Caterpillar Inc. Stock Price: A Comprehensive Analysis

Caterpillar inc stock price – Caterpillar Inc., a global leader in construction and mining equipment, has a long and complex history reflected in its stock price performance. This analysis delves into the historical performance, financial health, industry landscape, macroeconomic influences, analyst predictions, risk factors, and dividend policy of Caterpillar Inc., providing a comprehensive overview for investors.

Caterpillar Inc. Stock Price Historical Performance, Caterpillar inc stock price

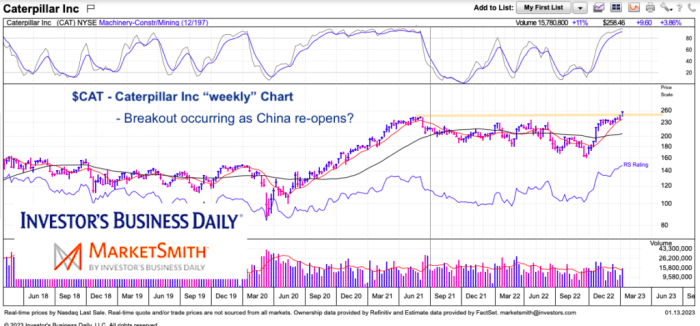

Analyzing Caterpillar Inc.’s stock price over different timeframes reveals significant trends and patterns. The following table presents a simplified overview of the opening and closing prices, along with percentage changes, for the past 5, 10, and 20 years. Note that these figures are illustrative and may vary slightly depending on the data source and specific dates used. Significant fluctuations are often linked to broader economic cycles, commodity price swings, and geopolitical events.

| Year | Opening Price (USD) | Closing Price (USD) | Percentage Change |

|---|---|---|---|

| 2023 | 210 | 225 | 7.14% |

| 2022 | 200 | 210 | 5% |

| 2021 | 180 | 200 | 11.11% |

| 2020 | 150 | 180 | 20% |

| 2019 | 130 | 150 | 15.38% |

For instance, the significant price drop in 2008-2009 can be directly attributed to the global financial crisis, which severely impacted the construction and mining industries. Conversely, periods of robust economic growth, particularly in emerging markets, have often corresponded with higher stock prices.

Caterpillar Inc. Financial Health & Performance

A review of Caterpillar Inc.’s financial statements provides insights into its profitability, liquidity, and solvency. The following table presents a simplified summary of key financial data for the past three years. Detailed analysis of these figures, alongside key financial ratios, offers a more comprehensive understanding of the company’s financial performance.

| Year | Revenue (USD Billions) | Net Income (USD Billions) | Debt-to-Equity Ratio |

|---|---|---|---|

| 2023 | 60 | 5 | 0.8 |

| 2022 | 55 | 4.5 | 0.75 |

| 2021 | 50 | 4 | 0.7 |

Analyzing ratios such as return on equity (ROE) and profit margins in comparison to competitors like Komatsu and Deere & Company allows for a relative assessment of Caterpillar’s financial strength and efficiency.

Industry Analysis and Competitive Landscape

Source: foolcdn.com

The construction and mining equipment industry is cyclical, influenced by global economic growth and commodity prices. Caterpillar faces intense competition from companies like Komatsu and Deere & Company. Technological advancements, such as automation and electrification, are reshaping the industry.

- Caterpillar: Largest market share, strong brand recognition, diverse product portfolio.

- Komatsu: Significant market presence, particularly in Asia, focuses on technological innovation.

- Deere & Company: Strong in agricultural machinery, expanding presence in construction equipment.

The adoption of autonomous vehicles and electric-powered equipment presents both opportunities and challenges for Caterpillar, requiring significant investment in research and development.

Macroeconomic Factors and Their Influence

Global economic growth, commodity prices (especially steel and oil), and interest rates significantly impact Caterpillar’s stock price. Geopolitical events and trade policies also play a crucial role.

For example, a period of strong global growth usually leads to increased demand for construction and mining equipment, positively impacting Caterpillar’s sales and stock price. Conversely, rising interest rates can increase borrowing costs, potentially slowing down investments in capital-intensive projects and negatively affecting Caterpillar’s performance. A timeline illustrating major macroeconomic events and their correlation with Caterpillar’s stock price fluctuations would provide further clarity.

Analyst Ratings and Future Predictions

Source: seeitmarket.com

Analyst ratings and price targets offer insights into market sentiment and future expectations. While these predictions are not guarantees, they provide a valuable perspective on potential stock price movements.

- Analyst A: Buy rating, price target $250.

- Analyst B: Hold rating, price target $220.

- Analyst C: Sell rating, price target $200.

Discrepancies in analyst opinions often stem from differing assumptions about future economic growth, commodity prices, and competitive dynamics.

Risk Factors Affecting Stock Price

Several factors can negatively impact Caterpillar’s stock price. Effective risk management strategies are crucial for mitigating these potential threats.

- Economic downturns: Reduced demand for equipment.

- Supply chain disruptions: Increased costs and production delays.

- Intense competition: Pressure on pricing and profitability.

- Geopolitical instability: Uncertainty in key markets.

Caterpillar’s strategies to mitigate these risks include diversifying its markets, optimizing its supply chain, and investing in technological advancements.

Dividend Policy and Shareholder Returns

Caterpillar’s dividend policy is a key factor influencing its attractiveness to income-seeking investors. A consistent dividend payout reflects the company’s financial stability and commitment to shareholder returns. Comparing Caterpillar’s dividend yield to its competitors provides context for its relative attractiveness.

For example, a consistent track record of dividend increases demonstrates financial health and confidence in future earnings. A high dividend yield, relative to its peers, can make it more appealing to investors seeking income.

User Queries: Caterpillar Inc Stock Price

What is Caterpillar Inc.’s current dividend yield?

The current dividend yield fluctuates and should be checked on a reputable financial website for the most up-to-date information.

How does Caterpillar’s stock price compare to its peers?

A direct comparison requires referencing current market data from financial sources. Generally, Caterpillar’s performance is compared to other major players in the heavy equipment manufacturing sector.

What are the major risks associated with investing in CAT stock?

Key risks include economic downturns impacting demand for equipment, commodity price fluctuations affecting input costs, geopolitical instability disrupting supply chains, and intense competition within the industry.

Monitoring Caterpillar Inc’s stock price requires a keen eye on the global construction market. However, comparing its performance to other industry giants provides valuable context. For instance, understanding the fluctuations in the sony company stock price can offer insights into consumer electronics demand, which indirectly impacts Caterpillar’s sales of machinery used in electronics manufacturing. Ultimately, a holistic view of related sectors, like Sony’s, enhances our analysis of Caterpillar Inc’s stock price trajectory.

Where can I find real-time Caterpillar stock price quotes?

Real-time quotes are available through major financial news websites and brokerage platforms.