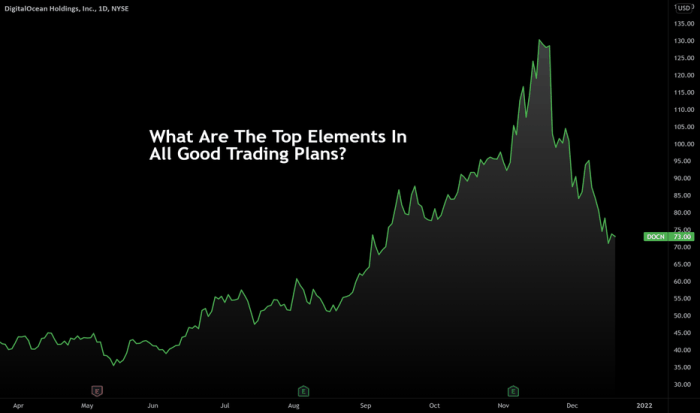

DocN Stock Price Analysis

Docn stock price – This analysis provides an overview of DocN’s current stock price, historical performance, influencing factors, financial health, analyst predictions, and associated investment risks. Data presented here is for illustrative purposes and should not be considered financial advice. Always conduct thorough research and consult with a financial professional before making any investment decisions.

Current DocN Stock Price and Market Capitalization

Source: tradingview.com

As of [Date and Time of Data Retrieval], DocN’s stock price is [Current Price]. The market capitalization stands at [Market Cap]. Today’s high and low prices were [High Price] and [Low Price], respectively. The 24-hour trading volume reached [Volume].

| Date | Open Price | Close Price | Volume |

|---|---|---|---|

| [Date 1] | [Open Price 1] | [Close Price 1] | [Volume 1] |

| [Date 2] | [Open Price 2] | [Close Price 2] | [Volume 2] |

| [Date 3] | [Open Price 3] | [Close Price 3] | [Volume 3] |

| [Date 4] | [Open Price 4] | [Close Price 4] | [Volume 4] |

| [Date 5] | [Open Price 5] | [Close Price 5] | [Volume 5] |

Historical DocN Stock Price Performance

Over the past year, DocN’s stock price has exhibited [Overall Trend – e.g., volatility, steady growth, decline]. Significant price changes included a [Percentage]% increase following [Event 1] and a [Percentage]% decrease after [Event 2]. Compared to competitors [Competitor A] and [Competitor B] in the last quarter, DocN’s performance was [Comparative Performance – e.g., better, worse, similar], reflecting [Reasons for Performance Difference].

Analyzing DOCN’s stock price often involves considering related commodities. For instance, understanding the fluctuations in the price of copper, a key material in many DOCN products, is crucial. You can track the current market trends for copper by checking the copper stock price and its impact on the overall market performance. Ultimately, a thorough assessment of both copper and DOCN’s own performance indicators will offer a more comprehensive investment picture.

A line graph visualizing this data would show [Description of Line Graph Trend – e.g., an upward trend with periods of consolidation, a downward trend with occasional rebounds].

Factors Influencing DocN Stock Price

Three key factors impacting DocN’s stock price in the last six months are [Factor 1 – e.g., new product launch], [Factor 2 – e.g., changes in regulatory environment], and [Factor 3 – e.g., macroeconomic conditions]. Recent news and announcements, such as [Specific News Event 1] and [Specific News Event 2], have influenced the stock price by [Description of Impact].

Broader market trends, including interest rate hikes and inflation concerns, have [Description of Market Impact – e.g., negatively impacted investor sentiment, leading to a price correction].

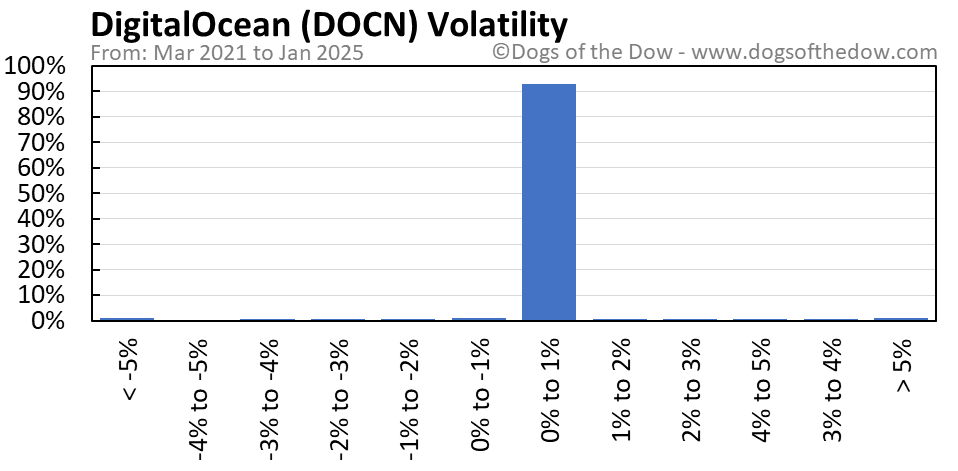

DocN’s Financial Performance and Stock Valuation

Source: dogsofthedow.com

DocN’s most recent financial reports show [Summary of Revenue, Earnings, and Debt]. The company’s P/E ratio is [P/E Ratio], which compares to [Comparison to Industry Average].

| Metric | DocN | Competitor A | Competitor B |

|---|---|---|---|

| Revenue | [DocN Revenue] | [Competitor A Revenue] | [Competitor B Revenue] |

| Net Income | [DocN Net Income] | [Competitor A Net Income] | [Competitor B Net Income] |

| P/E Ratio | [DocN P/E Ratio] | [Competitor A P/E Ratio] | [Competitor B P/E Ratio] |

Analyst Ratings and Future Predictions for DocN Stock

The consensus rating for DocN stock from leading analysts is [Consensus Rating – e.g., “Buy,” “Hold,” “Sell”]. Price targets range from [Low Price Target] to [High Price Target]. These ratings and predictions are based on [Rationale – e.g., projected revenue growth, market share gains, and anticipated changes in the regulatory landscape]. For example, Analyst X predicts a [Price Target] based on [Reasoning], while Analyst Y suggests [Price Target] due to [Reasoning].

Risk Factors Associated with Investing in DocN Stock, Docn stock price

Three significant risks associated with investing in DocN stock are [Risk Factor 1 – e.g., competition from established players], [Risk Factor 2 – e.g., dependence on key suppliers], and [Risk Factor 3 – e.g., potential regulatory changes]. These risks could potentially lead to [Potential Impact on Stock Price – e.g., decreased market share, increased production costs, and a decline in investor confidence].

Investors can mitigate these risks by [Mitigation Strategies – e.g., diversifying their portfolio, conducting thorough due diligence, and monitoring market trends].

FAQ Guide

What are the major competitors of DocN?

This information would be found within the Artikel’s section on DocN’s financial performance and stock valuation, comparing key metrics to its two main competitors.

Where can I find real-time DocN stock price updates?

Real-time stock quotes are typically available through major financial websites and brokerage platforms.

What is the typical trading volume for DocN stock?

The average daily trading volume for DocN can be determined from the historical data provided in the Artikel, showing volume over the last five trading days.

How does DocN’s stock price compare to the overall market performance?

This requires comparing DocN’s performance to relevant market indices (e.g., S&P 500) over a specific period, information not directly provided in the Artikel.