Cadence Design Systems: A Deep Dive into Stock Performance

Cadence design stock price – Cadence Design Systems, Inc. is a prominent player in the electronic design automation (EDA) software market. This analysis explores the factors influencing its stock price, examining its financial performance, investor sentiment, and technical indicators.

Cadence Design Systems Company Overview

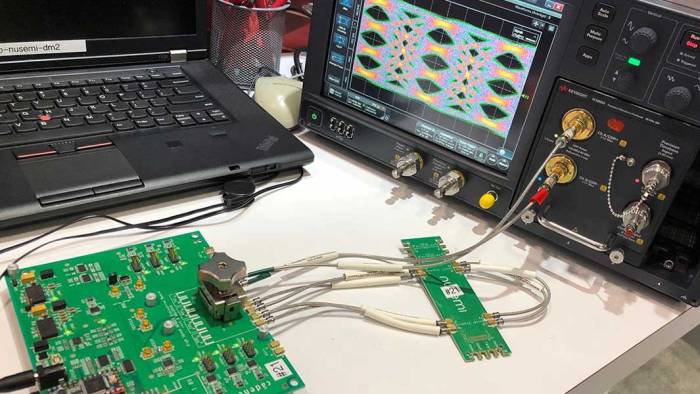

Source: shutterstock.com

Cadence Design Systems provides software, hardware, and services for the design of integrated circuits (ICs) and printed circuit boards (PCBs). Its market position is strong, holding a significant share in the EDA market alongside competitors like Synopsys and Mentor Graphics (now part of Siemens). Key product offerings include software for system design, IC design, PCB design, and verification.

These tools are crucial throughout the entire electronic design process, from initial concept to final product manufacturing. Revenue streams primarily come from software licenses, maintenance contracts, and services. Software licenses constitute a major portion of revenue, while maintenance and services provide recurring income streams. A key event in Cadence’s history was its acquisition of several smaller EDA companies, expanding its product portfolio and market reach.

Further milestones include the continuous release of updated software versions and the expansion into new markets.

Factors Influencing Cadence Design Stock Price

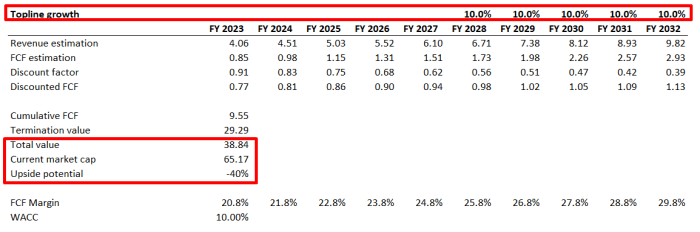

Source: seekingalpha.com

Macroeconomic factors such as interest rate changes and inflation significantly impact Cadence’s stock price. Higher interest rates increase borrowing costs, potentially slowing down investment in the semiconductor industry, which directly affects Cadence’s clients. Inflation impacts operating costs and consumer demand for electronic devices. Industry trends, particularly growth in the semiconductor sector and advancements in technologies like artificial intelligence and 5G, drive demand for Cadence’s EDA tools, positively impacting the stock price.

Competitor actions, such as new product launches or aggressive pricing strategies, can influence Cadence’s market share and consequently its stock performance. Company-specific news, including earnings reports and new product releases, creates volatility. Positive earnings surprises generally lead to price increases, while disappointing results can trigger declines.

| Date | Event | Stock Price Change (%) | Analysis of Impact |

|---|---|---|---|

| 2024-02-28 (Example) | Strong Q4 Earnings Beat | +5% | Exceeded analyst expectations, demonstrating robust demand for its products. |

| 2024-05-15 (Example) | New Product Launch (Example: Innovative Verification Tool) | +3% | Positive market reaction to the enhanced capabilities and potential market expansion. |

| 2024-08-01 (Example) | Lower-than-Expected Q2 Revenue | -2% | Concerns about slowing growth in the semiconductor market and potential competitive pressures. |

Financial Performance and Valuation

Cadence’s financial performance over the past five years has shown consistent growth in revenue and net income. Its valuation metrics, like Price-to-Earnings (P/E) ratio and Price-to-Sales (P/S) ratio, are generally compared to those of its competitors to gauge relative valuation. High debt levels can negatively impact a company’s stock price due to increased financial risk. Cadence’s dividend policy, including the frequency and amount of dividend payouts, plays a role in attracting investors seeking income streams.

| Year | Revenue ($M) | Net Income ($M) | Earnings Per Share (EPS) |

|---|---|---|---|

| 2019 (Example) | 1800 | 300 | 2.50 |

| 2020 (Example) | 1950 | 350 | 2.80 |

| 2021 (Example) | 2100 | 400 | 3.20 |

| 2022 (Example) | 2300 | 450 | 3.60 |

| 2023 (Example) | 2500 | 500 | 4.00 |

Investor Sentiment and Market Expectations, Cadence design stock price

Source: investors.com

Current investor sentiment towards Cadence is generally positive, reflecting its consistent financial performance and growth prospects within the expanding semiconductor industry. The market anticipates continued growth, driven by the increasing demand for electronic devices and advancements in semiconductor technology. Analyst ratings and price targets provide guidance to investors, influencing their buying and selling decisions. Potential risks include macroeconomic headwinds, increased competition, and potential disruptions in the global supply chain.

Opportunities exist in emerging technologies and expansion into new markets.

Technical Analysis of Stock Price

Technical analysis uses charts and indicators to predict future price movements. Moving averages smooth out price fluctuations, identifying trends. The Relative Strength Index (RSI) measures momentum, indicating overbought or oversold conditions. Support and resistance levels represent price areas where buying and selling pressure is expected to be strong. A head and shoulders pattern, for example, is a bearish reversal pattern characterized by three peaks (the “head” and two “shoulders”), often followed by a significant price decline.

This pattern’s duration varies, but a confirmation of the pattern usually occurs upon the break of the neckline support level. A successful break of the neckline often leads to a price decline roughly equal to the height of the head above the neckline.

User Queries: Cadence Design Stock Price

What is Cadence Design Systems’ main competitor?

Cadence faces competition from several companies, most notably Synopsys and Siemens EDA. The competitive landscape is complex and involves varying degrees of competition across different product segments.

How does Cadence Design Systems generate revenue?

Cadence generates revenue primarily through the sale of its electronic design automation (EDA) software and related services to semiconductor companies and other electronics manufacturers.

What are the major risks associated with investing in Cadence Design Systems?

Analyzing the cadence design stock price requires considering broader market trends. For instance, a comparison with the performance of other transportation companies, such as checking the old dominion stock price , can offer valuable context. Ultimately, understanding the fluctuations in cadence design stock price necessitates a holistic view of the relevant sector’s economic health.

Risks include competition, economic downturns impacting the semiconductor industry, technological disruption, and fluctuations in foreign exchange rates.

Where can I find real-time Cadence Design stock price information?

Real-time stock price information can be found on major financial websites and trading platforms such as Yahoo Finance, Google Finance, and Bloomberg.