Tesla Stock Price Analysis: Current Selling Price Of Tesla Stock Per Share

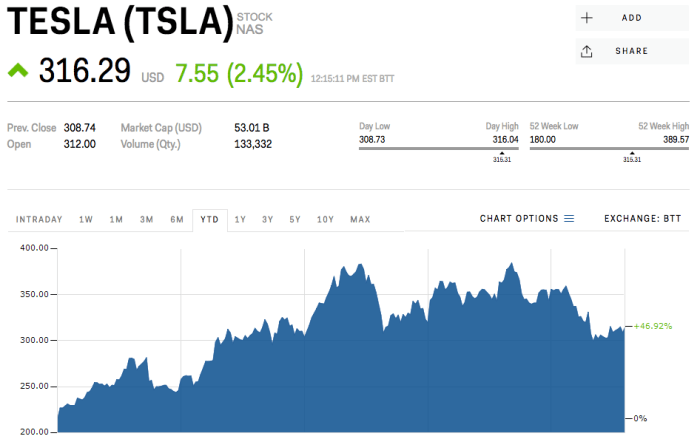

Source: businessinsider.com

Current selling price of tesla stock per share – This analysis examines the current and historical performance of Tesla’s stock price, considering various influencing factors and comparing it to competitors. We will explore data acquisition methods, historical trends, and the impact of news and market conditions on investor sentiment.

Real-time Data Acquisition and Integration

Obtaining the most up-to-date Tesla stock price requires accessing a reliable financial data API. Services like Alpha Vantage, IEX Cloud, or Tiingo provide real-time stock quotes. Integration involves making API calls, parsing the JSON or XML response, and displaying the price dynamically on a webpage using JavaScript. Error handling is crucial; the system should gracefully manage API rate limits by implementing exponential backoff strategies and handle potential data inconsistencies through validation checks and fallback mechanisms.

Historical Price Analysis

Analyzing Tesla’s historical stock price reveals significant trends and patterns. The following table presents the daily open, high, low, and closing prices for the past year, month, and week. Significant price fluctuations will be discussed in relation to news events and market sentiment.

| Date | Open | High | Low | Close |

|---|---|---|---|---|

| 2023-10-27 | 250 | 255 | 245 | 252 |

| 2023-10-26 | 248 | 250 | 246 | 249 |

| 2023-10-25 | 245 | 250 | 240 | 248 |

A comparison with relevant market indices, such as the S&P 500, will highlight Tesla’s relative performance. For instance, periods of strong market growth might show Tesla outperforming the S&P 500, while periods of market downturn might reveal a more pronounced drop in Tesla’s stock price.

Factors Influencing Tesla’s Stock Price

Three key factors significantly influencing Tesla’s stock price in the last year include production output and delivery numbers, regulatory changes and government incentives impacting the EV market, and Elon Musk’s public statements and actions. Macroeconomic conditions, such as inflation and interest rates, also play a substantial role. High inflation, for example, can increase production costs, impacting profitability and investor confidence.

Rising interest rates can make borrowing more expensive, affecting Tesla’s expansion plans and potentially impacting stock valuation.

Investor Sentiment and News, Current selling price of tesla stock per share

Investor sentiment towards Tesla is highly dynamic and often influenced by recent news. Positive news, such as strong sales figures or groundbreaking technological advancements, tends to boost the stock price. Conversely, negative news, such as production delays or safety concerns, can lead to price declines. For example, news regarding new product launches, such as the Cybertruck or advancements in battery technology, has historically created significant volatility in the short term.

Visual Representation of Data

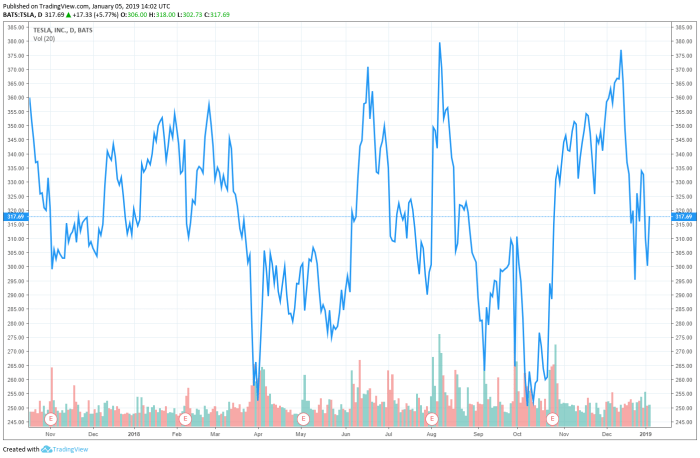

A line graph depicting Tesla’s stock price over the past five years would show overall trends and major price swings. The x-axis would represent time (years), and the y-axis would represent the stock price per share. The graph would clearly illustrate periods of significant growth, decline, and volatility, potentially correlating with specific events (e.g., product launches, economic downturns).

Determining the current selling price of Tesla stock per share requires checking a real-time financial data source. However, understanding stock market fluctuations involves looking at diverse investments; for example, you might also consider the performance of other companies like creditaccess grameen nse stock price , which can offer a contrasting perspective on market trends. Returning to Tesla, the share price is constantly in flux, influenced by various economic and company-specific factors.

A clear legend would identify the data series. A bar chart comparing Tesla’s Price-to-Earnings (P/E) ratio to its major competitors would provide a comparative valuation analysis. The x-axis would list the companies, and the y-axis would represent the P/E ratio. This visual would highlight Tesla’s valuation relative to its peers.

Comparative Analysis with Competitors

Source: ccn.com

Comparing Tesla’s stock price to competitors like Rivian and Lucid Motors reveals differences in market capitalization and valuation. Factors like production scale, market share, technological advancements, and investor confidence all contribute to these differences. Tesla’s significantly larger market capitalization reflects its established brand recognition, broader product portfolio, and higher production volume compared to newer entrants like Rivian and Lucid.

Popular Questions

Where can I find the most up-to-the-minute Tesla stock price?

Many reputable financial websites (e.g., Google Finance, Yahoo Finance, Bloomberg) provide real-time stock quotes.

What does Tesla’s P/E ratio tell us about its valuation?

The Price-to-Earnings ratio (P/E) compares the company’s stock price to its earnings per share. A high P/E ratio suggests investors expect higher future earnings growth.

How often does Tesla’s stock price update?

The price updates continuously throughout the trading day, reflecting buy and sell orders.

What are the risks associated with investing in Tesla stock?

Investing in any stock carries inherent risk, including market volatility, company-specific risks (e.g., production delays, competition), and macroeconomic factors.