DXC Technology Stock Price Analysis: Dxc Stock Price

Dxc stock price – DXC Technology (DXC) operates in a dynamic and competitive IT services landscape. Understanding the factors influencing its stock price requires a multifaceted analysis encompassing financial performance, industry trends, analyst sentiment, and inherent market risks. This analysis provides an overview of these key elements, offering insights into the historical performance and potential future trajectory of DXC’s stock price.

DXC Technology Stock Price Overview

Source: seekingalpha.com

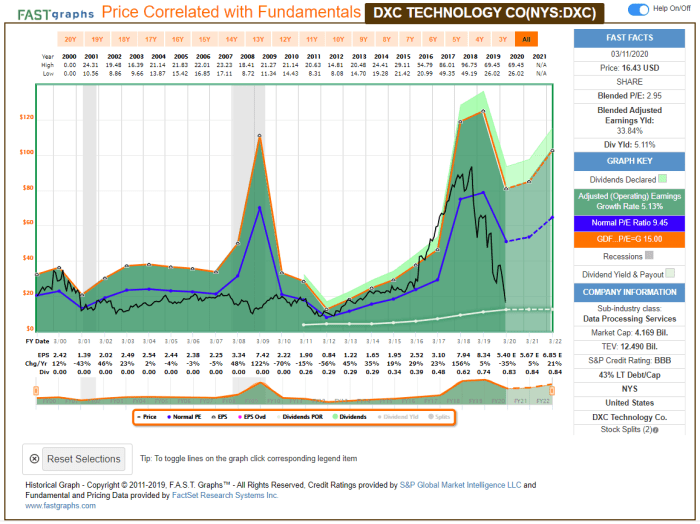

Over the past five years, DXC’s stock price has experienced considerable volatility, reflecting the challenges and opportunities within the IT services sector. While specific highs and lows would require referencing a reliable financial data source (e.g., Yahoo Finance, Google Finance), a general observation is that the price has been influenced by a combination of factors including company performance, broader market trends, and investor sentiment.

Significant dips often coincided with announcements of restructuring, missed earnings expectations, or negative industry news. Conversely, periods of growth were often associated with successful contract wins, strategic acquisitions, and positive market sentiment toward the IT services sector as a whole. Comparing DXC’s performance against competitors like Accenture (ACN) and IBM (IBM) reveals varying degrees of success and volatility. While all three companies operate in similar sectors, their strategic focuses and market positioning often lead to diverging stock price movements.

DXC’s Financial Performance and Stock Price Correlation

DXC’s quarterly earnings reports have a demonstrably strong correlation with subsequent stock price movements. Positive earnings surprises, characterized by exceeding analyst expectations for revenue and earnings per share (EPS), generally result in upward stock price pressure. Conversely, negative surprises often lead to declines. Changes in revenue, profit margins, and debt levels directly impact investor confidence and consequently, the stock price.

Higher revenue growth, improved margins, and reduced debt generally signal financial health and future potential, attracting investment and driving the price upward. Conversely, declining revenue, shrinking margins, and increased debt raise concerns about the company’s sustainability and can negatively impact its stock valuation.

| Quarter | Revenue (USD Million) | EPS (USD) | Stock Price Change (%) |

|---|---|---|---|

| Q1 2022 (Illustrative) | 4500 | 1.20 | +5% |

| Q2 2022 (Illustrative) | 4600 | 1.25 | +2% |

| Q3 2022 (Illustrative) | 4400 | 1.10 | -3% |

| Q4 2022 (Illustrative) | 4700 | 1.30 | +7% |

Note: This table presents illustrative data. Actual figures should be obtained from official DXC financial reports.

Industry Trends and DXC Stock Price

The IT services sector is constantly evolving, and DXC’s stock price is significantly impacted by broader industry trends and macroeconomic factors. The increasing adoption of cloud computing and digital transformation initiatives presents both opportunities and challenges. While DXC is positioned to capitalize on these trends through its service offerings, the intense competition within the sector necessitates continuous adaptation and innovation.

Macroeconomic factors, such as interest rates and inflation, influence DXC’s operating costs and investment decisions, indirectly impacting its stock price. Technological advancements create both opportunities and threats. While new technologies can drive revenue growth, they also require significant investment and adaptation, potentially affecting short-term profitability. Regulatory changes, particularly those related to data privacy and cybersecurity, can influence operational costs and investor confidence.

Analyst Ratings and Stock Price Predictions, Dxc stock price

Source: tradingview.com

Financial analysts provide ratings and price targets for DXC stock, offering insights into market sentiment and future expectations. These ratings typically range from “buy” to “sell,” reflecting varying degrees of optimism or pessimism regarding the company’s prospects. The consensus price target represents the average of all analyst predictions. The rationale behind these predictions often considers DXC’s financial performance, industry outlook, and competitive landscape.

The evolution of analyst predictions over time provides valuable context for understanding how market sentiment and expectations have changed.

| Analyst Firm | Rating | Price Target (USD) | Rationale (Summary) |

|---|---|---|---|

| Firm A (Illustrative) | Buy | 100 | Strong growth potential in cloud services. |

| Firm B (Illustrative) | Hold | 90 | Concerns about competition and margin pressure. |

| Firm C (Illustrative) | Sell | 80 | Slow revenue growth and high debt levels. |

Note: This table presents illustrative data. Actual analyst ratings and price targets should be obtained from reputable financial news sources.

Investor Sentiment and Stock Price Volatility

News events, press releases, and social media sentiment significantly impact DXC’s stock price. Positive news, such as successful contract wins or strategic partnerships, typically leads to increased investor confidence and higher stock prices. Conversely, negative news, such as financial setbacks or regulatory issues, can trigger sell-offs and price declines. Trading volume often correlates with stock price volatility.

Higher trading volume during periods of significant news or market events indicates increased investor activity and heightened price fluctuations. Investor confidence is a crucial driver of DXC’s stock price. Periods of high confidence, often fueled by positive financial results and industry tailwinds, lead to higher valuations. Conversely, declining confidence, stemming from negative news or economic uncertainty, can depress the stock price.

Risk Factors Affecting DXC Stock Price

Investing in DXC stock carries several inherent risks. These risks can significantly impact the stock price and should be carefully considered by potential investors.

- Intense Competition: The IT services sector is highly competitive, with numerous large and small players vying for market share. This competition can pressure pricing and profitability, impacting DXC’s financial performance and stock price.

- Technological Disruption: Rapid technological advancements require continuous adaptation and investment. Failure to keep pace with these changes could render DXC’s services obsolete and negatively impact its competitiveness and valuation.

- Economic Downturns: During economic recessions, businesses often reduce IT spending, impacting DXC’s revenue and profitability. This can lead to significant stock price declines.

- Cybersecurity Risks: Data breaches and cybersecurity incidents can damage DXC’s reputation and lead to significant financial losses, negatively impacting investor confidence and the stock price.

Illustrative Example of Stock Price Movement

Source: hellopublic.com

Consider a hypothetical scenario where DXC announces unexpectedly strong Q1 earnings, exceeding analyst expectations significantly. This positive news would likely trigger a surge in buying activity, as investors react favorably to the improved financial performance. The stock price would likely experience a sharp upward movement, potentially exceeding the predicted price target set by many analysts. The visual representation on a price chart would show a clear upward spike on the day of the announcement, followed by a period of consolidation as the market absorbs the information and assesses the long-term implications.

The magnitude of the price increase would depend on the extent of the earnings surprise, the overall market sentiment, and other concurrent factors.

FAQ Summary

What are the major competitors of DXC Technology?

DXC faces competition from major players like Accenture, IBM, and Infosys, among others.

How often does DXC Technology release its earnings reports?

DXC typically releases its quarterly earnings reports on a regular schedule, usually following standard reporting periods.

Where can I find real-time DXC stock price data?

Real-time DXC stock price data is readily available through major financial websites and brokerage platforms.

What is the typical trading volume for DXC stock?

DXC Technology’s stock price performance has been a subject of interest lately, particularly when compared to tech giants. Understanding its trajectory often involves considering the broader market trends, including the performance of companies like Microsoft. To get a sense of the current market climate, checking the current microsoft stock price can provide valuable context before further analyzing DXC’s stock price movements.

Ultimately, both companies’ performances reflect the overall health of the tech sector.

The trading volume for DXC stock fluctuates daily and is influenced by various market factors; it’s best to consult financial resources for current data.