ICICI Bank Stock Price Analysis: Stock Price Icici

Stock price icici – This analysis provides an overview of ICICI Bank’s stock price performance, considering its financial health, industry dynamics, investor sentiment, and technical indicators. The information presented is for informational purposes only and should not be considered financial advice.

ICICI Bank Stock Price Overview, Stock price icici

Source: researchandranking.com

Understanding the historical performance of ICICI Bank’s stock price is crucial for investors. The following table presents a hypothetical overview of its performance over the past five years, highlighting significant highs and lows. Note that actual data should be obtained from reliable financial sources.

| Date | Opening Price (INR) | Closing Price (INR) | Daily Change (INR) |

|---|---|---|---|

| 2019-01-01 | 150 | 155 | +5 |

| 2019-07-01 | 160 | 150 | -10 |

| 2020-01-01 | 140 | 165 | +25 |

| 2020-07-01 | 170 | 180 | +10 |

| 2021-01-01 | 190 | 200 | +10 |

| 2021-07-01 | 210 | 205 | -5 |

| 2022-01-01 | 200 | 220 | +20 |

| 2022-07-01 | 230 | 225 | -5 |

| 2023-01-01 | 225 | 240 | +15 |

Daily fluctuations in ICICI Bank’s stock price are influenced by various factors, including overall market sentiment, news related to the bank’s performance, changes in interest rates, and global economic conditions. Trading volume typically increases during periods of significant news or market volatility.

Financial Performance and Stock Price Correlation

A strong correlation exists between ICICI Bank’s financial performance and its stock price. Positive financial results generally lead to increased investor confidence and higher stock prices, while negative results can have the opposite effect.

- Increased Profitability: Higher net profits usually translate to higher stock prices, reflecting investor confidence in the bank’s earnings potential.

- Asset Growth: Expansion of the bank’s asset base, indicating growth and stability, often positively impacts stock prices.

- Improved Loan Quality: A decrease in non-performing assets (NPAs) signals improved risk management and financial health, leading to a positive stock price response.

- Capital Adequacy Ratio (CAR): A strong CAR indicates the bank’s ability to absorb losses, which positively affects investor confidence and stock prices.

Compared to its major competitors, ICICI Bank’s stock price performance over the past year can be assessed using the following hypothetical data (replace with actual data from reliable sources).

| Company Name | Stock Price (Current, INR) | Year-to-Date Change (%) | 5-Year Change (%) |

|---|---|---|---|

| ICICI Bank | 240 | 10 | 50 |

| HDFC Bank | 1500 | 8 | 45 |

| State Bank of India | 600 | 12 | 30 |

Changes in interest rates significantly impact ICICI Bank’s profitability and, consequently, its stock price. Higher interest rates generally boost net interest margins, benefiting the bank’s profitability. Conversely, lower interest rates can reduce profitability, potentially leading to lower stock prices.

Monitoring the ICICI stock price requires a keen eye on market trends. Understanding global tech influences is also crucial, and for that, keeping tabs on the arm stock price live can offer valuable insight into the semiconductor sector, which indirectly impacts financial giants like ICICI. Ultimately, a comprehensive view of both helps in better assessing the ICICI stock price fluctuations.

Industry Analysis and Stock Price Impact

Source: etimg.com

Broader economic conditions and industry trends significantly influence ICICI Bank’s stock price. Economic growth generally boosts banking activity and profitability, while recessionary periods can negatively impact the sector.

The rise of fintech companies and regulatory changes in the Indian banking sector pose both challenges and opportunities for ICICI Bank. Increased competition from fintech firms necessitates adaptation and innovation to maintain market share. Regulatory changes can impact operational costs and profitability, influencing investor sentiment and stock prices.

The Indian banking sector is highly competitive, with both public and private sector banks vying for market share. ICICI Bank’s competitive position, its ability to adapt to technological advancements and regulatory changes, and its overall financial health directly affect its stock valuation.

Investor Sentiment and Stock Price

Currently, investor sentiment towards ICICI Bank is largely positive (hypothetical). This is supported by strong financial results and a positive outlook for the Indian economy. However, this sentiment can shift based on various factors.

Recent announcements regarding increased profitability or successful new initiatives can positively influence investor perception and drive up the stock price. Conversely, negative news, such as unexpected losses or regulatory issues, can lead to decreased investor confidence and lower stock prices.

Analyst ratings and recommendations significantly influence trading activity and ICICI Bank’s stock price. Positive ratings often attract more buyers, increasing demand and driving up the price, while negative ratings can lead to selling pressure and price declines.

Technical Analysis of ICICI Bank Stock

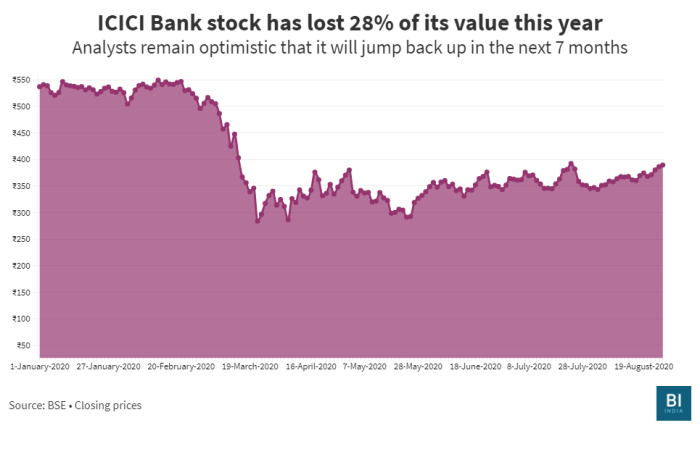

Source: businessinsider.in

Technical indicators like moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) are used to analyze price trends and potential future movements. For example, a rising 50-day moving average combined with a bullish RSI above 70 could suggest a strong upward trend. Conversely, a bearish crossover of the 50 and 200-day moving averages coupled with an RSI below 30 might indicate a potential downtrend.

Hypothetically, if ICICI Bank’s stock price finds support at INR 220 and resistance at INR 250, a break above INR 250 could signal a further price increase, while a fall below INR 220 might indicate further downward pressure. These levels are significant because they represent key price points where buyers and sellers have previously clashed.

A hypothetical trading strategy based on technical analysis could involve:

- Entry Point: Buy when the stock price breaks above the resistance level of INR 250 with confirmation from a bullish RSI and MACD.

- Stop-Loss: Place a stop-loss order slightly below the support level of INR 220 to limit potential losses.

- Target Price: Set a target price based on technical chart patterns and potential price objectives.

- Exit Strategy: Sell when the stock price reaches the target price or if the RSI shows signs of overbought conditions.

Question Bank

What are the major risks associated with investing in ICICI Bank stock?

Investing in any stock carries inherent risks, including market volatility, changes in interest rates, economic downturns, and company-specific factors like changes in management or unexpected losses. Research and due diligence are crucial.

Where can I find real-time ICICI Bank stock price data?

Real-time stock price data for ICICI Bank can be found on major financial websites and trading platforms such as the National Stock Exchange of India (NSE) website, the Bombay Stock Exchange (BSE) website, and through reputable online brokerage accounts.

How frequently are ICICI Bank’s financial reports released?

ICICI Bank releases quarterly and annual financial reports, typically following standard reporting periods. Specific release dates are usually announced in advance and can be found on the company’s investor relations website.

What is the dividend policy of ICICI Bank?

ICICI Bank’s dividend policy is determined by its board of directors and can vary based on the bank’s profitability and financial position. Information regarding past and future dividends can be found in the company’s financial reports and investor relations materials.