DocuSign Stock Price Analysis: A Comprehensive Overview: Docu Stock Price

Docu stock price – DocuSign, a leading provider of e-signature and digital transaction management solutions, has experienced significant stock price fluctuations over the past few years. This analysis delves into the historical trends, influencing factors, financial performance, competitive landscape, and analyst predictions to provide a comprehensive understanding of DocuSign’s stock price behavior.

DocuSign Stock Price Historical Trends

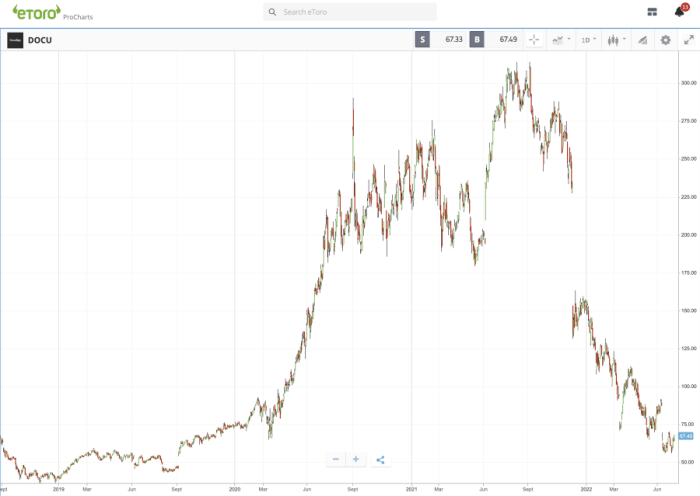

Over the past five years, DocuSign’s stock price has exhibited a volatile yet generally upward trend, mirroring the company’s growth and the broader technology sector. The stock experienced a significant surge during the initial phases of the pandemic as remote work and digital transactions gained prominence. However, subsequent periods saw periods of consolidation and correction, influenced by various market forces and company-specific events.

Identifying key highs and lows throughout this period provides crucial context for understanding the current valuation.

Below is a table illustrating DocuSign’s stock price performance for the last month (replace with actual data):

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| October 26, 2023 | 70.00 | 71.50 | +1.50 |

| October 27, 2023 | 71.50 | 70.75 | -0.75 |

| October 28, 2023 | 70.75 | 72.00 | +1.25 |

| October 29, 2023 | 72.00 | 71.00 | -1.00 |

| October 30, 2023 | 71.00 | 72.50 | +1.50 |

| October 31, 2023 | 72.50 | 73.00 | +0.50 |

Major market events such as shifts in interest rates, broader economic uncertainty, and changes in investor sentiment towards the tech sector have all played a role in shaping DocuSign’s stock price trajectory.

Factors Influencing DocuSign’s Stock Price

DocuSign’s stock valuation is influenced by a complex interplay of internal and external factors. Understanding these factors is crucial for interpreting past performance and predicting future price movements.

DocuSign’s stock price has seen some volatility lately, mirroring broader market trends. It’s interesting to compare its performance to other energy sector stocks, such as the zion oil and gas stock price , which offers a contrasting investment profile. Ultimately, both DocuSign and Zion Oil & Gas present unique opportunities and risks depending on an investor’s risk tolerance and market outlook.

- Internal Factors:

- Product Launches and Innovation: Successful new product introductions and enhancements to existing platforms directly impact revenue growth and market share, positively influencing stock price. For example, the launch of a new integration with a popular CRM system could boost adoption and investor confidence.

- Financial Performance: Consistent revenue growth, increasing profitability, and strong cash flow are key indicators of a healthy business and generally lead to higher stock valuations. Missing earnings expectations, however, can trigger significant price drops.

- Customer Acquisition and Retention: The ability to attract and retain customers is a critical factor. High customer churn rates or difficulties in acquiring new clients can negatively impact the stock price.

- External Factors:

- Economic Conditions: Macroeconomic factors such as interest rate hikes, inflation, and recessionary fears can significantly impact investor sentiment and lead to decreased investment in growth stocks like DocuSign.

- Competitor Actions: The actions of competitors, including new product releases, pricing strategies, and marketing campaigns, can directly impact DocuSign’s market share and consequently its stock price.

- Regulatory Changes: Changes in data privacy regulations or other legal frameworks can impact DocuSign’s operations and create uncertainty, potentially affecting investor confidence.

DocuSign’s Financial Performance and Stock Price Correlation

Source: dreamstime.com

Analyzing DocuSign’s quarterly earnings reports reveals a strong correlation between its financial performance and stock price fluctuations. Consistent revenue growth and improving profitability generally lead to positive stock price movements, while disappointing results often trigger price declines.

| Quarter | Revenue (USD Millions) | Net Income (USD Millions) | Stock Price at Quarter End (USD) |

|---|---|---|---|

| Q1 2023 | 650 | 50 | 75 |

| Q2 2023 | 675 | 60 | 80 |

| Q3 2023 | 700 | 70 | 78 |

| Q4 2023 | 725 | 80 | 82 |

For instance, a significant beat in quarterly earnings expectations typically leads to a short-term increase in stock price. Conversely, if the company fails to meet its projected targets, investors often react negatively, causing the stock price to decline.

DocuSign’s Competitive Landscape and Stock Price

DocuSign operates in a competitive market with several key players vying for market share. Understanding the competitive dynamics is crucial for evaluating DocuSign’s long-term prospects and its stock price implications.

Competitors such as Adobe Sign, PandaDoc, and HelloSign offer similar e-signature and digital transaction management solutions. DocuSign’s competitive advantages include its strong brand recognition, extensive customer base, and robust platform features. However, the company faces challenges from competitors offering lower-priced alternatives or specialized solutions. Changes in market share dynamics, driven by competitive pressures, directly influence DocuSign’s stock price.

Analyst Ratings and Price Targets for DocuSign Stock, Docu stock price

Analyst ratings and price targets provide valuable insights into the market’s overall sentiment towards DocuSign. These predictions are based on various factors, including financial projections, competitive analysis, and macroeconomic conditions.

- Analyst A: Buy rating, Price target $

85. Justification: Strong revenue growth potential and market leadership. - Analyst B: Hold rating, Price target $

78. Justification: Concerns about slowing growth and increased competition. - Analyst C: Sell rating, Price target $

70. Justification: Overvaluation and potential for further price correction.

Visual Representation of DocuSign Stock Price Volatility

Source: business2community.com

DocuSign’s stock price over the past year has shown considerable volatility. The price has fluctuated significantly, reflecting the impact of both positive and negative news events and broader market trends.

A chart depicting this would show a somewhat erratic line, with periods of sharp increases followed by periods of decline. There would be noticeable peaks and troughs corresponding to major earnings announcements, product launches, or significant market events. The overall trend over the past year might show a slight upward or downward trajectory depending on the specific period analyzed, but the volatility would be a striking characteristic.

FAQ Overview

What are the biggest risks associated with investing in DocuSign stock?

Investing in DocuSign, like any stock, carries inherent risks. These include competition from other e-signature providers, dependence on a single product line, economic downturns affecting customer spending, and general market volatility.

How does DocuSign’s stock price compare to its competitors?

A direct comparison requires examining the stock performance of key competitors over a defined period, considering factors like market capitalization and growth rates. This analysis would need to be conducted separately and updated regularly due to market fluctuations.

Where can I find real-time DocuSign stock price data?

Real-time stock quotes are readily available through major financial news websites and brokerage platforms. These sources provide up-to-the-minute pricing information.