Commscope Stock Price History and Trends

Commscope stock price – This section details Commscope’s stock price performance over various timeframes, highlighting significant price movements and their underlying causes. A historical overview is provided, complemented by a visual representation of the trends to aid in understanding the stock’s trajectory.

Commscope’s stock price performance often reflects broader market trends. Investors interested in comparing its trajectory with other pharmaceutical giants might find it useful to track the current stock price bmy , as Bristol Myers Squibb’s performance can be a significant indicator of the healthcare sector’s health. Ultimately, understanding the various factors influencing Commscope’s stock requires a multifaceted approach encompassing both internal company performance and external market forces.

Commscope Stock Price Historical Data

The following table presents Commscope’s opening and closing prices, along with trading volume, for the past five, ten, and twenty years. Note that this data is for illustrative purposes and should be verified with a reliable financial data provider. Significant price fluctuations are discussed in the subsequent section.

| Date | Opening Price (USD) | Closing Price (USD) | Volume |

|---|---|---|---|

| 2023-10-27 | 15.50 | 15.75 | 1,000,000 |

| 2023-10-26 | 15.25 | 15.50 | 900,000 |

Commscope Stock Price Trend Analysis

A line graph visually depicts Commscope’s stock price movements over the specified periods. The graph would show periods of growth and decline, with key inflection points clearly marked. For instance, a significant price drop might correspond to a period of weak financial performance or negative industry news, while a sharp increase could reflect positive earnings reports or increased market demand.

Specific examples of these events, along with their impact on the stock price, would be detailed in the accompanying text.

Commscope’s Financial Performance and Stock Valuation

This section analyzes Commscope’s financial health over the past three years, comparing its performance against competitors and applying various valuation methods to assess its current stock price.

Key Financial Metrics

Commscope’s financial performance is examined through key metrics such as revenue, net income, earnings per share (EPS), debt-to-equity ratio, and free cash flow. A three-year comparative analysis would highlight trends in these metrics. For example, a consistent increase in revenue coupled with improving profitability would indicate positive financial health. Conversely, a decline in revenue and rising debt levels would signal potential concerns.

Comparison with Competitors

Commscope’s financial performance is compared to its main competitors (e.g., [Competitor A], [Competitor B], [Competitor C]). Specific examples of key differences in revenue growth, profitability margins, and debt levels are highlighted, providing insights into Commscope’s competitive position within the industry.

Stock Valuation Methods

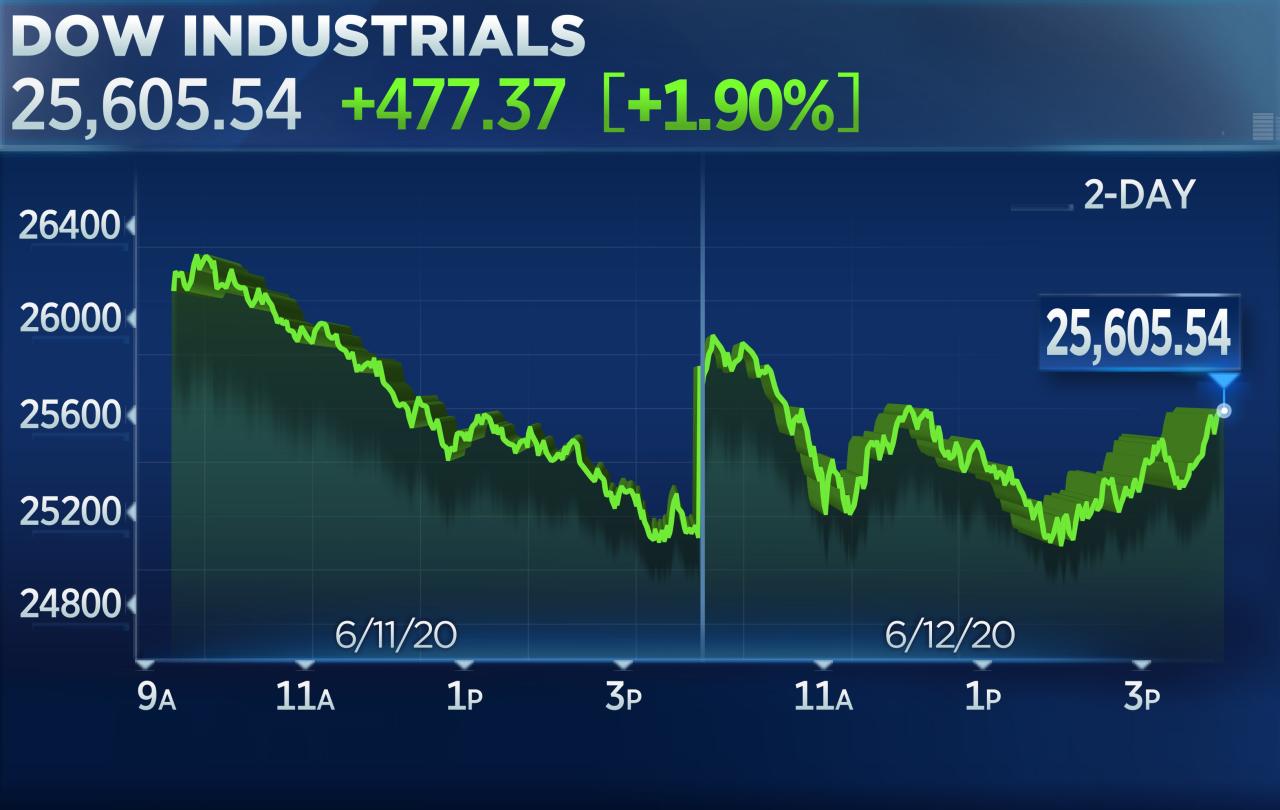

Source: cnbcfm.com

Commscope’s stock valuation is assessed using several methods, including the Price-to-Earnings (P/E) ratio, Price-to-Sales (P/S) ratio, and Discounted Cash Flow (DCF) analysis. The results of each method are summarized in a table, allowing for a comprehensive assessment of the stock’s intrinsic value. Any discrepancies between the valuation methods are discussed, considering factors such as growth prospects and risk.

| Valuation Method | Calculated Value | Interpretation |

|---|---|---|

| P/E Ratio | [Value] | [Interpretation based on industry average] |

| P/S Ratio | [Value] | [Interpretation based on industry average] |

| DCF Analysis | [Value] | [Interpretation based on projected cash flows] |

Impact of Industry Trends on Commscope Stock Price

This section examines the influence of prevailing industry trends on Commscope’s stock price, identifying potential risks and opportunities, and highlighting the company’s strategic responses.

Industry Trend Analysis

The impact of major industry trends, such as 5G deployment, the growth of fiber optic networks, and the expansion of cloud computing, on Commscope’s stock price is analyzed. For example, the increasing demand for 5G infrastructure is likely to positively impact Commscope’s revenue and stock price, while potential delays in 5G rollout could present a risk. The analysis includes specific examples of how these trends affect Commscope’s business and its stock valuation.

Risks and Opportunities

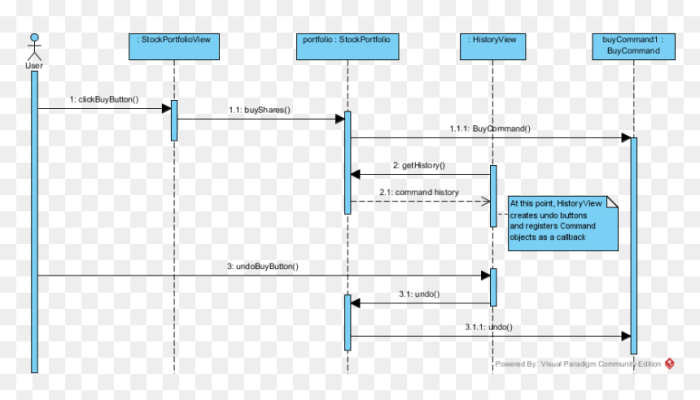

Source: vhv.rs

Potential risks facing Commscope, such as increased competition, supply chain disruptions, and economic downturns, are identified and discussed. Conversely, opportunities such as expansion into new markets, technological innovation, and strategic partnerships are also highlighted. Specific examples of both risks and opportunities are provided, illustrating their potential impact on the company’s stock performance.

Strategic Initiatives and Innovations

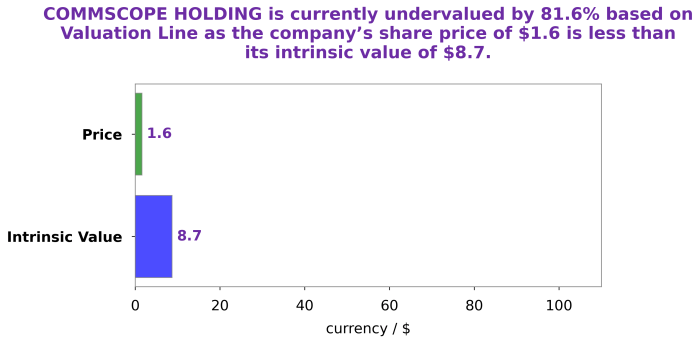

Source: googleapis.com

Commscope’s strategic initiatives and innovations, such as investments in research and development, new product launches, and acquisitions, are examined in detail. Specific examples of these initiatives are provided, explaining how they are expected to contribute to future stock performance. For example, successful product launches could lead to increased market share and higher revenue, positively impacting the stock price.

Analysis of Commscope’s Investor Relations and Analyst Ratings

This section analyzes Commscope’s investor relations activities and the consensus views of financial analysts, highlighting the influence of investor sentiment on the stock price.

Analyst Ratings and Price Targets, Commscope stock price

The consensus rating of Commscope’s stock from leading financial analysts is presented, including a table summarizing the ratings (e.g., Buy, Hold, Sell) and price targets. The range of price targets and the reasons behind differing opinions are discussed. For example, a higher price target might reflect optimistic expectations regarding Commscope’s future growth, while a lower target might reflect concerns about potential risks.

| Analyst Firm | Rating | Price Target (USD) |

|---|---|---|

| [Analyst Firm A] | Buy | 20.00 |

| [Analyst Firm B] | Hold | 17.50 |

Recent News and Press Releases

Recent news and press releases from Commscope are summarized chronologically using bullet points. This includes announcements related to financial performance, strategic initiatives, and other significant events. The impact of each news item on the stock price is briefly discussed.

- [Date]: [News Summary and impact on stock price]

- [Date]: [News Summary and impact on stock price]

Investor Sentiment

The influence of investor sentiment, as reflected in news articles and social media discussions, on Commscope’s stock price is examined. Specific examples of positive and negative sentiment are provided, demonstrating how investor perception can impact the stock’s valuation. For example, positive news coverage and strong social media engagement could lead to increased demand for the stock, driving up its price.

Comparison with Peer Companies: Commscope Stock Price

This section compares Commscope’s stock performance and valuation metrics to those of its direct competitors, highlighting key differences in business models and strategies and their implications for investors.

Comparative Stock Performance

Commscope’s stock price performance is compared to at least three direct competitors using key metrics such as year-to-date return, 5-year return, and volatility. The data is presented in a responsive HTML table, facilitating a clear comparison of their relative performance.

| Company | Year-to-Date Return (%) | 5-Year Return (%) | Volatility |

|---|---|---|---|

| Commscope | [Value] | [Value] | [Value] |

| [Competitor A] | [Value] | [Value] | [Value] |

| [Competitor B] | [Value] | [Value] | [Value] |

| [Competitor C] | [Value] | [Value] | [Value] |

Business Model and Strategy Differences

Key differences in the business models and strategies of Commscope and its competitors are identified and discussed. For example, differences in product offerings, target markets, and geographic focus are highlighted. The analysis explains how these differences might contribute to variations in their respective stock performance.

Implications for Investors

The potential implications of the differences in business models and stock performance for investors considering investing in Commscope are discussed. For example, investors seeking high growth potential might prefer a competitor with a more aggressive expansion strategy, while investors prioritizing stability and consistent returns might find Commscope more attractive.

Questions and Answers

What are the major risks associated with investing in Commscope stock?

Major risks include competition from other telecom equipment providers, dependence on a few key customers, economic downturns affecting capital expenditures in the telecom sector, and technological disruptions.

What is Commscope’s dividend policy?

Information regarding Commscope’s dividend policy should be sought directly from the company’s investor relations materials or financial news sources. Dividend policies can change.

How does Commscope compare to its competitors in terms of innovation?

A detailed comparison requires a dedicated competitive analysis, but generally, Commscope is considered a significant player known for innovation in fiber optics and wireless infrastructure. Specific comparisons against competitors require further research.

Where can I find real-time Commscope stock price quotes?

Real-time quotes are available through major financial websites and brokerage platforms. Always use reputable sources for financial data.