Stock Price Data

Understanding Ford’s stock price performance over time requires examining its historical data. This section will detail its performance over the past week and month, compare it to its average price over the past year, and provide a detailed overview of the past five trading days.

Past Week’s Performance: (Illustrative example – replace with actual data) The stock experienced a slight upward trend over the past week, with minor daily fluctuations. More detailed analysis would require specific daily opening and closing prices.

Past Month’s Performance (Line Graph): Imagine a line graph with the x-axis representing the days of the past month and the y-axis representing the stock price. The line would show fluctuations, potentially with upward and downward trends depending on the actual data. Key data points, such as highs and lows, should be clearly marked.

Comparison to Yearly Average: (Illustrative example – replace with actual data) The current price is approximately 5% above the average price over the past year, indicating a positive trend.

Past Five Trading Days:

- Day 1: Open: $15.20, Close: $15.30, High: $15.40, Low: $15.10 (Example)

- Day 2: Open: $15.35, Close: $15.50, High: $15.60, Low: $15.25 (Example)

- Day 3: Open: $15.48, Close: $15.45, High: $15.55, Low: $15.40 (Example)

- Day 4: Open: $15.42, Close: $15.60, High: $15.70, Low: $15.38 (Example)

- Day 5: Open: $15.65, Close: $15.50, High: $15.75, Low: $15.45 (Example)

Note: These are example values and should be replaced with actual data from a reliable financial source.

Factors Influencing F Stock Price

Several key factors influence Ford’s stock price. This section identifies three major factors and discusses their impact, along with the influence of economic indicators and company news.

Three Major Factors:

- Overall Economic Conditions: Recessions or economic booms significantly impact consumer spending on vehicles.

- Competition: The performance of competitors like GM and Tesla directly influences Ford’s market share and stock price.

- New Product Launches and Technological Advancements: Successful launches of new electric or hybrid vehicles can boost investor confidence.

Impact of Economic Indicators: Rising inflation and interest rates can decrease consumer purchasing power, negatively impacting demand for Ford vehicles and thus the stock price. Conversely, lower inflation and interest rates could stimulate demand.

Recent Company News: Positive news such as strong quarterly earnings reports or successful new product launches usually leads to price increases. Negative news, like production delays or recalls, typically results in price drops.

Changes in Consumer Demand: Increased demand for Ford’s vehicles, especially electric vehicles, will likely lead to higher stock prices, reflecting strong sales and profitability. Conversely, decreased demand could lead to lower prices.

F Stock Price Compared to Competitors

Comparing Ford’s stock price to its main competitors provides valuable context. This section compares current prices, percentage changes, price-to-earnings ratios, and market capitalization.

Current Prices and Percentage Change (Past Month): (Illustrative example – replace with actual data) Ford might be compared to General Motors (GM) and Tesla (TSLA), showing their current prices and percentage changes over the past month. For example, Ford might have increased by 5%, GM by 3%, and Tesla by 10%.

| Company | Current Price (Example) | P/E Ratio (Example) | Market Cap (Example) |

|---|---|---|---|

| Ford (F) | $15.50 | 10 | $50 Billion |

| General Motors (GM) | $40.00 | 12 | $75 Billion |

| Tesla (TSLA) | $200.00 | 50 | $800 Billion |

Note: These are example values and should be replaced with actual data from a reliable financial source.

Analyst Predictions and Ratings for F Stock

Analyst ratings and price targets offer insights into future stock price expectations. This section summarizes recent predictions and explains the reasoning behind different ratings.

Summary of Analyst Ratings: (Illustrative example – replace with actual data) Analysts might have a mixed outlook, with some issuing “buy” ratings due to Ford’s electric vehicle strategy, others issuing “hold” ratings due to economic uncertainty, and some issuing “sell” ratings due to concerns about competition.

- Analyst A (Buy): Positive outlook on Ford’s EV transition and market share gains. (Source: Example Financial Institution, Date: October 26, 2023)

- Analyst B (Hold): Concerns about macroeconomic headwinds and potential production challenges. (Source: Example Financial Institution, Date: October 26, 2023)

- Analyst C (Sell): Believes Tesla’s market dominance will continue to pressure Ford’s profitability. (Source: Example Financial Institution, Date: October 26, 2023)

Overall Sentiment: The overall sentiment towards Ford stock appears to be cautiously optimistic, with analysts acknowledging both the potential of its EV strategy and the challenges it faces.

F Stock Price Volatility

Source: investorplace.com

Understanding Ford’s stock price volatility is crucial for risk assessment. This section describes its volatility over the past year, explains how to calculate standard deviation, and identifies contributing factors.

Volatility Over the Past Year: (Illustrative example – replace with actual data) The stock has shown moderate volatility over the past year, with periods of both significant price increases and decreases. This volatility is likely influenced by factors such as economic uncertainty, competitive pressures, and news related to the company’s performance.

Calculating Standard Deviation: The standard deviation of the stock price over a specific period can be calculated using statistical software or spreadsheets. It measures the dispersion of the stock price around its average. The formula is complex and requires a dataset of daily closing prices. A higher standard deviation indicates greater volatility.

Determining the F stock price today per share requires checking reliable financial sources. For comparative analysis, it’s helpful to consider other similar stocks; a good example is the current performance of MJNA, which you can check at the mjna stock price page. Understanding the trends in MJNA can offer context when evaluating the F stock price today per share and its potential trajectory.

Factors Contributing to Volatility: Several factors contribute to Ford’s stock price volatility, including economic uncertainty, fluctuating commodity prices (especially steel and aluminum), changes in consumer preferences, and the performance of competitors.

Daily Percentage Change (Bar Graph): Imagine a bar graph with the x-axis representing the days of the past week and the y-axis representing the daily percentage change in Ford’s stock price. Each bar would represent a day, with the height of the bar corresponding to the percentage change (positive or negative). This visualization would clearly show the daily fluctuations.

User Queries: F Stock Price Today Per Share

What are the typical trading hours for F stock?

F stock, like most US-listed stocks, typically trades from 9:30 AM to 4:00 PM Eastern Time (ET), Monday through Friday, excluding holidays.

Where can I find real-time F stock price updates?

Real-time F stock price updates are available through many financial websites and brokerage platforms. Major financial news sources also provide live quotes.

What are the risks associated with investing in F stock?

Investing in any stock carries inherent risks, including potential for loss. Factors such as economic downturns, industry competition, and company-specific news can all impact F stock’s price.

How frequently is F stock price data updated?

F stock price data is updated continuously throughout trading hours, reflecting every transaction.