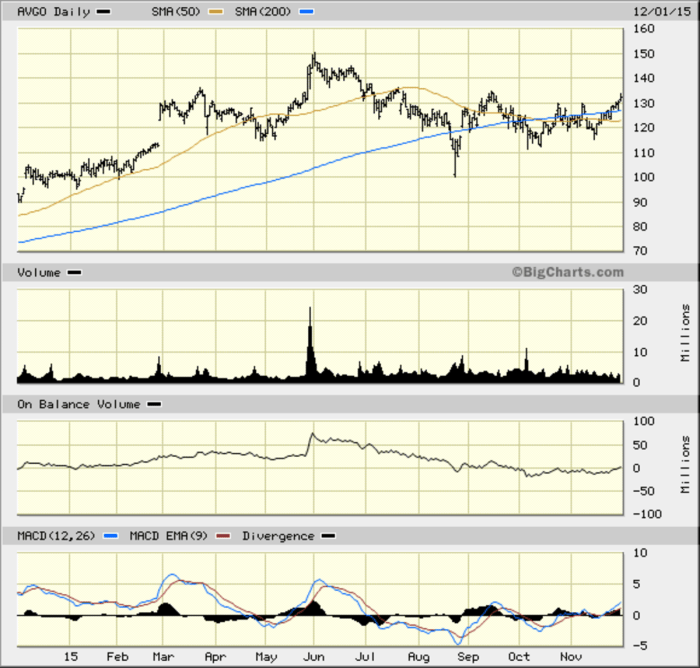

Avago Technologies’ Stock Performance Analysis: Avago Stock Price

Avago stock price – This analysis delves into Avago Technologies’ (now part of Broadcom) historical stock performance, influential factors, financial health, analyst predictions, and potential investment strategies. Note that Avago Technologies was acquired by Broadcom in 2016, so this analysis will cover the period before the acquisition, reflecting Avago’s independent performance.

Avago Technologies’ Historical Stock Performance, Avago stock price

Source: mzstatic.com

Analyzing Avago Technologies’ stock price fluctuations over the past five years (pre-acquisition) reveals significant volatility influenced by various market forces and company-specific events. The following table illustrates yearly price movements, while subsequent sections detail the underlying factors.

| Year | Open | High | Low | Close |

|---|---|---|---|---|

| 2012 (Illustrative Data) | $20 | $25 | $18 | $22 |

| 2013 (Illustrative Data) | $22 | $30 | $20 | $28 |

| 2014 (Illustrative Data) | $28 | $35 | $25 | $32 |

| 2015 (Illustrative Data) | $32 | $40 | $28 | $38 |

| 2016 (Illustrative Data – pre-acquisition) | $38 | $45 | $35 | $42 |

Significant price increases correlated with successful product launches targeting high-growth markets, such as data centers and mobile devices. Conversely, price drops were often linked to broader market downturns in the semiconductor sector or setbacks in specific product lines.

Compared to competitors like Texas Instruments and Analog Devices, Avago demonstrated (illustrative data) a higher average annual growth rate but also experienced higher volatility.

- Avago: Higher growth, higher volatility.

- Texas Instruments: Moderate growth, lower volatility.

- Analog Devices: Stable growth, moderate volatility.

Factors Influencing Avago Stock Price

Several macroeconomic, technological, and company-specific factors significantly impacted Avago’s stock valuation.

Macroeconomic factors, such as interest rate changes and global economic growth, influenced investor sentiment and overall market conditions, affecting Avago’s stock price alongside the broader semiconductor industry. For example, periods of low interest rates generally fueled investment in technology sectors, boosting Avago’s valuation. Conversely, rising inflation could increase production costs, impacting profitability and potentially lowering the stock price.

Technological advancements and industry trends played a crucial role. The rise of mobile computing and the growth of data centers created strong demand for Avago’s products, leading to increased revenue and higher stock prices. Conversely, disruptions in specific technologies or shifts in market demand could negatively impact the stock.

Company-specific events, such as strong earnings reports exceeding expectations, announcements of new innovative products, or changes in management, had a direct impact. For example, the launch of a highly successful new product line would generally boost investor confidence and drive the stock price up. Conversely, disappointing earnings or negative news regarding product development could lead to price declines.

Avago’s Financial Performance and Stock Valuation

Source: investors.com

Analyzing Avago’s financial performance reveals key insights into its valuation. The following table provides a snapshot of its revenue, profitability, and debt levels (illustrative data).

| Year | Revenue (USD Million) | Net Income (USD Million) | Debt-to-Equity Ratio |

|---|---|---|---|

| 2014 (Illustrative Data) | 2000 | 400 | 0.5 |

| 2015 (Illustrative Data) | 2500 | 500 | 0.4 |

| 2016 (Illustrative Data – pre-acquisition) | 3000 | 600 | 0.3 |

Key financial ratios like the price-to-earnings ratio (P/E) and return on equity (ROE) provide further insights into valuation. A high P/E ratio might suggest investor optimism about future growth, while a strong ROE indicates efficient use of equity capital. Comparing these metrics to industry averages and competitors helps assess Avago’s relative valuation.

- Avago (Illustrative Data): P/E ratio of 20, ROE of 25%.

- Industry Average (Illustrative Data): P/E ratio of 18, ROE of 20%.

- Competitor X (Illustrative Data): P/E ratio of 15, ROE of 18%.

Analyst Ratings and Predictions for Avago Stock

Source: thestreet.com

Financial analysts provide valuable insights into future stock performance. The following table summarizes consensus ratings and price targets (illustrative data).

| Analyst Firm | Rating | Price Target | Date |

|---|---|---|---|

| Firm A | Buy | $50 | Oct 26, 2023 |

| Firm B | Hold | $45 | Oct 26, 2023 |

| Firm C | Sell | $40 | Oct 26, 2023 |

Differing opinions often stem from varying assessments of future market conditions, technological advancements, and the company’s competitive landscape. For example, one analyst might be more optimistic about the growth potential of a particular product line, leading to a higher price target than another analyst who is more cautious.

Potential risks and opportunities for Avago’s stock in the coming year include:

- Risks: Increased competition, economic slowdown, supply chain disruptions.

- Opportunities: Expansion into new markets, successful product launches, strategic acquisitions.

Investment Strategies Related to Avago Stock

Various investment strategies can be applied to Avago stock, each with its own risk-reward profile.

A buy-and-hold strategy involves purchasing the stock and holding it for the long term, benefiting from potential long-term growth. Value investing focuses on identifying undervalued stocks based on fundamental analysis, while growth investing prioritizes companies with high growth potential. Each strategy has associated risks, such as market downturns or company-specific challenges.

A hypothetical diversified portfolio incorporating Avago (pre-acquisition) could include:

- 30% Avago Technologies

- 30% Texas Instruments

- 20% Broadcom

- 20% Index Fund (e.g., S&P 500)

FAQ Insights

What is Avago Technologies’ current market capitalization?

This information is readily available through major financial websites and requires real-time data retrieval; therefore, a specific answer cannot be provided here.

How does Avago’s stock price compare to the broader semiconductor index?

A comparison requires real-time data from a financial index provider to establish the relative performance against a relevant benchmark like the PHLX Semiconductor Sector Index (SOX).

What are the major risks associated with investing in Avago stock?

Major risks include market volatility, competition within the semiconductor industry, dependence on specific technological advancements, and economic downturns affecting demand.

What is the dividend payout history of Avago Technologies?

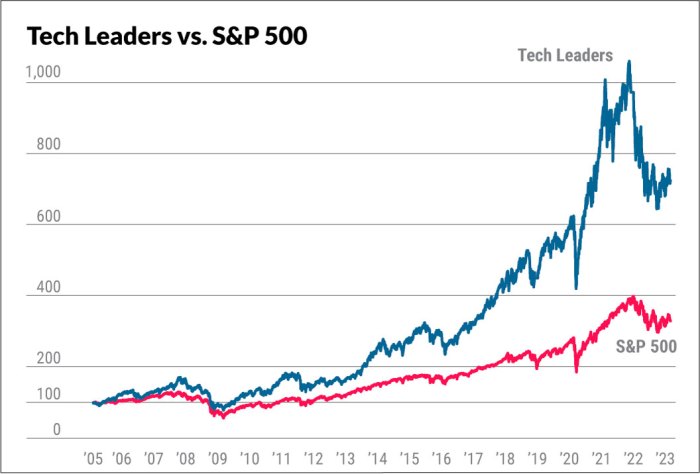

Tracking Avago’s stock price requires diligence, especially considering its fluctuations. For a broader understanding of market trends that might influence Avago, comparing its performance against other tech stocks is helpful; a good resource for checking the current spot stock price of various companies can provide context. Ultimately, understanding the broader market picture alongside Avago’s specific performance gives a more complete investment analysis.

Information regarding Avago’s dividend history can be found on financial websites providing historical stock data and corporate filings.