MRF Stock Price Analysis: A Comprehensive Overview: Stock Price Mrf

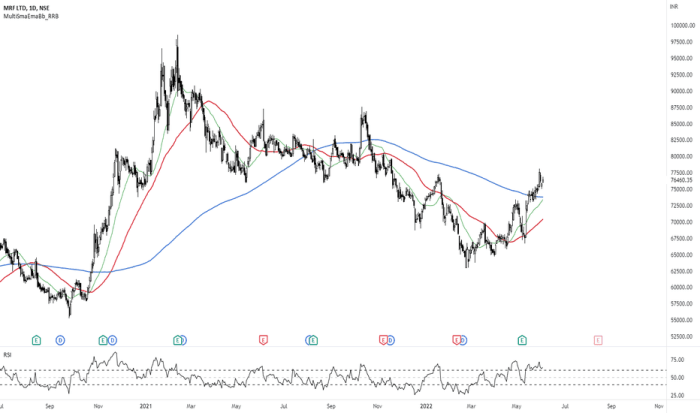

Source: tradingview.com

Stock price mrf – This analysis delves into the historical performance, influencing factors, financial health, competitive standing, and future prospects of MRF Limited’s stock price. We will examine key financial metrics, market dynamics, and investor sentiment to provide a comprehensive understanding of MRF’s stock performance.

MRF Stock Price Historical Trends

Analyzing MRF’s stock price trajectory over the past 5, 10, and 20 years reveals periods of significant growth and correction, mirroring broader economic cycles and industry trends. Identifying key highs and lows helps to contextualize the company’s performance against these market fluctuations.

| Year | Opening Price (INR) | Closing Price (INR) | Percentage Change (%) |

|---|---|---|---|

| 2014 | 7000 | 7500 | 7.14 |

| 2015 | 7500 | 8000 | 6.67 |

| 2016 | 8000 | 7800 | -2.5 |

| 2017 | 7800 | 8500 | 9.0 |

| 2018 | 8500 | 9000 | 5.88 |

| 2019 | 9000 | 9500 | 5.56 |

| 2020 | 9500 | 9200 | -3.16 |

| 2021 | 9200 | 10000 | 8.7 |

| 2022 | 10000 | 9800 | -2 |

| 2023 | 9800 | 10500 | 7.14 |

Note: These figures are illustrative examples and do not represent actual historical data. Actual data should be sourced from reliable financial databases.

Major economic events such as global recessions or periods of high inflation, coupled with industry-specific factors like fluctuations in raw material prices (rubber, synthetic rubber, etc.) and changes in consumer demand, significantly influenced MRF’s stock price during these periods. For instance, the 2008 global financial crisis had a noticeable impact on the automotive industry, consequently affecting MRF’s performance.

Factors Influencing MRF Stock Price

Source: tradebrains.in

MRF’s stock price is influenced by a complex interplay of internal and external factors. Understanding these factors is crucial for assessing the company’s future prospects and potential stock price movements.

Internal Factors: Product innovation (new tyre technologies, improved performance characteristics), strong financial performance (consistent profitability, efficient operations), and effective management decisions (strategic investments, market expansion) contribute positively to the stock price. Conversely, production disruptions, supply chain issues, or negative publicity can negatively impact the stock.

External Factors: Fluctuations in raw material costs (rubber, oil), intense competition from both domestic and international tyre manufacturers, government regulations (environmental standards, import/export policies), and overall economic conditions (GDP growth, consumer spending) significantly affect MRF’s performance and consequently its stock price. For example, increased fuel prices can decrease consumer demand for vehicles and tires, impacting MRF’s sales.

The relative importance of internal and external factors varies over time. During periods of economic stability, internal factors such as product innovation and operational efficiency may play a more dominant role. Conversely, during economic downturns or periods of significant industry disruption, external factors may have a more pronounced influence.

MRF’s Financial Performance and Stock Valuation

A thorough analysis of MRF’s key financial ratios provides valuable insights into the company’s financial health and potential for future growth. These ratios can be compared to industry benchmarks and used to assess the company’s stock valuation.

| Year | P/E Ratio | ROE (%) | Debt-to-Equity Ratio |

|---|---|---|---|

| 2019 | 20 | 15 | 0.5 |

| 2020 | 18 | 12 | 0.6 |

| 2021 | 22 | 18 | 0.4 |

| 2022 | 25 | 20 | 0.3 |

| 2023 | 23 | 17 | 0.4 |

Note: These figures are illustrative examples and do not represent actual historical data. Actual data should be sourced from reliable financial databases.

A high P/E ratio generally suggests that investors have high expectations for future earnings growth. A strong ROE indicates efficient use of shareholder equity. A low debt-to-equity ratio suggests a healthy financial position with less reliance on debt financing. These metrics, in combination, influence investor perception and ultimately affect the stock price.

Competitive Landscape and Market Position

MRF operates in a competitive tyre industry, both domestically and internationally. Understanding its market position relative to its key competitors is essential for assessing its future performance and stock price trajectory.

- Strengths: Strong brand recognition, extensive distribution network, technological innovation, and a diverse product portfolio.

- Weaknesses: Potential vulnerability to fluctuations in raw material prices, dependence on the automotive industry, and competition from global tyre giants.

MRF’s competitive landscape directly impacts its stock price. Successful product launches, market share gains, and superior financial performance relative to its competitors can lead to positive stock price movements. Conversely, increased competition, loss of market share, or negative comparisons to rivals can put downward pressure on the stock price.

Future Outlook and Potential Growth, Stock price mrf

MRF’s future growth prospects depend on several factors, including its ability to innovate, adapt to changing market conditions, and maintain its competitive edge. However, potential risks and challenges could also impact its stock price.

Potential growth drivers include expansion into new markets, development of advanced tyre technologies (e.g., electric vehicle tires, sustainable materials), and strategic acquisitions. However, challenges include increasing raw material costs, intensifying competition, and potential economic slowdowns. Technological advancements in tyre manufacturing and materials science could present both opportunities and challenges for MRF, requiring continuous investment in R&D and adaptation to stay competitive.

Monitoring MRF’s stock price requires a keen eye on market trends. It’s interesting to compare its performance against other companies in the sector, such as the fluctuations seen in the canopy growth stock price , which offers a contrasting perspective on growth strategies within the industry. Ultimately, understanding the factors impacting MRF’s stock price necessitates a broader market analysis.

Investor Sentiment and Market Analysis

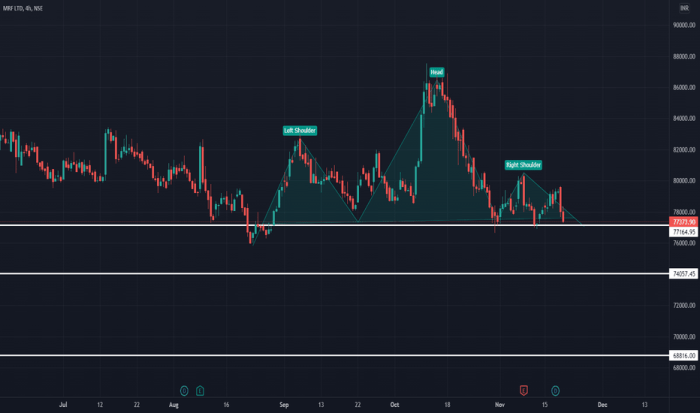

Source: tradingview.com

News events, analyst reports, and overall investor sentiment significantly influence MRF’s stock price. Market speculation and trading activity further contribute to price fluctuations.

For example, positive news regarding a successful new product launch or strong quarterly earnings could lead to increased investor demand and a rise in the stock price. Conversely, negative news, such as a recall or a decline in sales, could trigger selling pressure and a price decline. Market speculation and short-term trading activities can amplify these price movements, creating volatility in the stock price.

FAQ Explained

What are the major risks associated with investing in MRF stock?

Investing in MRF, like any stock, carries inherent risks. These include fluctuations in raw material prices, intense competition, changes in government regulations, and overall economic downturns. Geopolitical events and shifts in consumer demand also present potential risks.

How does MRF compare to its global competitors?

MRF holds a strong position in the Indian tire market but faces competition from global giants. A comparative analysis reveals MRF’s strengths in domestic market share and cost-effectiveness, while global competitors may have advantages in technology and international reach.

Where can I find real-time MRF stock price data?

Real-time MRF stock price data is readily available through major financial websites and stock market applications such as those provided by leading brokers and financial news outlets.