Arm Stock Price Live: A Comprehensive Analysis

Arm stock price live – This analysis provides a detailed overview of Arm Holdings plc’s current stock price, recent news impacting its performance, financial health, analyst predictions, potential risks, and a hypothetical scenario illustrating the impact of significant technological advancements.

Current Arm Stock Price & Market Context

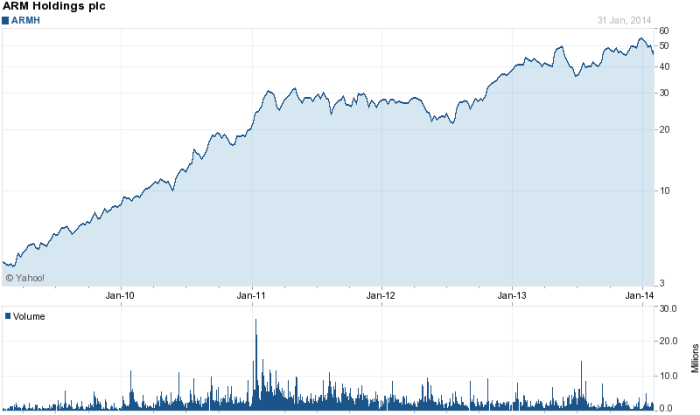

Source: seekingalpha.com

Arm Holdings plc’s stock price fluctuates constantly, reflecting the dynamic nature of the semiconductor industry and broader market conditions. To provide the most up-to-date information, please refer to a live financial data source for the current price, daily trading volume, and percentage change from the previous closing price. The overall market context, including indices like the Nasdaq Composite and the S&P 500, significantly influences Arm’s stock performance.

Positive market sentiment often translates into higher stock prices, while negative sentiment can lead to declines. Geopolitical events, economic indicators (inflation, interest rates), and investor confidence also play crucial roles.

| Metric | Value |

|---|---|

| Current Price | (Data from live financial source) |

| 52-Week High | (Data from live financial source) |

| 52-Week Low | (Data from live financial source) |

Recent News Affecting Arm Stock Price

Significant news events, such as financial reports, strategic partnerships, and regulatory updates, have a substantial impact on Arm’s stock price. Positive news, like exceeding revenue expectations or announcing a major partnership, typically leads to price increases. Conversely, negative news, such as disappointing financial results or regulatory setbacks, often results in price declines. The market’s reaction to these events is often swift and pronounced, reflecting investor sentiment and expectations.

- [Date]: [News Event]

-Stock price [Change in percentage and direction]. - [Date]: [News Event]

-Stock price [Change in percentage and direction]. - [Date]: [News Event]

-Stock price [Change in percentage and direction].

Arm’s Financial Performance and Stock Valuation

Arm’s financial performance, including revenue, earnings, and profit margins, is a key driver of its stock valuation. Analysts use various methods, such as price-to-earnings (P/E) ratio and price-to-sales (P/S) ratio, to assess the company’s valuation relative to its peers and historical performance. Comparing Arm’s key financial metrics and valuation ratios to its competitors provides insights into its relative strength and potential for future growth.

| Metric | Arm | Competitor A | Competitor B |

|---|---|---|---|

| Revenue (Last Quarter) | (Data from financial reports) | (Data from financial reports) | (Data from financial reports) |

| Net Income (Last Quarter) | (Data from financial reports) | (Data from financial reports) | (Data from financial reports) |

| P/E Ratio | (Data from financial reports) | (Data from financial reports) | (Data from financial reports) |

Analyst Ratings and Future Predictions for Arm Stock

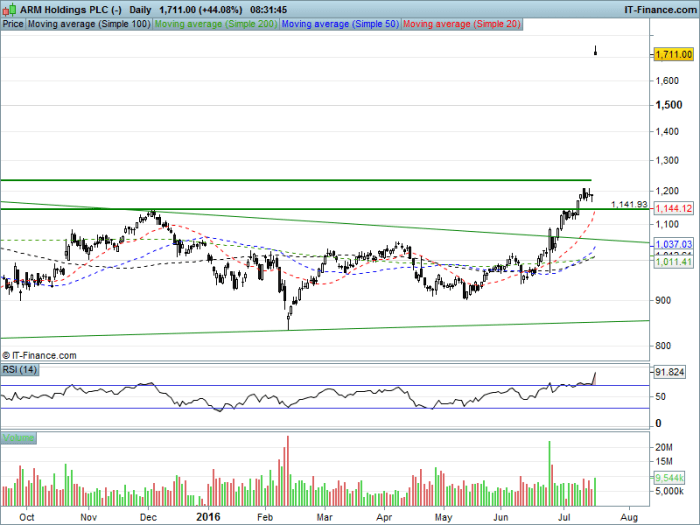

Source: investingcube.com

Keeping an eye on the ARM stock price live is crucial for many investors. It’s interesting to compare its performance against other established names, such as the fluctuations seen in the kodak stock price , which offers a contrasting case study in market dynamics. Understanding these different trajectories helps contextualize the current ARM stock price live and its potential future movements.

Financial analysts provide ratings and price targets for Arm’s stock based on their assessment of the company’s financial performance, growth prospects, and market conditions. The consensus rating represents the average opinion of multiple analysts, while individual price targets may vary significantly. The accuracy of past analyst predictions can provide some insight into the reliability of future forecasts, although it’s important to remember that predicting stock prices is inherently uncertain.

- Analyst A: Buy rating, Price target: [Value]

- Analyst B: Hold rating, Price target: [Value]

- Analyst C: Sell rating, Price target: [Value]

Risk Factors and Potential Challenges Facing Arm

Several factors could negatively impact Arm’s stock price. Intense competition in the semiconductor industry, economic downturns affecting demand for its products, and disruptive technological advancements are key risks. The severity and likelihood of these risks vary, and investors should carefully consider their potential impact on Arm’s future financial performance before making investment decisions.

| Risk Factor | Potential Impact | Likelihood |

|---|---|---|

| Increased Competition | Reduced market share, lower profit margins | Medium to High |

| Economic Slowdown | Decreased demand for semiconductors | Medium |

| Technological Disruption | Obsolescence of current technology | Low to Medium |

Illustrative Scenario: Impact of a Major Technological Advancement, Arm stock price live

Source: amazonaws.com

Let’s consider a hypothetical scenario where a significant breakthrough in chip architecture renders Arm’s current technology partially obsolete. This could lead to a sharp decline in demand for Arm’s products, negatively impacting its revenue and profitability. The market would likely react negatively, resulting in a substantial drop in Arm’s stock price. This scenario is comparable to historical instances where technological advancements have disrupted established players in the semiconductor industry, leading to significant stock price corrections.

The unfolding events would likely involve a period of uncertainty and investor apprehension, potentially leading to a prolonged decline in the stock price until Arm adapts to the new technological landscape.

Essential Questionnaire: Arm Stock Price Live

What factors influence Arm’s stock price volatility?

Several factors contribute to Arm’s stock price volatility, including overall market trends, news related to its partnerships and product launches, competitor actions, and broader economic conditions.

How does Arm compare to its competitors in terms of valuation?

A comparative analysis of Arm’s valuation metrics (e.g., P/E ratio, P/S ratio) against its competitors is necessary to determine its relative attractiveness in the market. This would require a detailed review of financial data for similar companies.

Where can I find real-time Arm stock price data?

Real-time Arm stock price data is available through major financial websites and trading platforms such as Google Finance, Yahoo Finance, Bloomberg, and others.

What are the long-term growth prospects for Arm?

Arm’s long-term growth prospects depend on several factors, including its ability to innovate, maintain market share in a competitive landscape, and successfully navigate technological shifts in the semiconductor industry. Analyst reports offer varying perspectives on this.