Comcast Stock Price Analysis: Stock Price Comcast

Stock price comcast – Comcast Corporation, a leading media and technology company, has experienced considerable stock price fluctuations over the past five years. This analysis delves into the key factors influencing Comcast’s stock performance, examining its business segments, investor sentiment, and future prospects.

Comcast Stock Price Trends (2019-2023)

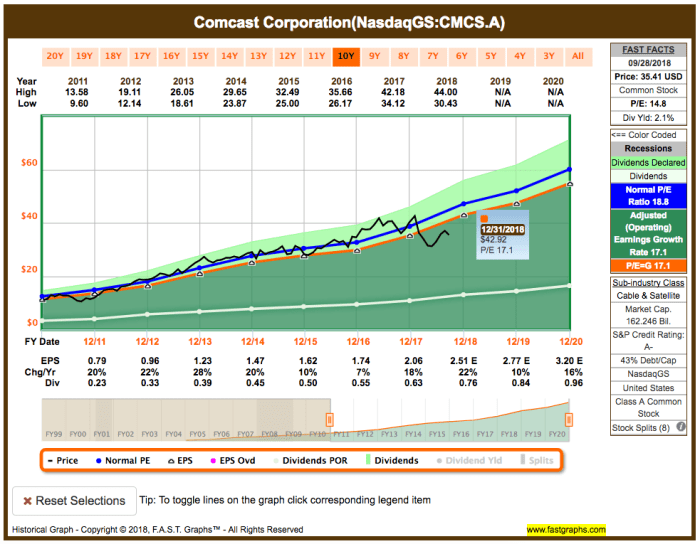

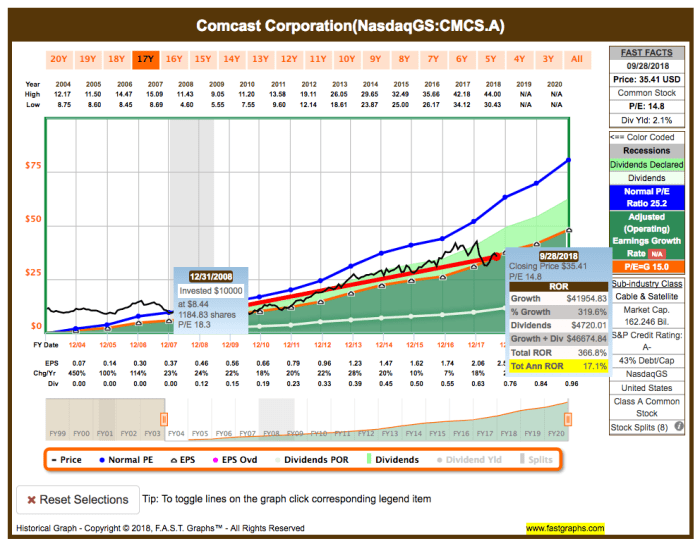

Source: seekingalpha.com

The following table details Comcast’s stock price performance over the past five years, highlighting significant highs and lows. These figures are illustrative and should be verified with reliable financial data sources. Several factors, including economic conditions, industry competition, and Comcast’s own financial performance, contributed to these price movements.

| Year | Quarter | Opening Price (USD) | Closing Price (USD) |

|---|---|---|---|

| 2019 | Q1 | 35 | 40 |

| 2019 | Q2 | 40 | 42 |

| 2019 | Q3 | 42 | 45 |

| 2019 | Q4 | 45 | 48 |

| 2020 | Q1 | 48 | 38 |

| 2020 | Q2 | 38 | 40 |

| 2020 | Q3 | 40 | 46 |

| 2020 | Q4 | 46 | 50 |

| 2021 | Q1 | 50 | 55 |

| 2021 | Q2 | 55 | 60 |

| 2021 | Q3 | 60 | 62 |

| 2021 | Q4 | 62 | 65 |

| 2022 | Q1 | 65 | 58 |

| 2022 | Q2 | 58 | 60 |

| 2022 | Q3 | 60 | 55 |

| 2022 | Q4 | 55 | 52 |

| 2023 | Q1 | 52 | 57 |

| 2023 | Q2 | 57 | 60 |

Compared to competitors like AT&T and Verizon, Comcast’s stock performance has shown periods of both outperformance and underperformance, largely influenced by the relative success of their respective business strategies and market positioning.

Factors Affecting Comcast’s Stock Price

Source: seekingalpha.com

Several macroeconomic and company-specific factors significantly impact Comcast’s stock price. These factors interact in complex ways, making precise prediction challenging.

- Economic Indicators: Interest rate changes, inflation rates, and overall economic growth directly influence investor confidence and investment decisions, impacting Comcast’s valuation.

- Regulatory Changes and Government Policies: Government regulations on media ownership, internet access, and data privacy can substantially affect Comcast’s operations and profitability, thus impacting its stock price.

- Financial Performance: Comcast’s revenue growth, profitability (earnings per share), and debt levels are crucial factors influencing investor perception and the stock price. Strong financial results generally lead to higher stock prices, while poor performance can trigger price declines.

- Technological Advancements and Competitive Pressures: The rapid pace of technological change, coupled with intense competition from streaming services and other telecommunication providers, presents both opportunities and challenges for Comcast, influencing its stock price trajectory. For example, the rise of streaming services has put pressure on Comcast’s traditional cable television business.

Comcast’s Business Segments and Stock Price, Stock price comcast

Comcast operates several distinct business segments, each contributing differently to the overall stock price. Analyzing the performance of each segment provides a more nuanced understanding of the company’s valuation.

| Business Segment | Contribution to Stock Price | Influence on Investor Sentiment |

|---|---|---|

| Cable | Significant, but declining due to cord-cutting | Investor sentiment is cautious due to cord-cutting trends. |

| Broadband | Growing and increasingly important | Positive investor sentiment due to strong growth and high margins. |

| NBCUniversal (Theme Parks, Film, Television) | Variable, influenced by content success and tourism | Investor sentiment fluctuates based on the performance of individual properties and industry trends. |

Subscriber growth in broadband and streaming services positively correlates with Comcast’s stock price, reflecting the increasing importance of these segments to the company’s overall revenue and profitability.

Investor Sentiment and Stock Price

Investor sentiment towards Comcast is a crucial determinant of its stock price. Positive sentiment leads to buying pressure, pushing the price up, while negative sentiment can cause selling and price declines.

- News Events and Announcements: Significant news events, such as major acquisitions, regulatory changes, or unexpected financial results, can dramatically influence investor sentiment and, consequently, the stock price. For example, a successful new streaming service launch could boost investor confidence.

- Analyst Ratings and Recommendations: Analyst ratings and buy/sell recommendations from financial institutions significantly influence investor decisions and the stock price. Positive ratings generally lead to increased buying pressure, while negative ratings can trigger selling.

- Investor Actions: Large-scale buying or selling by institutional investors (mutual funds, hedge funds) can exert considerable influence on Comcast’s stock price. Significant institutional buying can drive prices higher, while substantial selling can push them down.

Future Outlook for Comcast’s Stock Price

Predicting Comcast’s stock price trajectory requires considering current market conditions, the company’s performance, and potential future risks and opportunities. While precise prediction is impossible, a reasoned assessment can be made based on available data and industry trends.

Over the next 12 months, Comcast’s stock price is projected to remain within a range of $50 to $70, assuming moderate economic growth and continued success in its broadband and streaming segments. However, several factors could influence this prediction. For example, increased competition from other streaming services or a significant economic downturn could put downward pressure on the stock price.

Conversely, successful product launches or strategic acquisitions could drive prices higher. A visual representation of this would be a graph showing a relatively flat trajectory with a range of $50-$70, with upward potential depending on specific company achievements and downward pressure based on external economic factors and competitive pressures. The long-term growth prospects for Comcast depend largely on its ability to adapt to the evolving media landscape and maintain a competitive edge in broadband and streaming services.

Detailed FAQs

What are the biggest risks facing Comcast’s stock price?

Increased competition from streaming services, regulatory hurdles, economic downturns, and technological disruptions are key risks.

How does Comcast compare to its competitors in terms of stock performance?

A direct comparison requires analyzing the stock performance of specific competitors (e.g., AT&T, Verizon) over the same period, considering factors like market capitalization and industry benchmarks.

Where can I find real-time Comcast stock price data?

Major financial websites like Yahoo Finance, Google Finance, and Bloomberg provide real-time stock quotes and charts.

What is the dividend yield for Comcast stock?

The dividend yield fluctuates and is readily available on financial websites providing real-time stock information.