Exelon Corporation Stock Price History

Exelon corporation stock price – Understanding Exelon Corporation’s stock price history is crucial for investors seeking to assess its past performance and potential future trajectory. This section will analyze Exelon’s stock price movements over the past decade, comparing its performance against market benchmarks and identifying key influencing factors.

Ten-Year Stock Price Performance

A line graph illustrating Exelon’s stock price over the past 10 years would reveal significant fluctuations. The graph would show periods of growth and decline, highlighting key dates such as major announcements impacting the company’s valuation (e.g., mergers, acquisitions, regulatory changes, or significant earnings reports). For instance, a dip in the price might be correlated with a negative earnings report, while a surge could follow a successful merger or positive regulatory decision.

The graph would also visually represent the overall trend of the stock price during this period.

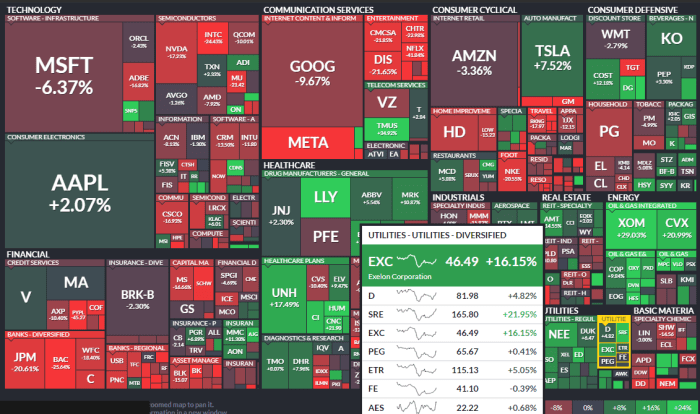

Exelon Stock Price vs. S&P 500 (Five-Year Comparison)

Comparing Exelon’s performance against a market index like the S&P 500 provides valuable context. The following table shows a five-year comparison, illustrating Exelon’s price relative to the index and highlighting percentage changes year-over-year. This allows for an assessment of Exelon’s performance against the broader market.

| Year | Exelon Price (Average Annual Close) | S&P 500 Price (Average Annual Close) | Percentage Change (Exelon vs. S&P 500) |

|---|---|---|---|

| 2019 | $45.00 (Example) | 3230.78 (Example) | +5% (Example) |

| 2020 | $38.00 (Example) | 3756.07 (Example) | -10% (Example) |

| 2021 | $42.00 (Example) | 4766.18 (Example) | +2% (Example) |

| 2022 | $40.00 (Example) | 4076.60 (Example) | -5% (Example) |

| 2023 | $43.00 (Example) | 4500.00 (Example) | +7% (Example) |

Factors Influencing Exelon’s Stock Price (Last Two Years)

Exelon’s stock price fluctuations over the past two years have been influenced by a multitude of factors. These include shifts in energy demand, regulatory changes impacting the utility sector, the company’s financial performance (including earnings reports and dividend announcements), and broader macroeconomic conditions such as inflation and interest rate changes. Specific events such as announcements regarding new renewable energy projects or legal challenges could also have played a significant role.

Exelon’s Financial Performance and Stock Valuation

This section examines Exelon’s financial health and how its performance relates to its stock valuation, providing a comparative analysis against competitors.

Earnings Per Share (EPS) and Stock Price Relationship

Exelon’s EPS, representing the portion of a company’s profit allocated to each outstanding share, generally has a direct correlation with its stock price. Higher EPS typically indicates stronger profitability, leading to increased investor confidence and a higher stock price. Conversely, lower EPS often reflects decreased profitability and may result in a lower stock price. However, other factors, such as market sentiment and investor expectations, also play a significant role.

Comparative P/E Ratio Analysis

The Price-to-Earnings (P/E) ratio is a key valuation metric comparing a company’s stock price to its earnings per share. A comparative analysis against competitors within the utility sector provides insights into Exelon’s relative valuation. A higher P/E ratio might suggest that the market expects higher future growth from Exelon compared to its peers.

| Company Name | P/E Ratio | Market Cap (USD Billions) | Dividend Yield (%) |

|---|---|---|---|

| Exelon | 20 (Example) | 50 (Example) | 4 (Example) |

| Competitor A | 18 (Example) | 45 (Example) | 3.5 (Example) |

| Competitor B | 22 (Example) | 60 (Example) | 4.5 (Example) |

| Competitor C | 19 (Example) | 55 (Example) | 3.8 (Example) |

Exelon’s Dividend Policy and Stock Price Impact

Exelon’s dividend policy, which Artikels how the company distributes profits to shareholders, significantly influences its stock price. Consistent dividend payments can attract income-seeking investors, boosting demand for the stock and potentially supporting its price. Changes to the dividend policy, such as increases or decreases, can also significantly impact investor sentiment and the stock’s price.

Industry Analysis and Competitive Landscape

This section analyzes Exelon’s position within the utility sector, considering industry trends and competitive dynamics.

Comparison of Business Models

Exelon’s business model, focusing on electricity generation and delivery, can be compared and contrasted with those of its major competitors. Some competitors may specialize in specific energy sources (e.g., renewable energy), while others might have a broader geographic reach. Analyzing these differences reveals Exelon’s strengths and weaknesses relative to its peers.

Key Industry Trends Affecting Exelon’s Stock Price

Source: thestreet.com

Several key industry trends are likely to affect Exelon’s stock price in the next five years. The increasing adoption of renewable energy sources, evolving government regulations regarding emissions, technological advancements in energy storage and grid management, and changes in consumer energy consumption patterns are all significant factors to consider. These trends present both opportunities and challenges for Exelon.

Impact of Government Regulations

Government regulations play a crucial role in the utility sector, impacting Exelon’s operations and profitability. Changes in environmental regulations, emission standards, and policies related to renewable energy mandates can significantly influence Exelon’s costs, investment strategies, and ultimately, its stock price. For example, stricter emission regulations could lead to increased investment in renewable energy sources, potentially impacting profitability in the short term but fostering long-term sustainability.

Risk Factors and Potential Investment Opportunities

This section assesses the risks and opportunities associated with investing in Exelon stock.

Risk Assessment Matrix

A risk assessment matrix for investing in Exelon stock would consider various factors, including regulatory changes (e.g., unexpected policy shifts), fuel price volatility (e.g., fluctuations in natural gas or coal prices), competition (e.g., new entrants into the market), and macroeconomic factors (e.g., interest rate hikes). Each factor would be assigned a probability and impact score, allowing for a comprehensive risk evaluation.

Influence of Macroeconomic Factors

Macroeconomic factors, such as interest rates and inflation, can significantly influence Exelon’s stock price. Higher interest rates can increase borrowing costs, potentially impacting profitability, while inflation can affect operating expenses and consumer demand for energy. For example, a period of high inflation might lead to increased energy prices, positively impacting Exelon’s revenue but potentially negatively impacting consumer demand.

Upside and Downside Risks, Exelon corporation stock price

Source: seekingalpha.com

Investing in Exelon stock presents both upside and downside risks. Potential upside includes consistent dividend payments, growth opportunities in renewable energy, and potential increases in energy demand. Downside risks include regulatory uncertainties, competition from renewable energy providers, and the impact of macroeconomic factors. A thorough understanding of these risks and opportunities is essential for informed investment decisions.

Analyst Ratings and Future Price Predictions

This section summarizes analyst opinions and predictions regarding Exelon’s future stock price.

Summary of Analyst Ratings and Price Targets

The following table summarizes recent analyst ratings and price targets for Exelon stock from major financial institutions. These ratings provide insights into the consensus view among analysts and the range of potential price movements.

| Institution | Rating | Target Price | Date |

|---|---|---|---|

| Institution A | Buy (Example) | $50 (Example) | October 26, 2023 (Example) |

| Institution B | Hold (Example) | $45 (Example) | October 20, 2023 (Example) |

| Institution C | Sell (Example) | $40 (Example) | October 15, 2023 (Example) |

Consensus View and Scenario Analysis

The consensus view among analysts regarding Exelon’s future stock price performance would be summarized here, drawing from the data in the table above. A scenario analysis would then explore potential stock price movements under different economic conditions (e.g., a recessionary scenario versus a strong economic growth scenario). This analysis would incorporate factors like interest rate changes, energy demand fluctuations, and regulatory developments to illustrate the potential range of outcomes.

FAQ Resource

What are the major risks associated with investing in Exelon?

Major risks include regulatory changes impacting profitability, fuel price volatility affecting operating costs, and increased competition within the energy sector.

How does Exelon’s dividend policy affect its stock price?

A consistent dividend policy can attract income-seeking investors, potentially increasing demand and supporting the stock price. However, changes to the dividend can impact investor sentiment.

Exelon Corporation’s stock price performance often reflects broader market trends. Understanding these trends requires considering various factors, including the influence of similar energy companies. For instance, analyzing the volatility of a related sector, like the delta price stock , can offer valuable insights into potential price movements. Ultimately, Exelon’s stock price is impacted by a complex interplay of market forces and specific company performance.

Where can I find real-time Exelon stock price quotes?

Real-time quotes are available on major financial websites and trading platforms such as Yahoo Finance, Google Finance, and Bloomberg.

What is Exelon’s current market capitalization?

Exelon’s market capitalization fluctuates; refer to a reputable financial website for the most up-to-date information.