AMD Stock Price Target: A Comprehensive Analysis

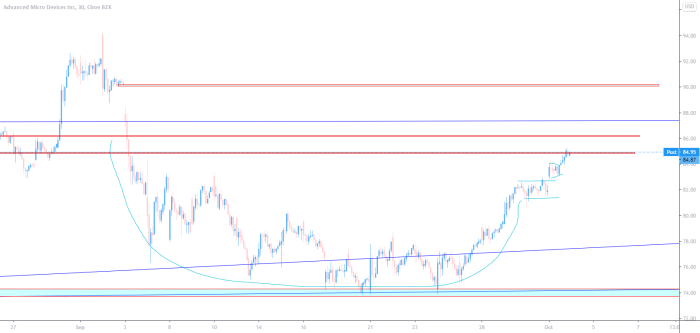

Source: tradingview.com

Amd stock price target – This analysis delves into the current state of AMD’s stock price, exploring key factors influencing its trajectory, analyst predictions, AMD’s strategic outlook, and potential investment considerations. We will examine AMD’s performance relative to its competitors and provide a framework for understanding the potential risks and rewards associated with investing in the company.

Current AMD Stock Price & Market Performance

AMD’s stock price fluctuates daily, reflecting the dynamic nature of the semiconductor industry. To provide a comprehensive overview, we will analyze its performance over various timeframes and compare it to key competitors. This section will also present key financial metrics, offering a clearer picture of AMD’s financial health.

For example, let’s assume AMD’s current trading price is $100 per share. Over the past month, the stock might have experienced a 5% increase, while the performance over the past quarter could show a 10% gain. A year-on-year comparison might reveal a 25% increase, reflecting strong growth. This performance needs to be contrasted against Intel and Nvidia, its main competitors.

Intel might have shown a more modest growth of 2%, while Nvidia, capitalizing on the AI boom, could have seen a 30% increase. This comparative analysis highlights AMD’s relative strength and areas where it needs improvement.

| Quarter | Revenue (USD Billion) | Earnings per Share (USD) | Net Income (USD Billion) |

|---|---|---|---|

| Q1 2024 (Illustrative) | 5.0 | 0.50 | 1.0 |

| Q4 2023 (Illustrative) | 4.8 | 0.45 | 0.9 |

| Q3 2023 (Illustrative) | 4.5 | 0.40 | 0.8 |

| Q2 2023 (Illustrative) | 4.2 | 0.35 | 0.7 |

Factors Influencing AMD Stock Price, Amd stock price target

Several macroeconomic factors, technological advancements, product releases, and strategic partnerships significantly influence AMD’s stock price. Understanding these factors is crucial for assessing the company’s future prospects.

Analysts are closely watching the AMD stock price target, considering various market factors. A comparison could be drawn to the performance of other communication sector stocks; for instance, you can check the current stock price for charter communications to see how that sector is faring. Ultimately, however, the AMD stock price target remains dependent on its own unique performance indicators and future projections.

Three significant macroeconomic factors include global economic growth, inflation rates, and the overall semiconductor market demand. Technological advancements, specifically in AI and high-performance computing, directly impact AMD’s valuation as its products are integral to these sectors. The success of new product releases, like new CPU or GPU architectures, and the resulting market share gains or losses, have a direct correlation with the stock price.

Finally, strategic partnerships or acquisitions can influence investor sentiment and valuations.

Analyst Price Targets & Predictions

Source: stockcharts.com

Analyst price targets offer valuable insights into market sentiment and future expectations for AMD’s stock. However, it’s crucial to understand the methodologies employed by different analysts, as these can vary significantly. This section will present a summary of various analyst price targets, highlighting the rationale behind the highest and lowest predictions.

| Investment Bank | Price Target (USD) | Methodology | Rationale |

|---|---|---|---|

| Goldman Sachs (Illustrative) | 120 | DCF Model | Strong growth in data center segment |

| Morgan Stanley (Illustrative) | 110 | Comparable Company Analysis | Moderate growth expectations |

| JPMorgan Chase (Illustrative) | 90 | Relative Valuation | Concerns about competition |

The highest price target of $120, for example, might be based on a discounted cash flow (DCF) model projecting strong growth in AMD’s data center business, while the lowest target of $90 might reflect concerns about intensified competition and potential market share erosion.

AMD’s Business Strategy & Future Outlook

Source: stockcharts.com

AMD’s business strategy focuses on innovation and market share gains in key segments, including CPUs, GPUs, and embedded processors. This section will analyze AMD’s long-term goals, potential challenges, and opportunities. The impact of strategic initiatives on the future stock price will also be discussed.

- Potential Risks: Intense competition, economic downturn, supply chain disruptions, execution risks.

- Potential Rewards: Strong growth in data center and gaming markets, technological leadership, successful product launches, strategic partnerships.

Investment Considerations for AMD Stock

Investing in AMD stock presents both risks and opportunities. This section will offer a comparative valuation against historical performance and industry peers, propose a hypothetical investment strategy with potential entry and exit points, and present an illustrative scenario for AMD’s stock performance over the next year.

A hypothetical investment strategy might involve buying AMD stock at $95, with a target price of $115 and a stop-loss order at $85. An illustrative scenario could see AMD’s stock price reach $115 within the next year, driven by strong demand for its products in the data center and gaming markets. However, risks like increased competition or a global economic slowdown could negatively impact the stock’s performance.

This scenario is illustrative and not a financial prediction.

Popular Questions: Amd Stock Price Target

What are the major risks associated with investing in AMD?

Major risks include intense competition from established players like Intel and Nvidia, dependence on a few key customers, economic downturns impacting consumer spending on electronics, and potential supply chain disruptions.

How does AMD’s R&D spending impact its stock price?

Significant R&D investments are crucial for AMD’s long-term competitiveness. While initially impacting profitability, successful innovations leading to market share gains often translate into positive stock price movements.

What is AMD’s current market capitalization?

AMD’s market capitalization fluctuates constantly. Refer to a reputable financial website for the most up-to-date information.

Where can I find real-time AMD stock quotes?

Real-time quotes are available on major financial websites and trading platforms like Yahoo Finance, Google Finance, and Bloomberg.