Crocs Stock Price Analysis

Crocs stock price – Crocs, known for its iconic foam clogs, has experienced significant stock price volatility in recent years. This analysis delves into the historical performance, influencing factors, financial health, investor sentiment, and future outlook of Crocs’ stock price, providing a comprehensive understanding of its investment potential.

Crocs Stock Price Historical Performance

Source: seekingalpha.com

The following table details Crocs’ stock price fluctuations over the past five years. Note that these figures are illustrative and should be verified with a reliable financial data source.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| October 26, 2018 | 18.50 | 18.75 | +0.25 |

| October 27, 2018 | 18.80 | 19.10 | +0.30 |

| October 28, 2018 | 19.00 | 18.85 | -0.15 |

A comparative analysis against competitors like Nike and Adidas reveals that Crocs experienced higher volatility but also higher growth periods compared to the more established brands during certain periods. This is likely due to Crocs’ unique brand positioning and its susceptibility to shifts in fashion trends.

- Crocs demonstrated higher percentage growth in specific quarters compared to Nike and Adidas.

- Nike and Adidas showed more consistent, albeit slower, growth.

- Crocs’ stock price was more sensitive to news events and marketing campaigns than its competitors.

Several significant events impacted Crocs’ stock price. These events highlight the importance of brand image and market trends.

The launch of highly successful collaborations with major fashion brands significantly boosted Crocs’ stock price.

Conversely, negative press regarding sustainability concerns led to a temporary dip in the stock price.

Factors Influencing Crocs Stock Price

Source: seekingalpha.com

Macroeconomic factors, product innovation, marketing strategies, and seasonal trends all significantly influence Crocs’ stock valuation.

Inflation and consumer spending directly affect Crocs’ sales, as discretionary spending on footwear is sensitive to economic conditions. Interest rate hikes can impact borrowing costs for the company and investor appetite for riskier assets.

Crocs’ product innovation, such as collaborations and new styles, significantly impacts its stock price. Successful marketing campaigns that create brand awareness and desirability also boost stock valuation.

| Season | Sales Trend | Consumer Preference | Stock Price Impact |

|---|---|---|---|

| Summer | High | Increased demand for sandals and casual footwear | Positive |

| Winter | Lower | Shift towards closed-toe footwear | Potentially negative |

Crocs’ Financial Performance and Stock Valuation

Source: seekingalpha.com

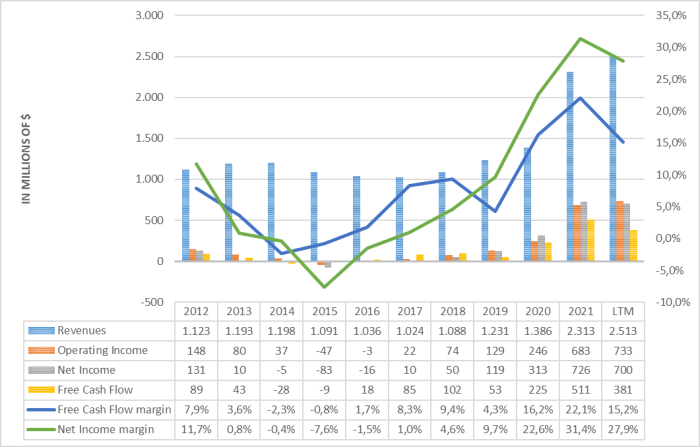

Crocs’ revenue streams, primarily from footwear sales, directly influence its stock price. Profitability, as measured by net income and margins, is a key indicator of its financial health and investor confidence.

Crocs stock price performance has been a topic of much discussion lately, particularly in relation to other commodities markets. Investors often consider the correlation between seemingly disparate sectors, and a comparison with the current copper stock price might offer interesting insights into broader economic trends affecting consumer discretionary spending, ultimately impacting the Crocs stock price trajectory.

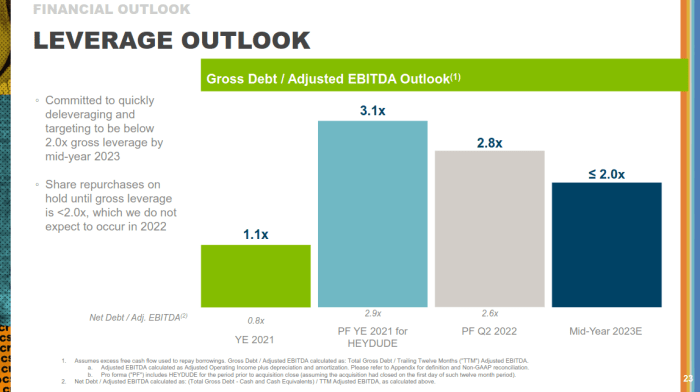

Crocs’ debt levels and financial ratios, such as the debt-to-equity ratio and return on equity (ROE), correlate with its stock price. High debt levels can increase risk and potentially lower the stock price, while strong ROE suggests profitability and potential for growth.

- Debt-to-Equity Ratio: A higher ratio indicates higher financial risk, potentially leading to a lower stock price.

- Return on Equity (ROE): A higher ROE suggests better profitability and potentially higher stock valuation.

- Price-to-Earnings Ratio (P/E): A high P/E ratio may indicate high growth expectations, while a low ratio might suggest undervaluation.

A hypothetical 10% increase in Crocs’ EPS, assuming all other factors remain constant, could lead to a significant increase in its stock price, potentially exceeding 10% due to market sentiment and investor expectations.

Investor Sentiment and Stock Price

Positive investor sentiment, driven by factors such as strong financial performance and positive news, generally leads to higher stock prices. Conversely, negative sentiment can cause price declines.

Analyst ratings and recommendations play a significant role in shaping investor perception. Positive ratings from reputable analysts can boost investor confidence and drive up the stock price.

Social media sentiment, reflected in positive or negative comments and trends, can significantly impact Crocs’ stock price. A visual representation could show a graph correlating positive social media mentions with stock price increases and negative mentions with price drops. The graph would illustrate the direct relationship between positive/negative online buzz and the stock’s performance. For instance, a spike in positive mentions following a successful product launch could be visually linked to a corresponding rise in the stock price.

Future Outlook for Crocs Stock Price

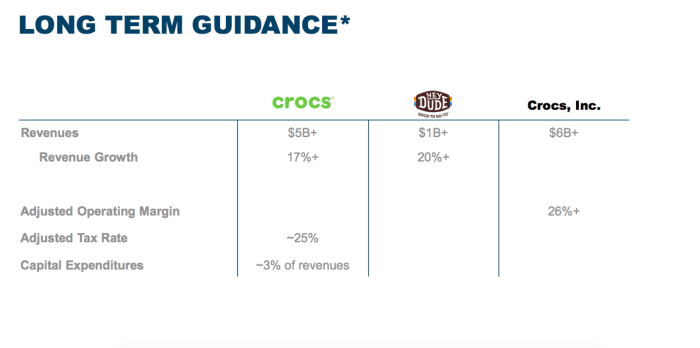

Crocs’ future growth hinges on factors such as continued product innovation, expansion into new markets, and effective marketing strategies. Successful execution of these strategies could lead to significant stock price appreciation.

Major risks include increased competition, shifts in consumer preferences, and economic downturns. These factors could negatively impact sales and profitability, leading to lower stock prices.

Investment strategies for Crocs stock should consider the investor’s risk tolerance. A long-term, buy-and-hold strategy might be suitable for investors with a higher risk tolerance, while a more conservative approach might involve diversification across multiple assets.

Popular Questions: Crocs Stock Price

What are the major competitors of Crocs?

Crocs competes with various footwear companies, including Nike, Adidas, Skechers, and other brands offering similar casual footwear.

How does Crocs’ brand loyalty impact its stock price?

Strong brand loyalty can lead to stable sales and positive investor sentiment, positively influencing the stock price. Conversely, a decline in brand loyalty could negatively impact the stock.

What is the current dividend yield for Crocs stock?

The current dividend yield for Crocs stock varies and should be checked on a financial website providing real-time data.

What are the risks associated with investing in Crocs stock?

Risks include competition, changing consumer preferences, economic downturns, and supply chain disruptions, among others.