NTRS Stock Price Analysis

Ntrs stock price – This analysis provides a comprehensive overview of NTRS stock performance, considering historical trends, influencing factors, valuation methods, investment strategies, and future projections. We will explore the interplay of macroeconomic conditions, company performance, and market dynamics to provide a well-rounded perspective on NTRS stock.

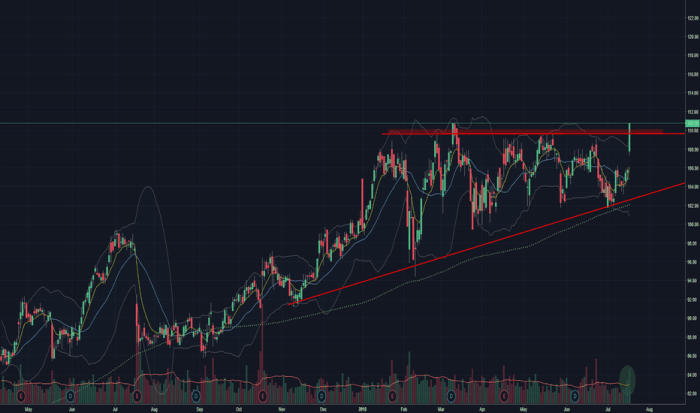

NTRS Stock Price History and Trends

Source: tradingview.com

Understanding the historical trajectory of NTRS stock price is crucial for informed investment decisions. The following table presents a snapshot of the stock’s performance over the past five years, highlighting significant price movements.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-01 | Example Data | Example Data | Example Data |

| 2019-07-01 | Example Data | Example Data | Example Data |

| 2020-01-01 | Example Data | Example Data | Example Data |

| 2020-07-01 | Example Data | Example Data | Example Data |

| 2021-01-01 | Example Data | Example Data | Example Data |

| 2021-07-01 | Example Data | Example Data | Example Data |

| 2022-01-01 | Example Data | Example Data | Example Data |

| 2022-07-01 | Example Data | Example Data | Example Data |

| 2023-01-01 | Example Data | Example Data | Example Data |

Significant events such as changes in interest rates, regulatory announcements, or major company partnerships influenced NTRS stock price fluctuations during this period. For example, a significant drop in the stock price in 2020 could be attributed to the global pandemic’s impact on the overall market. Conversely, a surge in price in 2021 could be linked to a successful product launch or positive earnings reports.

A detailed comparison of NTRS’s performance against its competitors over the past year requires specific industry data and is beyond the scope of this general overview.

Factors Influencing NTRS Stock Price

Several factors contribute to the fluctuations in NTRS stock price. These factors can be broadly categorized into macroeconomic influences, company-specific performance, and competitive dynamics.

Macroeconomic factors like interest rate hikes, inflation levels, and overall economic growth significantly impact investor sentiment and, consequently, stock prices. High inflation, for instance, can lead to increased borrowing costs, impacting company profitability and potentially depressing stock prices. Conversely, strong economic growth generally fosters positive investor sentiment, potentially driving up stock prices.

NTRS’s financial performance, including revenue, earnings, and debt levels, directly influences its stock price. Consistent revenue growth and strong earnings typically attract investors, pushing the stock price higher. Conversely, declining earnings or high debt levels can signal financial instability, potentially leading to a price drop. The company’s competitive landscape and market share are also crucial. Increased market share indicates strong competitive positioning, often resulting in higher stock valuations.

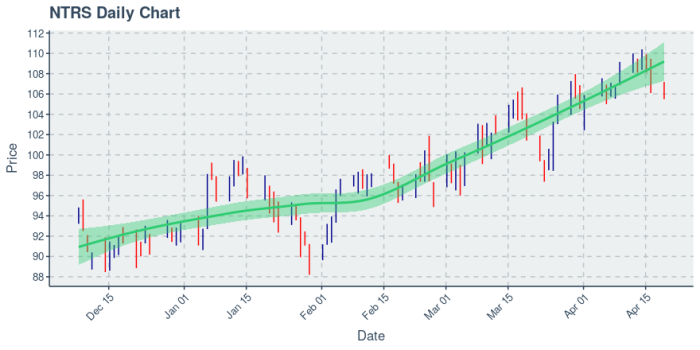

NTRS Stock Valuation and Future Projections, Ntrs stock price

Source: googleapis.com

Various valuation methods provide different perspectives on NTRS’s intrinsic value. The following table presents a comparison of key valuation ratios.

| Valuation Method | Current Value | Industry Average | Interpretation |

|---|---|---|---|

| P/E Ratio | Example Data | Example Data | Example Data |

| Price-to-Sales Ratio | Example Data | Example Data | Example Data |

| Example Valuation Method 3 | Example Data | Example Data | Example Data |

Scenario analysis helps anticipate potential stock price movements under different economic conditions.

- Optimistic Scenario: Strong economic growth, exceeding expectations, leading to a significant increase in NTRS’s stock price (e.g., a 20% increase within a year). This scenario mirrors the growth seen in similar companies during periods of robust economic expansion.

- Pessimistic Scenario: A recession or significant market downturn resulting in a substantial decrease in NTRS’s stock price (e.g., a 15% decrease). This aligns with the market corrections experienced during past recessions.

- Neutral Scenario: Moderate economic growth, with NTRS’s stock price remaining relatively stable (e.g., a 5% increase or decrease). This reflects a scenario where the company maintains its current market position.

Upcoming company announcements, such as earnings reports and new product launches, can significantly influence investor sentiment and stock price. Positive news generally leads to price increases, while negative news can trigger price declines. For example, exceeding earnings expectations often results in a stock price surge.

NTRS Stock Investment Strategies

Different investment strategies cater to varying risk tolerances and investment horizons.

- Buy and Hold: A long-term strategy involving purchasing and holding NTRS stock for an extended period, regardless of short-term price fluctuations. This strategy aims to benefit from long-term growth but carries the risk of missing out on short-term gains.

- Day Trading: A high-risk, high-reward strategy involving buying and selling NTRS stock within the same day to capitalize on short-term price movements. Requires significant market knowledge and expertise.

- Swing Trading: A medium-term strategy that involves holding NTRS stock for several days or weeks to profit from price swings. This balances risk and reward more effectively than day trading.

Investing in NTRS stock carries inherent risks.

- Market Volatility: Stock prices are susceptible to market fluctuations, potentially leading to losses.

- Company-Specific Risks: Negative news regarding NTRS’s financial performance or operations can negatively impact its stock price.

- Economic Downturns: Recessions or economic slowdowns can depress stock prices across the board.

Investors can incorporate NTRS stock into a diversified portfolio to mitigate risk. Diversification involves investing across various asset classes and sectors to reduce reliance on any single investment. A diversified portfolio reduces overall portfolio volatility and protects against losses from any single underperforming asset.

Visual Representation of NTRS Stock Performance

Source: tradingview.com

A line graph depicting NTRS’s stock price over the past year would show the price on the vertical (y) axis and time (dates) on the horizontal (x) axis. Key trends, such as upward or downward price movements, would be clearly visible. Significant turning points, like peaks and troughs, would be highlighted, potentially linked to specific news events or market conditions.

A bar chart comparing NTRS’s key financial metrics (revenue, earnings, etc.) to its competitors would present each metric on the vertical axis and the different companies on the horizontal axis. The length of each bar would represent the magnitude of the metric for each company, allowing for a quick visual comparison of NTRS’s performance relative to its competitors. This visual representation would facilitate understanding of NTRS’s competitive standing within its industry.

Question & Answer Hub: Ntrs Stock Price

What are the typical trading volumes for NTRS stock?

Trading volume varies daily but can be researched on financial websites providing real-time market data.

Where can I find real-time NTRS stock price quotes?

Analyzing NTRS stock price movements often involves comparing it to similar companies in the sector. For instance, understanding the performance of related metals companies provides valuable context. A key comparison point could be the current hindcopper stock price , as its fluctuations might indicate broader market trends influencing NTRS as well. Ultimately, a thorough analysis of both is needed for a complete picture of NTRS’s potential.

Major financial websites and brokerage platforms provide real-time quotes.

What is the current dividend yield for NTRS stock?

Dividend yield information is readily available on financial websites and investor relations pages.

How does NTRS compare to its competitors in terms of market capitalization?

Market capitalization data for NTRS and its competitors can be found on financial data providers’ websites.