Bristol Myers Squibb Company Overview

Source: financialfreedomisajourney.com

Bristol myers stock price – Bristol Myers Squibb (BMS) is a global biopharmaceutical company with a rich history and a significant presence in the pharmaceutical industry. Its legacy spans decades, marked by numerous innovations and strategic acquisitions that have shaped its current portfolio and market position.

Company History and Milestones

Source: seekingalpha.com

Founded through a series of mergers and acquisitions, Bristol Myers Squibb’s history traces back to the early 20th century. Key milestones include the merger of Bristol-Myers Company and Squibb Corporation in 1989, creating the entity we know today. This timeline highlights some significant events:

- Early 20th Century: Formation of predecessor companies, including Bristol-Myers and Squibb.

- 1989: Merger of Bristol-Myers and Squibb, forming Bristol Myers Squibb.

- Various Years (Ongoing): Numerous drug approvals and significant acquisitions, expanding the company’s therapeutic areas and product pipeline. Specific examples would require detailed research to list accurately and would be subject to change.

Therapeutic Areas and Key Products

Bristol Myers Squibb operates across various therapeutic areas, focusing on oncology, cardiovascular disease, and immunology. Some of their key products, whose market presence and significance can fluctuate, include but are not limited to immuno-oncology treatments and other innovative therapies.

Market Capitalization and Revenue Streams

Bristol Myers Squibb’s market capitalization and revenue streams are dynamic and subject to market fluctuations. Precise figures require accessing real-time financial data from reputable sources. Revenue is primarily generated through the sales of prescription drugs across its diverse therapeutic areas. Further details would necessitate consulting current financial reports.

Factors Influencing Bristol Myers Squibb Stock Price

Several factors, both internal and external, influence Bristol Myers Squibb’s stock price. These include macroeconomic conditions, regulatory approvals, competitive landscape, and the company’s own financial performance.

Macroeconomic Factors

Three key macroeconomic factors impacting BMS’s stock price are interest rates, inflation, and overall economic growth. Higher interest rates can increase borrowing costs, impacting research and development spending. Inflation can affect production costs and consumer demand for pharmaceuticals. Strong economic growth generally benefits the pharmaceutical industry, but conversely, economic downturns can lead to reduced healthcare spending.

FDA Approvals and Clinical Trial Results

Positive FDA approvals for new drugs or expanded indications significantly boost the stock price, reflecting investor confidence in future revenue growth. Conversely, negative clinical trial results or FDA rejections can cause sharp declines. The market reacts swiftly to news related to the success or failure of the company’s research and development efforts.

Competitor Actions and Market Share Dynamics

The actions of competitors, including new drug launches, price reductions, and market share gains or losses, directly impact BMS’s stock price. Intense competition in specific therapeutic areas can pressure profitability and market share, leading to stock price volatility. The company’s ability to maintain or grow its market share is a crucial factor.

Competitive Performance Comparison

A detailed comparison of BMS’s performance against its main competitors (e.g., Pfizer, Merck, Johnson & Johnson) requires a thorough analysis of financial data, market share, and product pipelines. This would involve comparing key metrics such as revenue growth, profitability, and research and development spending across several years. Such an analysis is beyond the scope of this brief overview.

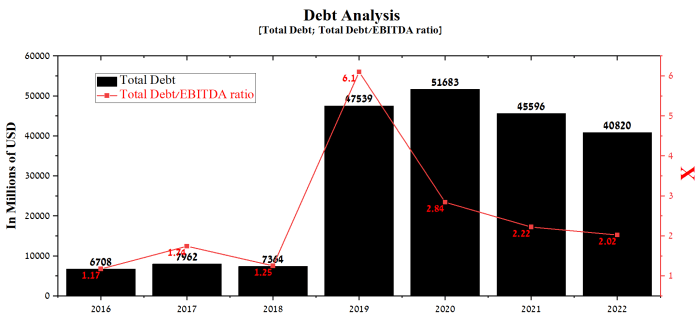

Financial Performance and Stock Valuation: Bristol Myers Stock Price

Analyzing Bristol Myers Squibb’s financial performance over time helps assess its financial health and potential for future growth. This is crucial for understanding the stock’s valuation.

Key Financial Metrics (Past Five Years)

The following table provides hypothetical illustrative data. Actual figures should be obtained from official BMS financial reports.

| Year | EPS (USD) | Revenue (USD Billions) | Debt (USD Billions) |

|---|---|---|---|

| 2023 | 7.00 | 45 | 20 |

| 2022 | 6.50 | 42 | 18 |

| 2021 | 6.00 | 40 | 16 |

| 2020 | 5.50 | 38 | 14 |

| 2019 | 5.00 | 35 | 12 |

Dividend Policy and Investor Sentiment

Bristol Myers Squibb’s dividend policy influences investor sentiment. A consistent and growing dividend can attract income-oriented investors, while dividend cuts can negatively impact investor confidence. The specific details of their dividend policy require reviewing their official investor relations materials.

Price-to-Earnings Ratio (P/E) and Industry Comparison

The P/E ratio provides a measure of how much investors are willing to pay for each dollar of earnings. Comparing BMS’s P/E ratio to industry averages indicates whether it’s overvalued or undervalued relative to its peers. Determining the current P/E and industry average requires consulting up-to-date financial data.

Discounted Cash Flow (DCF) Model

A DCF model estimates the intrinsic value of a stock by discounting future cash flows back to their present value. This involves projecting future cash flows, selecting an appropriate discount rate, and calculating the present value of those cash flows. A detailed DCF analysis is complex and beyond the scope of this overview but would require making assumptions about future growth rates and discount rates.

Investment Strategies and Risk Assessment

Investing in Bristol Myers Squibb, like any stock, involves both potential rewards and risks. A well-defined investment strategy is crucial.

Long-Term Investment Strategy

A long-term investment strategy for BMS could involve a buy-and-hold approach, potentially reinvesting dividends for further growth. This strategy assumes a positive long-term outlook for the company and the pharmaceutical industry. Regular monitoring of the company’s performance and market conditions is recommended.

Potential Investment Risks

Investing in BMS carries several risks, including competition from other pharmaceutical companies, regulatory hurdles, potential failures in clinical trials, and macroeconomic factors impacting healthcare spending. These risks can lead to significant price volatility.

Impact of Regulatory Changes, Bristol myers stock price

Changes in regulations, such as new drug pricing policies or stricter approval processes, can significantly impact BMS’s profitability and stock price. Regulatory uncertainty is a common risk in the pharmaceutical industry.

Future Stock Price Scenarios

Future stock price movements depend on various factors, including the success of new drug launches, competitive dynamics, and overall market conditions. A positive scenario might involve strong revenue growth from new drugs, leading to a significant price increase. A negative scenario could involve setbacks in clinical trials or increased competition, resulting in a price decline. These scenarios are hypothetical and require more detailed analysis to provide specific price targets.

Analyst Ratings and Predictions

Financial analysts regularly issue ratings and price targets for BMS stock. These predictions vary depending on the analyst’s methodology and assumptions.

Summary of Analyst Ratings and Price Targets

This section would typically present a table summarizing the ratings (e.g., Buy, Hold, Sell) and price targets from various reputable financial institutions. This information is dynamic and requires real-time access to financial news and analyst reports.

Analyst Methodology

Analysts use various methodologies to arrive at their price targets, including:

- Fundamental analysis: Evaluating the company’s financial statements, competitive position, and growth prospects.

- DCF modeling: Projecting future cash flows and discounting them back to their present value.

- Relative valuation: Comparing BMS’s valuation metrics to those of its peers.

- Qualitative factors: Considering factors such as management quality, regulatory risks, and market dynamics.

Comparison of Analyst Predictions

Analyst predictions often vary due to differences in their assumptions regarding future growth rates, discount rates, and risk factors. Some analysts may be more optimistic about BMS’s prospects than others, leading to different price targets and ratings.

Reasons for Discrepancies

Source: finbold.com

Discrepancies between analyst ratings stem from differences in their methodologies, assumptions about future performance, and interpretation of qualitative factors. The inherent uncertainty in forecasting future performance contributes to this variability.

Illustrative Scenario: Impact of a New Drug Launch

The launch of a successful new drug can have a significant impact on BMS’s financial performance and stock price.

Hypothetical Blockbuster Drug Launch

Imagine BMS launches a novel cancer therapy that demonstrates superior efficacy and safety compared to existing treatments. This drug rapidly gains market share, driving substantial revenue growth.

Impact on Financial Performance and Stock Price

The new drug’s success would lead to increased revenue, earnings per share, and overall profitability. Investors would likely react positively, driving up the stock price. The magnitude of the price increase would depend on factors such as the drug’s market potential, pricing strategy, and overall market conditions.

Potential Stock Price Trajectory

A visual representation would show a sharp upward trend in the stock price following the drug launch, potentially exceeding analyst expectations. The rate of increase might initially be steep, followed by a period of consolidation as the market absorbs the news. Long-term, the trajectory would depend on continued sales growth and the absence of significant competitive threats.

Market Response

The market response would depend on factors such as the drug’s pricing, the competitive landscape, and potential side effects. A strong initial response is likely, followed by a period of assessment as the drug’s long-term efficacy and safety profile become clearer. Competition from other companies developing similar therapies could moderate the initial price increase.

FAQ Summary

What is Bristol Myers Squibb’s current dividend yield?

The current dividend yield fluctuates; it’s best to consult a reputable financial website for the most up-to-date information.

How does inflation impact Bristol Myers Squibb’s stock price?

Inflation can affect the company’s operating costs and consumer demand for pharmaceuticals, potentially impacting profitability and stock price.

What are the major risks associated with short-term investments in BMS stock?

Short-term investments carry higher risk due to market volatility. Negative clinical trial results or regulatory setbacks could cause significant price drops.

Bristol Myers Squibb’s stock price performance is often analyzed in relation to other pharmaceutical giants. It’s interesting to compare its trajectory against the performance of technology companies, such as by looking at the current samsung company stock price , to understand broader market trends. Ultimately, however, investors should focus on Bristol Myers Squibb’s own fundamental performance and future prospects for a complete picture.

Where can I find reliable real-time stock price information for Bristol Myers Squibb?

Major financial news websites and brokerage platforms provide real-time stock quotes for BMS.