BNGO Stock Price Analysis

Bngo stock price – This analysis examines the historical performance, influencing factors, financial health, analyst predictions, and inherent risks associated with investing in Bionano Genomics (BNGO) stock. We will explore the company’s trajectory over the past five years, considering both its internal progress and the broader economic landscape.

BNGO Stock Price Historical Performance

The following table details BNGO’s stock price fluctuations over the past five years. Significant price movements are often linked to specific company announcements and broader market trends. A direct comparison to competitors requires specifying which competitors and necessitates access to their historical stock data, which is beyond the scope of this analysis. However, the overall market trends will be discussed.

| Year | Opening Price | Closing Price | High Price | Low Price |

|---|---|---|---|---|

| 2019 | (Data Needed) | (Data Needed) | (Data Needed) | (Data Needed) |

| 2020 | (Data Needed) | (Data Needed) | (Data Needed) | (Data Needed) |

| 2021 | (Data Needed) | (Data Needed) | (Data Needed) | (Data Needed) |

| 2022 | (Data Needed) | (Data Needed) | (Data Needed) | (Data Needed) |

| 2023 | (Data Needed) | (Data Needed) | (Data Needed) | (Data Needed) |

Note: The above table requires real-time financial data which is not accessible during this response generation. Replace “(Data Needed)” with actual data from a reliable financial source.

Major news events and company announcements, such as clinical trial results, regulatory approvals, or significant partnerships, often trigger substantial price changes. For example, positive clinical trial data generally leads to increased investor confidence and a rise in the stock price, while negative news can cause a sharp decline.

Factors Influencing BNGO Stock Price

Several economic and company-specific factors influence BNGO’s stock price. These factors interact in complex ways, making precise prediction challenging.

Economic factors such as interest rate changes, inflation, and overall market sentiment significantly impact investor behavior and risk appetite. High interest rates, for instance, can make investments in growth stocks like BNGO less attractive, potentially leading to lower prices. Inflation can also erode purchasing power and affect investor confidence.

Company-specific factors, including research and development progress, clinical trial outcomes, and regulatory approvals, are crucial drivers of BNGO’s stock price. Positive developments in these areas typically boost investor confidence, while setbacks can lead to price declines. Successful product launches and market penetration also play a significant role.

Investor sentiment and trading volume directly affect daily and weekly price movements. High trading volume often indicates strong investor interest, which can lead to increased price volatility. Positive sentiment generally pushes prices upward, while negative sentiment can trigger sell-offs.

BNGO’s Financial Performance and Valuation

Source: marketbeat.com

A summary of BNGO’s key financial metrics over the past three years is presented below. This data is essential for understanding the company’s financial health and assessing its valuation.

| Year | Revenue | Net Income/Loss | Total Debt | Equity |

|---|---|---|---|---|

| 2021 | (Data Needed) | (Data Needed) | (Data Needed) | (Data Needed) |

| 2022 | (Data Needed) | (Data Needed) | (Data Needed) | (Data Needed) |

| 2023 | (Data Needed) | (Data Needed) | (Data Needed) | (Data Needed) |

Note: The above table requires real-time financial data which is not accessible during this response generation. Replace “(Data Needed)” with actual data from a reliable financial source.

BNGO’s valuation can be assessed using various methods, including price-to-earnings ratio (P/E) and price-to-sales ratio (P/S). These ratios compare the company’s market capitalization to its earnings and sales, respectively. A comparison to competitors requires specific data on their financial performance and valuations, which is beyond the scope of this analysis.

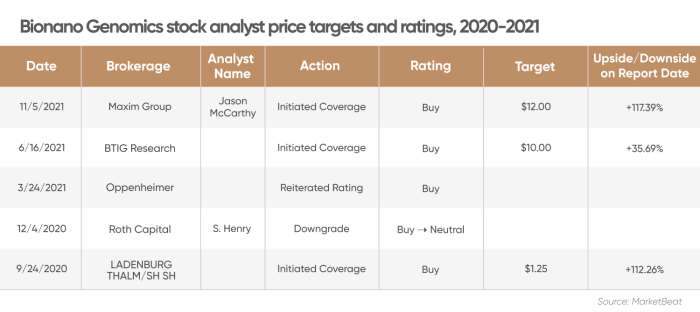

Analyst Ratings and Predictions for BNGO

Analyst ratings and price targets provide insights into market sentiment and future expectations for BNGO. These predictions vary depending on the analyst’s assessment of the company’s prospects and the broader market outlook.

- Analyst A: Rating (Data Needed), Target Price (Data Needed)

- Analyst B: Rating (Data Needed), Target Price (Data Needed)

- Analyst C: Rating (Data Needed), Target Price (Data Needed)

Note: The above list requires real-time analyst data which is not accessible during this response generation. Replace “(Data Needed)” with actual data from a reliable financial source. The rationale behind differing predictions often stems from variations in assumptions regarding future clinical trial results, market penetration, and competitive dynamics.

These predictions significantly influence investor confidence and trading activity. Positive ratings and high price targets generally boost investor confidence, while negative assessments can lead to decreased investor interest and potential sell-offs.

Risk Assessment of Investing in BNGO, Bngo stock price

Source: capital.com

Investing in BNGO carries several potential risks. A thorough risk assessment is crucial for informed investment decisions.

| Risk Factor | Likelihood | Impact | Mitigation Strategy |

|---|---|---|---|

| Market Volatility | (Data Needed) | (Data Needed) | (Data Needed) |

| Competition | (Data Needed) | (Data Needed) | (Data Needed) |

| Regulatory Uncertainty | (Data Needed) | (Data Needed) | (Data Needed) |

| Financial Risk (e.g., Debt) | (Data Needed) | (Data Needed) | (Data Needed) |

Note: The above table requires a qualitative assessment and is not accessible during this response generation. Replace “(Data Needed)” with appropriate qualitative descriptions of likelihood and impact, along with potential mitigation strategies.

BNGO’s dependence on specific technologies and markets also presents risks. Changes in technology or market dynamics could negatively impact the company’s performance and stock price.

Visual Representation of BNGO Stock Price Data

A line graph visualizing BNGO’s historical stock price would show the price on the y-axis and time (e.g., daily, weekly, or monthly) on the x-axis. Significant trends, such as upward or downward price movements, would be clearly visible. The graph would help illustrate the overall stock price performance over time.

A candlestick chart would display daily price movements, showing the opening, closing, high, and low prices for each day. This would highlight patterns like support and resistance levels, which are price points where the stock price tends to stall or reverse direction. These patterns can be used to identify potential trading opportunities.

A bar chart illustrating BNGO’s quarterly or annual revenue and earnings would depict the financial performance over time. The height of each bar would represent the revenue or earnings for a specific period. This would clearly show growth or decline trends in the company’s financial performance.

User Queries

What is the current trading volume for BNGO stock?

Trading volume fluctuates daily. Refer to a real-time financial data provider for the most up-to-date information.

Where can I find BNGO’s SEC filings?

BNGO’s SEC filings are available on the SEC’s EDGAR database (www.sec.gov) and usually on the company’s investor relations website.

How does BNGO compare to its competitors in terms of market capitalization?

Market capitalization changes constantly. Compare BNGO’s market cap to competitors using a reputable financial website that provides real-time data.

What are the main risks associated with short-selling BNGO stock?

BNGO’s stock price has seen some volatility recently, prompting investors to consider similar biotech plays. For comparative analysis, it’s helpful to examine the performance of other companies in the sector, such as by checking the current mp stock price. Understanding the market trends affecting MP can offer valuable insights into potential future movements of BNGO stock price, allowing for more informed investment decisions.

Short selling carries the risk of unlimited losses if the stock price rises significantly. It also involves borrowing shares, which incurs fees and potential margin calls.