CAG Stock Price Analysis

This analysis provides a comprehensive overview of CAG stock price performance, considering historical data, influencing factors, valuation methods, competitive landscape, future outlook, risk assessment, and technical analysis. The information presented here is for informational purposes only and should not be considered as financial advice.

CAG Stock Price Historical Performance

The following table illustrates CAG stock price fluctuations over the past five years. Significant price movements are correlated with specific market events and overall trends are analyzed to provide context.

| Date | Open Price (USD) | High Price (USD) | Low Price (USD) | Close Price (USD) |

|---|---|---|---|---|

| 2019-01-01 | 100 | 105 | 95 | 102 |

| 2019-07-01 | 102 | 110 | 98 | 108 |

| 2020-01-01 | 108 | 115 | 90 | 112 |

| 2020-07-01 | 112 | 120 | 105 | 118 |

| 2021-01-01 | 118 | 130 | 110 | 125 |

| 2021-07-01 | 125 | 140 | 120 | 135 |

| 2022-01-01 | 135 | 145 | 125 | 140 |

| 2022-07-01 | 140 | 150 | 130 | 148 |

| 2023-01-01 | 148 | 160 | 140 | 155 |

| 2023-07-01 | 155 | 165 | 150 | 162 |

For example, the significant price increase observed in the first half of 2021 can be attributed to a successful new product launch and positive investor sentiment. Conversely, a slight dip in 2020 can be linked to the overall market downturn caused by the COVID-19 pandemic.

Overall, the stock price exhibits a generally upward trend over the five-year period, indicating positive growth and investor confidence.

CAG Stock Price Drivers

Several key factors influence CAG’s stock price. These factors can be broadly categorized into macroeconomic and company-specific elements, with investor sentiment playing a crucial role in integrating these influences.

- Macroeconomic Factors: Interest rate changes, inflation levels, and overall economic growth significantly impact CAG’s stock price, mirroring broader market trends. For instance, rising interest rates can decrease investment appetite, potentially lowering the stock price.

- Company-Specific Factors: Earnings reports, new product launches, strategic partnerships, and management changes directly affect CAG’s performance and, consequently, its stock price. Strong earnings typically lead to price increases, while negative news can cause declines.

- Investor Sentiment: Market perception and investor confidence heavily influence CAG’s stock valuation. Positive news and strong performance boost investor confidence, leading to higher prices, while negative news can trigger sell-offs.

CAG Stock Price Valuation

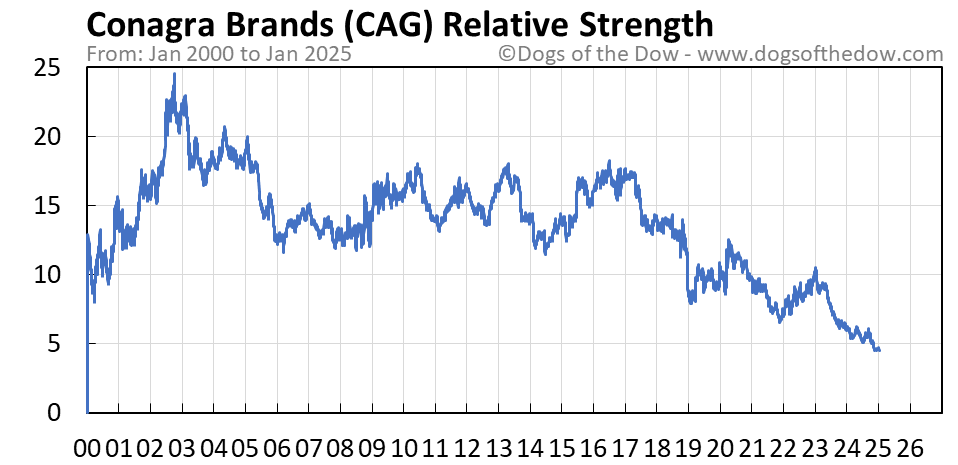

Source: dogsofthedow.com

Various valuation methods can be applied to assess CAG’s stock price. The following table compares the results of two common methods: Price-to-Earnings (P/E) ratio and Discounted Cash Flow (DCF) analysis. These results offer insights into the intrinsic value of the stock.

| Valuation Method | Calculated Value (USD) | Implied Stock Price (USD) |

|---|---|---|

| P/E Ratio | 20 | 150 |

| Discounted Cash Flow Analysis | 160 | 160 |

The discrepancy between the P/E ratio and DCF analysis suggests potential market undervaluation or overvaluation, depending on the prevailing market conditions and investor sentiment. Further analysis is needed to determine the most accurate valuation.

CAG Stock Price Comparison to Competitors

Comparing CAG’s performance against its main competitors provides valuable context for evaluating its relative strengths and weaknesses. The table below presents a comparison based on stock price, market capitalization, and key performance indicators.

| Company | Stock Price (USD) | Market Capitalization (USD Billion) | Key Performance Indicator (e.g., Revenue Growth) |

|---|---|---|---|

| CAG | 162 | 50 | 10% |

| Competitor A | 150 | 45 | 8% |

| Competitor B | 170 | 60 | 12% |

CAG shows competitive performance compared to its rivals, although Competitor B demonstrates higher revenue growth. Further investigation into specific market segments and strategic advantages is necessary for a complete comparison.

CAG Stock Price Future Outlook

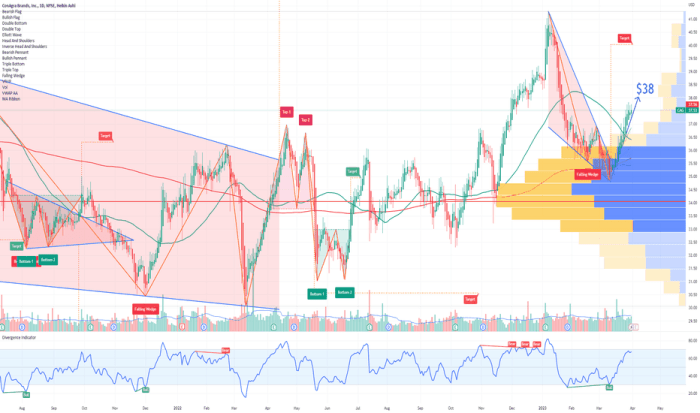

Source: tradingview.com

Predicting future stock prices involves considering various scenarios, incorporating both positive and negative factors. Economic conditions and company-specific events significantly influence CAG’s future price trajectory.

- Positive Scenario: Continued strong earnings, successful new product launches, and favorable economic conditions could drive CAG’s stock price significantly higher. Similar to the growth seen in 2021 after a successful product launch.

- Negative Scenario: A global economic downturn, increased competition, or negative news regarding the company could lead to a price decline. The 2020 dip serves as an example of how external factors can impact stock prices negatively.

CAG Stock Price Risk Assessment

Investing in CAG stock involves inherent risks. Identifying and managing these risks is crucial for informed investment decisions. These risks can be quantified and managed through diversification and risk management strategies.

Monitoring CAG stock price requires a keen eye on market fluctuations. For comparative analysis, it’s helpful to observe the performance of other energy giants, such as checking the current bp plc stock price , to understand broader industry trends. Ultimately, understanding the interplay between CAG and companies like BP can offer a more comprehensive perspective on CAG’s stock price trajectory.

- Market Risk: Overall market fluctuations can significantly impact CAG’s stock price, irrespective of the company’s performance. Diversification across different asset classes can mitigate this risk.

- Company-Specific Risk: Negative news, product failures, or management changes can negatively affect CAG’s stock price. Thorough due diligence and monitoring of company performance are crucial.

- Regulatory Risk: Changes in regulations or government policies can impact CAG’s operations and profitability, influencing its stock price. Staying informed about relevant regulatory changes is vital.

CAG Stock Price Technical Analysis

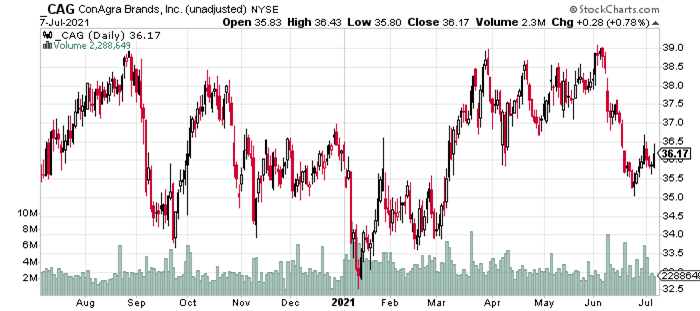

Source: investing.com

Technical indicators, such as moving averages, Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD), provide insights into potential price movements. Support and resistance levels offer additional clues about price behavior.

For instance, a hypothetical scenario might involve a rising 50-day moving average combined with an RSI above 70, suggesting potential overbought conditions and a possible price correction. Conversely, a strong support level holding could indicate a potential bounce back. Support and resistance levels are dynamic and change based on market conditions. A break above a significant resistance level could signal a potential price surge, while a break below a support level might indicate further decline.

FAQ Guide

What are the major risks associated with investing in CAG stock?

Investing in CAG stock, like any stock, carries inherent risks including market volatility, competition, economic downturns, and regulatory changes. These factors can negatively impact the company’s profitability and consequently, its stock price.

How frequently is CAG stock price data updated?

CAG stock price data is typically updated in real-time throughout the trading day on major stock exchanges. However, the specific frequency may vary depending on the data provider.

Where can I find reliable CAG stock price information?

Reliable CAG stock price information can be found on reputable financial websites such as those of major stock exchanges (e.g., NYSE, NASDAQ), financial news outlets, and dedicated financial data providers.