Apple Stock Price: A Comprehensive Overview

Source: businessinsider.com

Current price of apple stock – This article provides a detailed analysis of the current Apple stock price, incorporating real-time data acquisition methods, historical context, influential factors, visual representations, and a discussion of predictive analysis limitations. We will explore various data sources, macroeconomic influences, and the impact of company performance on stock valuation.

Real-Time Data Acquisition, Current price of apple stock

Retrieving and updating the current Apple stock price requires accessing reliable financial data APIs. Several approaches exist, each with its own strengths and weaknesses. A robust system should incorporate error handling and strategies to manage API rate limits.

- Data Source Comparison: Three popular options include Alpha Vantage (known for its free tier and extensive historical data), IEX Cloud (offering real-time data with various subscription levels), and Tiingo (providing robust historical and real-time data with competitive pricing). Alpha Vantage’s free tier may have limitations on request frequency, while IEX Cloud and Tiingo provide more robust solutions for high-frequency updates but at a cost.

The reliability and accuracy of data depend on the specific API and its maintenance.

- Data Retrieval Method: A Python script utilizing the `requests` library could be used to fetch data. The script would make an API call every minute, parse the JSON response, and extract the current price. Error handling would involve implementing `try-except` blocks to catch potential HTTP errors or API-specific exceptions.

- API Limitation Handling: Strategies include implementing exponential backoff (increasing the delay between requests after failures), using a queue to buffer requests, and utilizing caching mechanisms to reduce API calls. A well-designed system should gracefully handle temporary outages or rate limits without disrupting the price updates.

Historical Price Context

Source: arcpublishing.com

Understanding Apple’s historical stock performance is crucial for evaluating its current valuation and predicting future trends. Analyzing past price movements reveals patterns, identifies key events influencing the stock, and provides a basis for comparison.

| Date | Event | Price Change (%) | Brief Description |

|---|---|---|---|

| October 26, 2023 (Example) | Positive earnings report | +5% | Exceeded analyst expectations, boosting investor confidence. |

| March 8, 2023 (Example) | New product launch | +2% | Initial market response to new product line was positive. |

| September 12, 2022 (Example) | Economic downturn | -3% | Market correction affected tech stocks, including Apple. |

Note: This table provides example data. A complete timeline would require extensive research and access to reliable historical stock price data.

Factors Influencing Current Price

Several macroeconomic and company-specific factors influence Apple’s current stock price. Analyzing these factors provides a comprehensive understanding of the current market valuation.

- Macroeconomic Factors: Interest rate changes, inflation rates, and overall economic growth significantly impact investor sentiment and market valuations. High inflation and rising interest rates, for example, can lead to decreased investor confidence and lower stock prices.

- Product Releases and Sales: The success of new product launches and overall sales figures directly impact Apple’s revenue and profitability, which in turn influences investor perception and stock price. Strong sales of iPhones, for instance, generally lead to positive stock market reactions.

- Competitor Performance: The performance of competitors like Samsung and Google affects Apple’s market share and competitive landscape. Strong competitor performance can negatively impact Apple’s stock price, while weaker competitor performance can have the opposite effect.

- Price Comparison: Comparing the current price to the three-month average reveals short-term trends. Significant deviations may indicate market reactions to specific events or shifts in investor sentiment. A sustained price increase above the average might suggest strong investor confidence, while a decrease could signal concerns about the company’s future prospects.

Visual Representation of Data

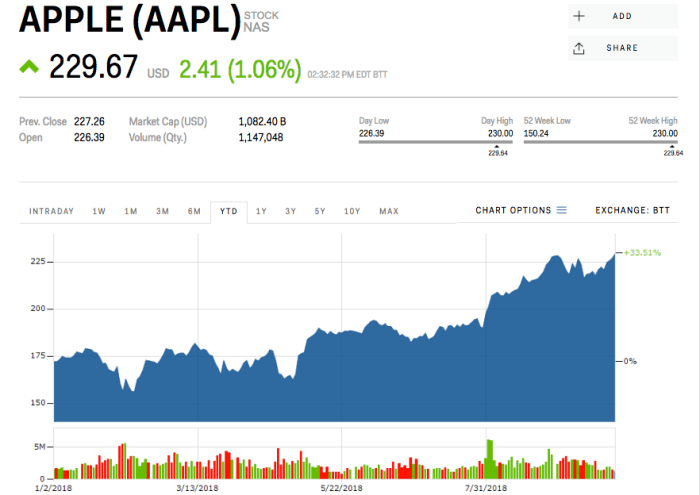

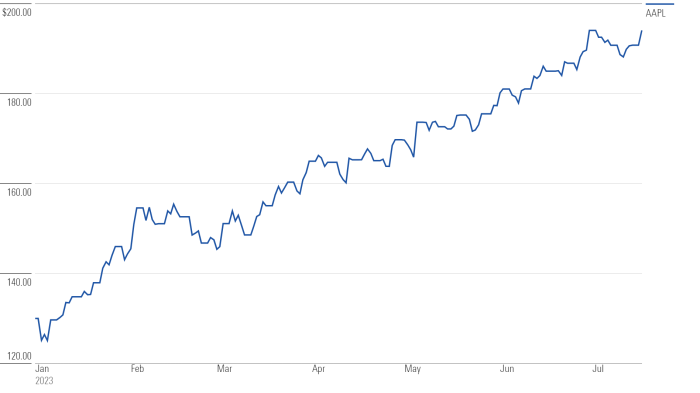

Visualizations effectively communicate complex data trends. The following descriptions illustrate how charts can represent Apple’s stock price performance and its relationship with other factors.

- Weekly Stock Price Movement: A line chart would display the daily closing prices of Apple stock over the past week. The x-axis represents the days, and the y-axis represents the stock price. The line would visually show the price fluctuations throughout the week, highlighting trends like upward or downward movements.

- Apple vs. S&P 500: A line chart comparing Apple’s stock price to the S&P 500 index would show how Apple’s performance relates to the overall market. Both price movements are plotted on the same chart, allowing for visual comparison of their relative performance. This highlights whether Apple is outperforming or underperforming the broader market.

- Revenue vs. Stock Price Correlation: A scatter plot would show the relationship between Apple’s quarterly revenue and its corresponding stock price. Each point represents a quarter, with revenue on the x-axis and stock price on the y-axis. A trend line could be added to visually demonstrate the correlation between these two variables. A positive correlation would suggest that increased revenue generally leads to a higher stock price.

Predictive Analysis (Without Predictions)

While the current price provides a snapshot of the market’s valuation, it’s insufficient for accurate future price prediction. Sophisticated models incorporate broader datasets and analytical techniques.

- Limitations of Using Current Price Alone: Relying solely on the current price ignores crucial factors like historical trends, macroeconomic conditions, and company-specific news. It lacks the context needed for reliable prediction.

- Data and Analytical Methods: More sophisticated models utilize time series analysis (e.g., ARIMA, LSTM), fundamental analysis (evaluating financial statements), and technical analysis (identifying patterns in price charts). These methods incorporate a wider range of data, including economic indicators, industry trends, and company-specific information.

- Quantitative Factors for Evaluation: Analysts consider metrics such as Price-to-Earnings ratio (P/E), Return on Equity (ROE), debt-to-equity ratio, and future earnings estimates. These quantitative factors help assess the company’s financial health and growth potential.

- Ethical Considerations: Sharing or relying on stock price predictions carries ethical implications. Predictions are inherently uncertain, and disseminating them without clear disclaimers can mislead investors. Responsible financial analysis emphasizes transparency and avoids making guarantees about future performance.

Common Queries: Current Price Of Apple Stock

What factors influence Apple’s stock price in the short term?

Short-term fluctuations are often driven by news events (product announcements, earnings reports), investor sentiment, and overall market trends. Specific catalysts can lead to rapid price changes.

Where can I find the most reliable real-time Apple stock price?

The current price of Apple stock fluctuates constantly, influenced by various market factors. It’s interesting to compare its performance against other tech companies; for instance, checking the current ebs stock price offers a contrasting perspective on market trends. Ultimately, understanding the current price of Apple stock requires a broader view of the tech sector’s overall health.

Major financial websites like Yahoo Finance, Google Finance, and Bloomberg provide real-time stock quotes, although slight variations may exist due to differing data feeds and update frequencies.

How often does the Apple stock price update?

Most reputable sources update Apple’s stock price every few seconds, reflecting the constant trading activity on the stock market.

Is it possible to predict Apple’s future stock price accurately?

No, accurately predicting future stock prices is impossible. While analysis can inform investment strategies, market volatility and unforeseen events make precise prediction inherently unreliable.