Baba Stock Price Today: A Comprehensive Overview

Source: investorplace.com

Baba stock price today – This analysis provides a detailed look at Alibaba Group Holding Limited (BABA) stock performance, considering current market conditions, historical trends, influencing factors, investor sentiment, and associated risks. We will examine various aspects to offer a comprehensive understanding of BABA’s stock price today and its potential future trajectory.

Current Baba Stock Price & Market Context

As of [Insert Current Date and Time], the Baba stock price is [Insert Current Price]. Trading volume stands at [Insert Current Trading Volume]. The day’s high was [Insert Day’s High], and the low was [Insert Day’s Low]. Compared to yesterday’s closing price, Baba’s stock price has changed by [Insert Percentage Change]%. The overall market is currently experiencing [Describe the current market trend – e.g., a period of moderate volatility influenced by global economic uncertainty and rising interest rates].

This broader market trend has [Explain the impact of the broader market trend on Baba’s stock performance – e.g., contributed to the recent decline in Baba’s stock price].

Baba Stock Price Historical Performance

Understanding Baba’s past performance is crucial for assessing its future potential. The table below shows the stock’s price fluctuations over the past week, month, and year. Significant events that impacted the price are noted below the table.

| Date | Open | Close | Change |

|---|---|---|---|

| [Date 1 – Week] | [Open Price] | [Close Price] | [Percentage Change] |

| [Date 2 – Week] | [Open Price] | [Close Price] | [Percentage Change] |

| [Date 3 – Week] | [Open Price] | [Close Price] | [Percentage Change] |

| [Date 4 – Week] | [Open Price] | [Close Price] | [Percentage Change] |

| [Date 5 – Week] | [Open Price] | [Close Price] | [Percentage Change] |

Compared to competitors like [Competitor 1] and [Competitor 2], Baba’s performance over the past year has been [Describe relative performance – e.g., relatively weaker due to regulatory headwinds]. Significant events impacting Baba’s stock price in the past year include [Event 1, e.g., increased regulatory scrutiny in China], [Event 2, e.g., release of Q3 earnings report showing lower-than-expected revenue], and [Event 3, e.g., geopolitical tensions impacting global market sentiment].

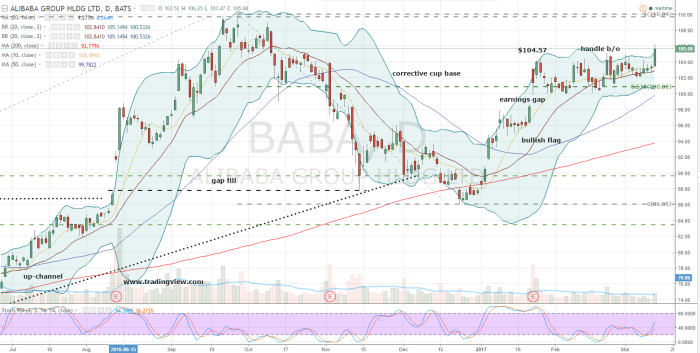

Factors Influencing Baba Stock Price

Source: warriortrading.com

Several factors influence Baba’s stock price. These range from macroeconomic conditions to company-specific performance and regulatory changes.

- Macroeconomic Factors: Rising inflation and increasing interest rates have [Explain the impact – e.g., created a more challenging environment for growth stocks like Baba].

- Regulatory Changes in China: Increased regulatory scrutiny in China has [Explain the impact – e.g., led to increased uncertainty and impacted investor confidence].

- Baba’s Financial Performance: Baba’s revenue and earnings reports directly influence investor sentiment. Strong financial results generally lead to [Explain the impact – e.g., increased stock prices], while weaker-than-expected results can lead to [Explain the impact – e.g., price declines].

- Consumer Spending and Market Competition: Changes in consumer spending patterns and increased competition from other e-commerce platforms impact Baba’s market share and profitability, influencing its stock price.

Investor Sentiment and Analyst Predictions, Baba stock price today

Analyst ratings and predictions offer insight into investor sentiment. Currently, the overall sentiment towards Baba stock is [Bullish, Bearish, or Neutral].

- Analyst Ratings: [Summarize recent analyst ratings – e.g., A majority of analysts rate BABA as a “hold” with a few “buy” and “sell” ratings].

- Price Targets: The average price target for Baba stock is [Insert Average Price Target] with a range from [Lowest Price Target] to [Highest Price Target].

- Recent News Articles: Recent news articles suggest [Summarize the overall sentiment from recent news articles – e.g., a cautious optimism regarding Baba’s long-term prospects despite short-term challenges].

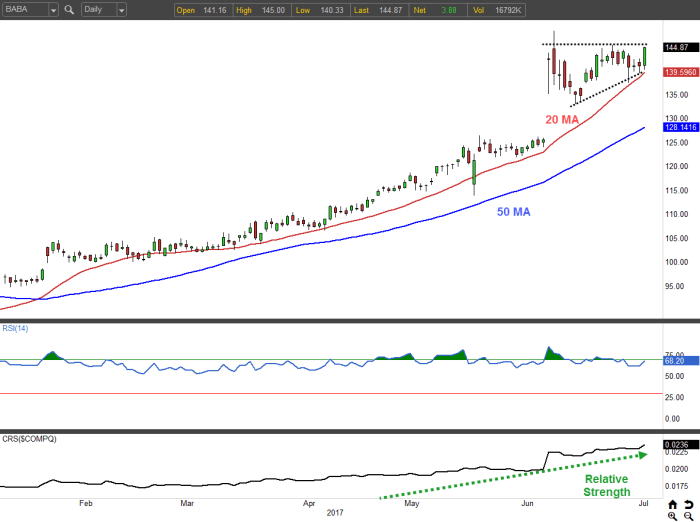

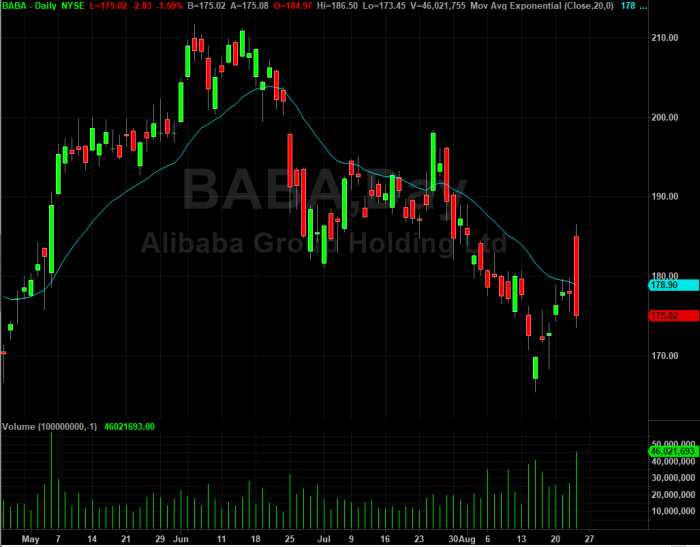

Visual Representation of Stock Price Movement

Source: investorplace.com

A visual representation of Baba’s stock price over the past year would show [Describe the overall trend – e.g., a significant decline followed by a period of consolidation]. Significant highs and lows would be clearly visible. The chart would likely show periods of sharp price fluctuations interspersed with periods of relative stability. Daily price fluctuations typically range from [Typical Low Percentage Change]% to [Typical High Percentage Change]% of the previous day’s closing price.

Risk Assessment of Investing in Baba Stock

Investing in Baba stock carries inherent risks.

- Regulatory Uncertainty: Ongoing regulatory changes in China pose a significant risk, potentially impacting Baba’s operations and profitability.

- Market Volatility: The stock market is inherently volatile, and Baba’s stock price can fluctuate significantly based on various factors.

- Geopolitical Events: Geopolitical events, both domestic and international, can significantly impact investor sentiment and Baba’s stock price.

- Competitive Landscape: Intense competition within the e-commerce sector presents a risk to Baba’s market share and profitability.

Compared to other similar investments in the technology sector, Baba’s risk profile is considered [High, Medium, or Low] due to the factors mentioned above. This assessment should be made in conjunction with a thorough review of your personal risk tolerance and investment goals.

Questions and Answers: Baba Stock Price Today

What are the main risks associated with investing in BABA stock?

Key risks include regulatory uncertainty in China, macroeconomic instability, intense competition within the e-commerce sector, and geopolitical events affecting the Chinese economy.

Tracking the Baba stock price today requires a keen eye on market fluctuations. It’s interesting to compare its performance against other tech giants; for instance, understanding the current cron stock price can offer a comparative perspective on the broader tech sector’s health. Ultimately, though, the Baba stock price today remains the primary focus for many investors.

How does the Chinese government’s regulatory environment impact BABA’s stock price?

Changes in Chinese regulations concerning technology companies and antitrust laws directly influence BABA’s operations and valuation, often resulting in significant price fluctuations.

Where can I find real-time updates on BABA’s stock price?

Major financial news websites and brokerage platforms provide real-time quotes and charting tools for BABA stock.

What is the typical daily trading volume for BABA stock?

BABA’s daily trading volume varies considerably depending on market conditions and news events, but you can find historical data on financial websites.