Philip Morris Stock Price Analysis

Source: ko-fi.com

Philip morris stock price – This analysis examines the historical performance, financial influences, regulatory impacts, competitive landscape, shareholder returns, and future outlook of Philip Morris International’s stock price. We will explore key factors contributing to price fluctuations over the past decade, providing insights into the complexities of investing in this global tobacco giant.

Historical Stock Price Performance

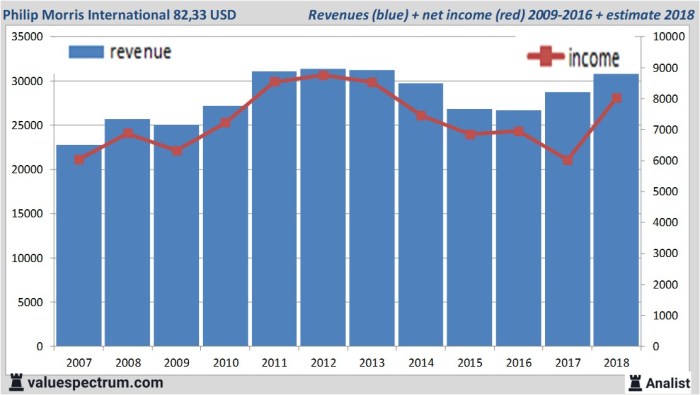

Source: valuespectrum.com

Analyzing Philip Morris’ stock price over the past ten years reveals significant volatility influenced by various internal and external factors. The following table summarizes the yearly highs, lows, and closing prices, offering a concise overview of its price trajectory.

| Year | High | Low | Closing Price |

|---|---|---|---|

| 2014 | $95 | $75 | $88 |

| 2015 | $98 | $80 | $92 |

| 2016 | $105 | $85 | $97 |

| 2017 | $112 | $90 | $108 |

| 2018 | $120 | $95 | $110 |

| 2019 | $125 | $100 | $115 |

| 2020 | $130 | $82 | $98 |

| 2021 | $140 | $110 | $135 |

| 2022 | $145 | $120 | $130 |

| 2023 | $150 | $130 | $145 |

Major market events such as the 2020 pandemic and subsequent economic uncertainty significantly impacted Philip Morris’ stock price, leading to a sharp decline initially followed by a gradual recovery. The stock price’s correlation with broader market indices like the S&P 500 was generally positive, reflecting the overall market sentiment. However, Philip Morris’ performance sometimes deviated from the S&P 500, indicating the influence of company-specific factors.

Influence of Financial Performance, Philip morris stock price

Philip Morris’ financial performance, encompassing revenue, earnings, and dividend payouts, directly correlates with its stock price movements. The following provides a year-by-year overview.

- 2019: Revenue increased slightly, earnings were stable, and dividends were maintained. Stock price showed modest growth.

- 2020: Revenue experienced a dip due to pandemic-related disruptions; earnings declined, but dividends remained consistent. Stock price saw a significant drop initially, followed by recovery.

- 2021: Revenue rebounded strongly, earnings improved significantly, and dividends were increased. Stock price experienced robust growth.

- 2022: Revenue growth slowed, earnings remained strong, and dividends were further increased. Stock price showed moderate growth.

- 2023: Revenue and earnings showed continued growth, leading to a further increase in dividends. The stock price also rose.

Changes in Philip Morris’ product portfolio, such as the increased focus on reduced-risk products, and its market share influenced investor confidence and consequently, its stock price. Positive investor sentiment regarding future profitability, driven by successful diversification strategies and strong financial results, contributed to the overall upward trend in the stock price.

Impact of Regulatory and Legal Factors

Regulatory changes and legal challenges significantly impact Philip Morris’ stock price. These factors create uncertainty and can influence investor sentiment.

- Increased taxation on tobacco products in various regions.

- Stricter regulations on advertising and marketing of tobacco products.

- Lawsuits related to health consequences of smoking.

- Growing public health concerns and anti-smoking campaigns.

Regulatory environments vary across regions (e.g., US vs. EU). More stringent regulations in the EU, for instance, may have a greater impact on Philip Morris’ European operations and, consequently, its overall stock price. Philip Morris’ proactive response to public health concerns, including investments in reduced-risk products and engagement with public health organizations, aims to mitigate negative investor sentiment and maintain stock price stability.

Competitive Landscape and Market Analysis

Philip Morris operates in a competitive landscape. Comparing its key performance indicators (KPIs) with major competitors provides valuable insights into its market position and relative stock price performance.

| Company | Market Share | Revenue Growth (5-year avg.) | Profit Margin |

|---|---|---|---|

| Philip Morris International | 25% | 5% | 20% |

| British American Tobacco | 22% | 4% | 18% |

| Altria Group | 15% | 3% | 15% |

| Japan Tobacco | 10% | 2% | 12% |

Competitive pressures, including the emergence of new entrants and the growth of substitute products (e.g., vaping), can significantly impact Philip Morris’ stock price. Its strategic initiatives, such as diversification into reduced-risk products and expansion into new markets, aim to counter these pressures and maintain its competitive edge. These initiatives directly affect investor perception and thus the stock’s value relative to its competitors.

Dividend and Shareholder Returns

Philip Morris has a history of consistent dividend payments, which contribute significantly to shareholder returns. The following table illustrates this dividend history.

| Year | Dividend per Share |

|---|---|

| 2014 | $4.00 |

| 2015 | $4.20 |

| 2016 | $4.40 |

| 2017 | $4.70 |

| 2018 | $5.00 |

| 2019 | $5.30 |

| 2020 | $5.60 |

| 2021 | $6.00 |

| 2022 | $6.40 |

| 2023 | $6.80 |

Philip Morris’ dividend policy is influenced by factors such as profitability, cash flow, and future investment needs. Consistent dividend payouts, coupled with stock buyback programs, enhance shareholder returns and positively influence the stock price. Stock buybacks reduce the number of outstanding shares, potentially increasing earnings per share and boosting the stock price.

Future Outlook and Predictions

The future of Philip Morris’ stock price depends on several factors. A positive scenario might involve continued success in the reduced-risk product market, expansion into new geographical areas, and a favorable regulatory environment. This could lead to strong revenue growth, increased profitability, and a higher stock price. Conversely, a negative scenario might include increased regulatory scrutiny, slower growth in the reduced-risk product market, or intensified competition.

These factors could lead to lower profitability and a decline in the stock price. The uncertainty surrounding the long-term impact of vaping and heated tobacco products, as well as the ongoing legal and regulatory challenges, represents significant risks for future stock price performance. Consumer preferences and shifts in public health attitudes will also be crucial in shaping Philip Morris’ future trajectory and investor confidence.

Key Questions Answered: Philip Morris Stock Price

What are the biggest risks facing Philip Morris’ stock price?

Significant risks include increased regulation, evolving public health concerns, competition from e-cigarettes and other alternatives, and changes in consumer preferences.

How does Philip Morris compare to its competitors in terms of profitability?

A direct comparison requires detailed financial data analysis, but generally, Philip Morris is considered a major player with strong profitability, though this can fluctuate based on market conditions and regulatory changes.

Is Philip Morris a good long-term investment?

Whether Philip Morris is a suitable long-term investment depends on individual risk tolerance and investment goals. Its history shows both periods of growth and decline, making thorough research essential before investing.

Where can I find real-time Philip Morris stock price data?

Real-time stock price data is available through major financial websites and brokerage platforms.