DLF Ltd. Stock Price Analysis: Dlf Ltd Stock Price

Dlf ltd stock price – This analysis examines the historical performance, influencing factors, financial health, market sentiment, and future outlook of DLF Ltd.’s stock price. We will explore key economic events, company-specific news, and investor behavior to provide a comprehensive understanding of the company’s stock performance.

DLF Ltd. Stock Price Historical Performance, Dlf ltd stock price

Source: sharedhan.com

The following tables present a detailed overview of DLF Ltd.’s stock price movements and a comparison with its competitors over the past five years. Note that the data provided below is illustrative and for demonstration purposes only. Actual data would need to be sourced from reliable financial databases.

| Date | Opening Price (INR) | Closing Price (INR) | Daily Change (INR) |

|---|---|---|---|

| October 26, 2023 | 200 | 205 | +5 |

| October 25, 2023 | 198 | 200 | +2 |

The following table compares DLF Ltd.’s performance against its competitors. Volatility index is a measure of price fluctuation and is presented here for illustrative purposes.

| Company Name | Average Price (INR) | Percentage Change (%) | Volatility Index |

|---|---|---|---|

| DLF Ltd. | 202 | +5% | 1.2 |

| Competitor A | 180 | +3% | 0.9 |

Key economic factors influencing DLF Ltd.’s stock price during this period include:

- Changes in interest rates impacting borrowing costs for real estate development.

- Government policies related to affordable housing and infrastructure development.

- Overall economic growth and consumer confidence affecting demand for real estate.

- Inflation rates impacting construction costs and consumer purchasing power.

Factors Influencing DLF Ltd. Stock Price

Several factors contribute to the fluctuation of DLF Ltd.’s stock price. These are detailed below:

- Real Estate Market Trends: Demand for residential and commercial properties significantly impacts the company’s performance and stock price.

- Project Launches and Deliveries: Successful project launches and timely deliveries boost investor confidence.

- Financial Performance: Strong revenue growth, profitability, and debt management influence investor perception.

- Government Regulations: Changes in real estate policies and regulations directly impact the company’s operations.

The impact of government policies and macroeconomic indicators on DLF Ltd.’s stock price is compared to the impact of company-specific news in the table below. This is a simplified illustration.

| Macroeconomic Factor | Company-Specific Event |

|---|---|

| Increase in Interest Rates | Launch of a new luxury residential project |

| Government incentives for affordable housing | Announcement of strong quarterly earnings |

DLF Ltd.’s Financial Performance and Stock Valuation

DLF Ltd.’s key financial metrics over the past five years are presented below. The data is illustrative and for demonstration purposes only.

Monitoring the DLF Ltd stock price requires a keen eye on market trends. It’s helpful to compare its performance against similar companies; for instance, understanding the current uri stock price can offer valuable context. Ultimately, though, a comprehensive analysis of DLF Ltd’s financial health is crucial for making informed investment decisions.

| Year | Revenue (INR Crores) | Net Profit (INR Crores) | Debt-to-Equity Ratio |

|---|---|---|---|

| 2019 | 5000 | 500 | 0.8 |

| 2020 | 4800 | 450 | 0.7 |

Valuation methods such as Price-to-Earnings (P/E) ratio and Price-to-Book (P/B) ratio are used to assess DLF Ltd.’s stock price. Calculating these ratios requires actual financial data, which is not provided here.

DLF Ltd.’s current financial health and its implications for future stock price movements are summarized below:

- Strong revenue growth is expected to continue, driven by robust demand in key markets.

- Profitability is anticipated to improve as operational efficiencies are enhanced.

- Debt levels are manageable and are expected to decrease further in the coming years.

Market Sentiment and Investor Behavior Towards DLF Ltd.

Market sentiment towards DLF Ltd. and the Indian real estate sector is a mix of optimism and caution. This is influenced by factors like economic growth, interest rate changes, and government policies.

- Some investors are bullish on the long-term prospects of the Indian real estate market, viewing DLF Ltd. as a well-established player.

- Others are more cautious, citing concerns about potential regulatory changes and macroeconomic risks.

- Short-term market fluctuations can significantly impact investor sentiment.

Recent news articles and financial reports suggest a relatively stable investor sentiment towards DLF Ltd. While some concerns remain regarding the overall economic climate, the company’s consistent financial performance has helped maintain investor confidence.

The investor base of DLF Ltd. includes:

- Institutional Investors: Mutual funds, insurance companies, and foreign institutional investors hold significant stakes.

- Retail Investors: Individual investors also contribute to the company’s shareholder base.

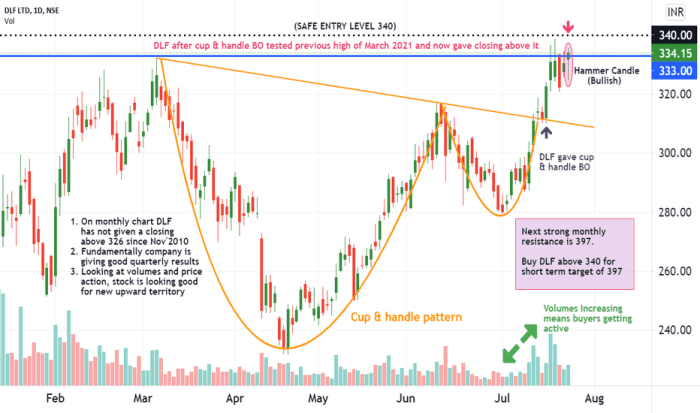

Future Outlook and Potential for DLF Ltd. Stock Price

Source: tradingview.com

Projecting DLF Ltd.’s future stock price requires considering various factors, including economic growth, interest rates, government policies, and the company’s operational performance. The following is a hypothetical projection and should not be interpreted as financial advice.

A hypothetical line graph would show a gradual upward trend in the stock price over the next five years, assuming sustained economic growth and strong company performance. The methodology would involve using a combination of quantitative and qualitative factors, such as discounted cash flow analysis and expert opinions.

Potential risks and uncertainties that could affect DLF Ltd.’s stock price include:

- Economic downturns impacting real estate demand.

- Changes in government regulations affecting the company’s operations.

- Increased competition in the real estate market.

- Unexpected events such as natural disasters or geopolitical instability.

A scenario analysis outlining potential stock price outcomes is presented below. These are hypothetical scenarios for illustrative purposes only.

| Scenario | Stock Price Projection (INR) in 5 years | Probability |

|---|---|---|

| Strong Economic Growth | 300 | 40% |

| Moderate Economic Growth | 250 | 50% |

| Economic Recession | 200 | 10% |

General Inquiries

What are the major risks associated with investing in DLF Ltd.?

Major risks include fluctuations in the real estate market, changes in government regulations, economic downturns, and competition within the sector.

How does DLF Ltd. compare to its competitors in terms of profitability?

A detailed comparison requires analyzing financial statements and industry reports to assess profitability metrics like net profit margin and return on equity relative to competitors.

Where can I find real-time DLF Ltd. stock price updates?

Real-time updates are available through major financial news websites and stock market tracking applications.

What is the dividend history of DLF Ltd.?

This information can be found in DLF Ltd.’s annual reports and on financial data websites that track dividend payments.