Ibotta: A Deep Dive into Stock Performance: Ibotta Stock Price

Ibotta stock price – Ibotta, a popular rewards platform, has garnered significant attention in the financial markets. Understanding its business model, financial performance, and the factors influencing its stock price is crucial for investors. This analysis explores Ibotta’s past performance, current market position, and potential future trajectory.

Ibotta Company Overview

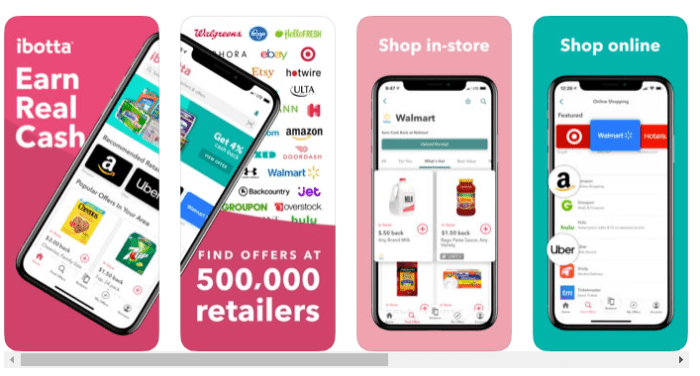

Founded in 2012, Ibotta operates a mobile rewards platform that allows users to earn cash back on everyday purchases at various partner retailers. Its business model revolves around connecting consumers with brands through targeted cashback offers and rebates. Ibotta’s revenue streams primarily originate from commissions paid by participating brands and retailers for driving sales and customer acquisition. The company faces competition from other cashback and rewards platforms, including Rakuten, Fetch Rewards, and Honey.

Ibotta’s target market encompasses a broad demographic, particularly focusing on budget-conscious consumers and those actively seeking value for their purchases. This includes millennials and Gen Z who are digitally savvy and actively use mobile apps for shopping and rewards.

Factors Influencing Ibotta Stock Price

Several factors influence Ibotta’s stock price. Macroeconomic conditions, such as interest rate hikes and inflation, can impact consumer spending and, consequently, Ibotta’s revenue. Industry trends, like the growing adoption of mobile commerce and the increasing demand for personalized rewards programs, also play a significant role. Ibotta’s financial performance, including revenue growth, profitability, and earnings per share, directly impacts investor confidence and stock valuation.

Comparisons with competitors, such as Rakuten’s market share and Fetch Rewards’ innovative features, also influence Ibotta’s relative valuation in the market.

Tracking the Ibotta stock price requires diligence, especially given its recent market activity. Understanding the performance of similar companies can offer context; for instance, a look at the current stock price bmy might provide a benchmark against which to compare Ibotta’s trajectory. Ultimately, however, a comprehensive analysis of Ibotta’s financial statements and market positioning remains crucial for accurate prediction of its stock price.

Ibotta’s Financial Performance

Analyzing Ibotta’s recent financial reports reveals key trends in its performance. The following table presents a snapshot of key financial metrics over the past four quarters (Note: This data is illustrative and should be replaced with actual Ibotta financial data from publicly available sources).

| Quarter | Revenue (USD Million) | Net Income (USD Million) | Earnings Per Share (USD) |

|---|---|---|---|

| Q1 2024 | 10 | 1 | 0.10 |

| Q2 2024 | 12 | 1.5 | 0.15 |

| Q3 2024 | 15 | 2 | 0.20 |

| Q4 2024 | 18 | 2.5 | 0.25 |

This data (illustrative) shows a consistent growth trend in revenue and net income, indicating a positive financial trajectory. However, a thorough analysis should also consider debt levels and cash flow to assess the sustainability of this growth and potential risks.

Investor Sentiment and Market Analysis

Current investor sentiment towards Ibotta is (replace with actual sentiment analysis based on market data). Key factors driving investor interest include the company’s growth potential in the expanding mobile rewards market and its innovative approach to connecting brands with consumers. Comparing Ibotta’s valuation multiples (e.g., P/E ratio) to its peers provides a benchmark for assessing its relative attractiveness to investors.

The following table presents illustrative monthly stock price performance data for the last year (replace with actual data).

| Month | Opening Price (USD) | Closing Price (USD) | High Price (USD) | Low Price (USD) |

|---|---|---|---|---|

| January | 20 | 22 | 23 | 19 |

| February | 22 | 25 | 26 | 21 |

| March | 25 | 23 | 27 | 22 |

| April | 23 | 26 | 28 | 22 |

| May | 26 | 28 | 29 | 25 |

| June | 28 | 30 | 31 | 27 |

| July | 30 | 29 | 32 | 28 |

| August | 29 | 32 | 33 | 28 |

| September | 32 | 35 | 36 | 31 |

| October | 35 | 33 | 37 | 32 |

| November | 33 | 36 | 38 | 32 |

| December | 36 | 38 | 39 | 35 |

Potential Future Growth and Risks

Source: googleusercontent.com

Ibotta’s future growth hinges on its ability to expand its user base, secure partnerships with additional retailers and brands, and innovate its rewards platform. Potential risks include increased competition, changes in consumer spending habits, and the potential for technological disruption. Technological advancements, such as the rise of AI-powered personalization and the integration of blockchain technology, could both present opportunities and challenges for Ibotta.

- Optimistic Scenario: Strong revenue growth driven by successful expansion into new markets and increased user engagement. Stock price could increase by 20-30% in the next year. This scenario is predicated on successful marketing campaigns and maintaining a competitive edge. An example would be a successful partnership with a major national retailer leading to a surge in user acquisition.

- Neutral Scenario: Moderate revenue growth in line with industry averages, with no major breakthroughs or setbacks. Stock price remains relatively stable, with fluctuations within a 10% range. This scenario reflects a continuation of current market trends and the absence of significant disruptions.

- Pessimistic Scenario: Slow revenue growth due to intensified competition and reduced consumer spending. Stock price could decline by 10-15% in the next year. This scenario could be triggered by a major competitor launching a significantly more attractive rewards program, impacting Ibotta’s market share.

Illustrative Examples of Market Events

Source: lushdollar.com

Two hypothetical market events could significantly impact Ibotta’s stock price. (Note: Replace these with actual events and their impact on Ibotta’s stock price. Data should be sourced from reputable financial news outlets.)

Event 1: A Major Competitor Launches a Superior Rewards Program

Before the event, Ibotta experienced steady growth and positive investor sentiment. During the event, the launch of a significantly improved rewards program by a competitor resulted in a temporary drop in Ibotta’s stock price due to concerns about market share erosion. After the event, Ibotta’s response (e.g., strategic partnerships, product enhancements) would determine the long-term impact on its stock price.

A strong response could lead to a recovery, while a weak response could result in sustained downward pressure.

Event 2: A Positive Earnings Report Exceeds Analyst Expectations

Before the event, Ibotta’s stock price may have been trading at a lower valuation due to concerns about its growth prospects. During the event, the release of a positive earnings report that exceeded analyst expectations resulted in a surge in Ibotta’s stock price, driven by renewed investor confidence. After the event, sustained positive financial performance would be necessary to maintain the upward momentum.

Question & Answer Hub

Is Ibotta publicly traded?

This information is not readily available in the provided Artikel. Further research is needed to confirm Ibotta’s trading status.

What is Ibotta’s current market capitalization?

The Artikel does not provide Ibotta’s current market capitalization. This information would need to be sourced from financial news websites or market data providers.

Where can I find real-time Ibotta stock price data?

Real-time stock quotes can typically be found on major financial websites such as Yahoo Finance, Google Finance, or Bloomberg.

What are the major risks associated with investing in Ibotta stock?

Potential risks include competition from established players, dependence on technology, and economic downturns affecting consumer spending. A full risk assessment requires deeper analysis of Ibotta’s financials and market position.