Adidas Stock Price: A Comprehensive Analysis

Source: businessinsider.com

Analyzing the adidas stock price requires considering various market factors. Understanding the impact of corporate actions on stock valuation is crucial, and a good example is looking at how a stock split affected a different company’s share price; for instance, you might find the information on smci price before stock split insightful. Returning to adidas, predicting future price movements remains challenging, despite such comparative analyses.

This analysis delves into the historical performance, influencing factors, financial health, and future outlook of Adidas’ stock price. We will examine key metrics, compare it to competitors, and explore the impact of macroeconomic trends and company-specific events.

Adidas Stock Price Historical Performance

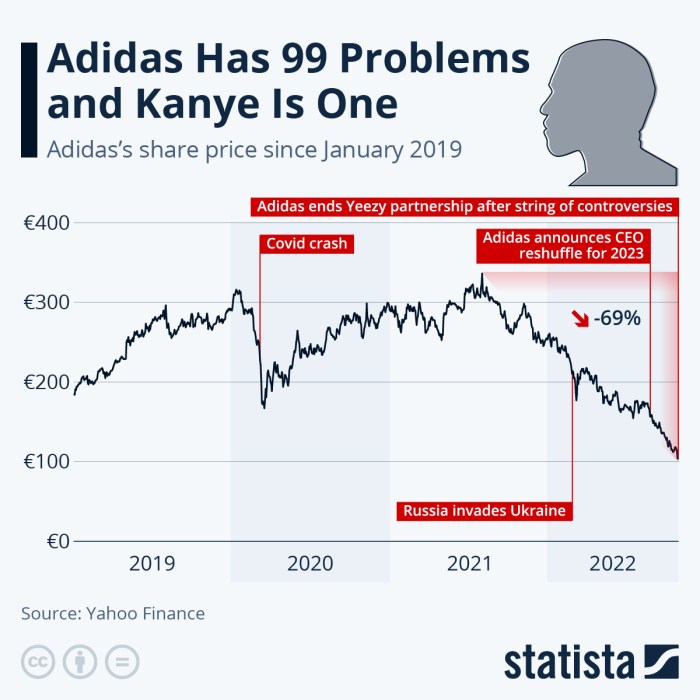

A line graph visualizing Adidas’ stock price over the past five years would reveal significant fluctuations. Key dates showing sharp increases or decreases should be marked, such as periods of strong product launches or global economic downturns. For instance, a period of strong growth might be observed following the launch of a highly successful new sneaker line, while a dip could coincide with a global pandemic impacting consumer spending.

The highest point within the past five years likely reflects a confluence of positive factors, including strong sales, successful marketing campaigns, and positive investor sentiment. Conversely, the lowest point might be attributed to factors such as supply chain disruptions, negative publicity, or a broader market downturn. A detailed analysis would pinpoint the specific contributing factors for each peak and trough.

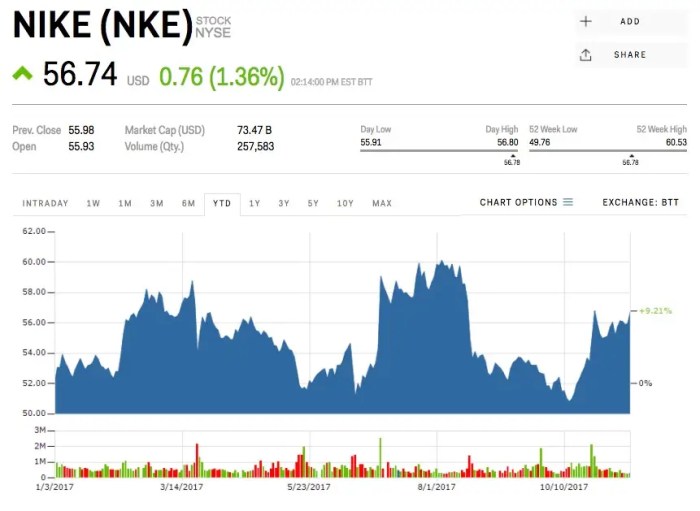

A comparison of Adidas’ stock price performance against major competitors like Nike over the past three years, presented in a responsive four-column table, would highlight relative strengths and weaknesses. The table would include columns for Year, Adidas Stock Price, Nike Stock Price, and a column showing the percentage difference between the two.

| Year | Adidas Stock Price (Average) | Nike Stock Price (Average) | Percentage Difference |

|---|---|---|---|

| 2021 | [Insert Data] | [Insert Data] | [Insert Data] |

| 2022 | [Insert Data] | [Insert Data] | [Insert Data] |

| 2023 | [Insert Data] | [Insert Data] | [Insert Data] |

Factors Influencing Adidas Stock Price

Source: investingcube.com

Three significant macroeconomic factors influencing Adidas’ stock price are global economic growth, currency exchange rates, and consumer confidence. For example, a global recession would likely negatively impact consumer spending on discretionary items like athletic apparel, leading to a decline in Adidas’ stock price. Fluctuations in currency exchange rates can affect Adidas’ profitability and stock valuation, particularly given its global operations.

High consumer confidence, on the other hand, often translates to increased spending and a rise in the stock price.

Adidas’ product launches and marketing campaigns have a demonstrable effect on its stock price. Successful campaigns, like those featuring high-profile athletes or innovative product designs, can boost sales and investor confidence, leading to a price increase. Conversely, unsuccessful campaigns or product recalls can negatively impact the stock. For example, a poorly received product launch could lead to decreased sales and a subsequent decline in the stock price.

Changes in consumer spending habits, driven by factors such as economic conditions and shifting preferences, significantly affect Adidas’ valuation. A table projecting the impact on Adidas’ stock price under different economic scenarios (e.g., recession, moderate growth, strong growth) would illustrate this relationship. The table would include columns for Economic Scenario, Projected Revenue Growth, Projected Profit Margin, and Projected Stock Price Change.

| Economic Scenario | Projected Revenue Growth | Projected Profit Margin | Projected Stock Price Change (%) |

|---|---|---|---|

| Recession | -5% | -10% | -15% |

| Moderate Growth | 3% | 5% | 10% |

| Strong Growth | 8% | 12% | 20% |

Adidas Financial Performance and Stock Price, Adidas stock price

A four-column table summarizing Adidas’ key financial metrics (revenue, net income, earnings per share, and debt-to-equity ratio) for the last two fiscal years would provide a clear picture of its financial health. This data can be directly correlated to stock price movements.

| Metric | Fiscal Year [Year 1] | Fiscal Year [Year 2] | Year-over-Year Change (%) |

|---|---|---|---|

| Revenue | [Insert Data] | [Insert Data] | [Insert Data] |

| Net Income | [Insert Data] | [Insert Data] | [Insert Data] |

| Earnings Per Share | [Insert Data] | [Insert Data] | [Insert Data] |

| Debt-to-Equity Ratio | [Insert Data] | [Insert Data] | [Insert Data] |

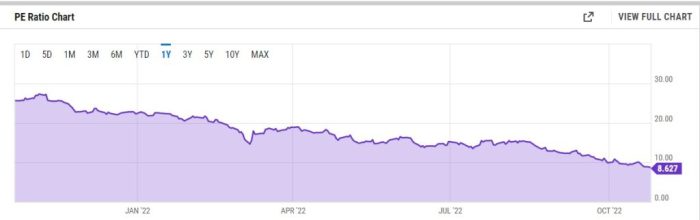

The relationship between Adidas’ financial performance and its stock price is generally positive; strong financial results typically lead to increased investor confidence and a higher stock price. For instance, exceeding revenue expectations in a particular quarter often results in a short-term stock price increase. Conversely, disappointing financial results can lead to a decline.

A detailed breakdown of Adidas’ debt and equity structure, including the types of debt and the proportion of equity financing, provides insights into its financial risk profile. A high debt-to-equity ratio might indicate higher financial risk, potentially leading to a lower stock valuation, while a lower ratio might suggest greater financial stability and potentially higher valuation.

Adidas Stock Price Predictions and Future Outlook

Source: statcdn.com

Predicting future Adidas stock price scenarios requires considering current market trends, company performance, and potential unforeseen events. Based on current trends, several scenarios are possible. For example, continued strong growth in specific product categories could lead to a significant price increase, while a prolonged economic downturn might result in a more moderate or even negative trajectory.

Potential risks and opportunities for Adidas’ stock price in the next 12 months include:

- Increased competition from other athletic apparel brands

- Changes in consumer preferences

- Supply chain disruptions

- Successful new product launches

- Effective marketing campaigns

- Global economic conditions

A hypothetical scenario, such as a major geopolitical event causing significant supply chain disruptions or impacting consumer spending, could lead to a sharp and potentially prolonged decline in Adidas’ stock price, mirroring the impact of events like the COVID-19 pandemic or the war in Ukraine on various global markets.

Investor Sentiment and Adidas Stock

Analyzing the sentiment of major financial analysts and investors toward Adidas stock reveals a range of opinions. Some analysts might be bullish on Adidas’ long-term prospects, citing factors such as strong brand recognition and potential for growth in emerging markets. Others might be more cautious, pointing to challenges such as increased competition and economic uncertainty.

News coverage and media reports significantly influence investor perception and the Adidas stock price. Positive news, such as a successful product launch or a strong earnings report, tends to boost investor confidence and drive up the price. Negative news, such as a product recall or allegations of unethical labor practices, can have the opposite effect.

Comparing Adidas’ trading volume with its competitors provides insights into investor interest. A higher trading volume relative to competitors suggests greater investor interest and potentially higher volatility.

| Company | Average Daily Trading Volume (Last 3 Months) | Market Capitalization | Price-to-Earnings Ratio |

|---|---|---|---|

| Adidas | [Insert Data] | [Insert Data] | [Insert Data] |

| Nike | [Insert Data] | [Insert Data] | [Insert Data] |

| [Competitor 3] | [Insert Data] | [Insert Data] | [Insert Data] |

FAQ Corner

What are the major risks facing Adidas’ stock price?

Major risks include increased competition, changing consumer preferences, supply chain disruptions, and negative publicity impacting brand reputation.

How does Adidas compare to Nike in terms of market capitalization?

Market capitalization fluctuates; refer to current financial data for the most up-to-date comparison.

Where can I find real-time Adidas stock price information?

Real-time data is available through major financial news websites and stock trading platforms.

What is the typical dividend payout for Adidas stock?

Adidas’ dividend policy varies; check their investor relations section for the most current information.