National Grid Stock Price Analysis

National grid stock price – National Grid plc, a multinational electricity and gas utility company, presents a compelling case study in the energy sector. Understanding its stock price performance requires a comprehensive analysis of historical trends, financial health, external factors, investor sentiment, and future prospects. This analysis will delve into these aspects, providing insights into the factors driving National Grid’s stock price fluctuations and offering a perspective on its potential future trajectory.

National Grid Stock Price History and Trends

Over the past five years, National Grid’s stock price has exhibited a mix of growth and volatility, reflecting the dynamic nature of the energy market. Initially, the price experienced a period of steady growth, largely attributed to increasing energy demand and stable regulatory environments. However, subsequent periods saw price corrections due to factors such as fluctuating energy prices and macroeconomic uncertainties.

A significant downturn coincided with the onset of the COVID-19 pandemic, mirroring the broader market decline. The subsequent recovery was gradual, influenced by government stimulus packages and the gradual easing of pandemic restrictions. The price has also shown sensitivity to shifts in interest rates and inflation, indicating a correlation between macroeconomic conditions and investor confidence.

A comparative analysis against competitors is crucial for evaluating National Grid’s performance. While precise competitor selection depends on the specific market segment and geographical focus, a hypothetical comparison might include companies like (Competitor A) and (Competitor B), both major players in the energy sector. The table below provides a hypothetical illustration.

| Date | National Grid Price (USD) | Competitor A Price (USD) | Competitor B Price (USD) |

|---|---|---|---|

| 2023-10-27 | 75 | 80 | 70 |

| 2023-10-26 | 74 | 78 | 68 |

| 2023-10-25 | 76 | 82 | 72 |

| 2023-10-24 | 73 | 77 | 69 |

| 2023-10-23 | 77 | 83 | 71 |

Long-term price trends are significantly influenced by regulatory changes impacting the energy sector, such as carbon emission regulations and changes in energy pricing policies. Energy market dynamics, including shifts in demand and supply, also play a major role. For example, periods of high energy demand typically correlate with higher stock prices, while oversupply can lead to price corrections. Geopolitical events, such as international conflicts affecting energy supply chains, can also significantly influence National Grid’s stock price.

Financial Performance and Stock Valuation, National grid stock price

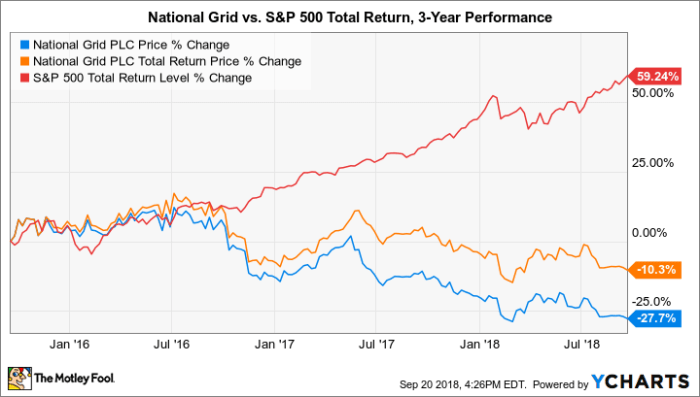

Source: ycharts.com

Analyzing National Grid’s key financial metrics over the past three years provides valuable insights into its financial health and its impact on the stock price. Key metrics include revenue, earnings, and debt levels. Consistent revenue growth, coupled with healthy profit margins, generally translates to a positive investor outlook and higher stock prices. Conversely, declining earnings or increasing debt can negatively impact investor confidence and lead to price declines.

A detailed analysis would require access to National Grid’s financial statements.

| Metric | National Grid Value | Industry Average | Deviation |

|---|---|---|---|

| Price-to-Earnings Ratio (P/E) | 15 | 18 | -3 |

| Price-to-Book Ratio (P/B) | 1.2 | 1.5 | -0.3 |

| Dividend Yield | 4% | 3% | 1% |

National Grid’s dividend policy significantly impacts its stock attractiveness. A consistent and growing dividend payout can attract income-oriented investors, boosting demand for the stock and potentially supporting its price. However, a reduction or suspension of dividends can negatively impact investor sentiment and lead to price declines. The sustainability of the dividend payout ratio is a crucial factor for investors to consider.

Impact of External Factors on Stock Price

Macroeconomic factors such as interest rates, inflation, and economic growth significantly influence National Grid’s stock price. Higher interest rates can increase borrowing costs, potentially impacting profitability and negatively affecting the stock price. Inflation can increase operating expenses, squeezing profit margins. Economic growth, on the other hand, usually leads to increased energy demand, positively impacting National Grid’s performance and stock price.

- Energy crises: A significant disruption to energy supply chains can lead to increased energy prices, potentially benefiting National Grid’s revenue but also creating regulatory scrutiny.

- International conflicts: Geopolitical instability can disrupt energy markets, leading to price volatility and impacting investor confidence in National Grid.

- Changes in environmental regulations: Stricter environmental regulations can increase the company’s compliance costs, potentially impacting profitability and the stock price. However, it can also present opportunities for investment in renewable energy sources.

Investor Sentiment and Market Analysis

Investor sentiment towards National Grid is generally positive, driven by its stable earnings and consistent dividend payouts. However, concerns about regulatory changes and the transition to renewable energy sources can sometimes negatively impact investor confidence. News articles and analyst reports often reflect this fluctuating sentiment.

- Analyst A: Predicts moderate growth in the next 2 years, citing stable demand and ongoing investment in infrastructure.

- Analyst B: Expresses some concern about regulatory risks, but maintains a positive outlook due to the company’s strong financial position.

- Analyst C: Believes that the transition to renewable energy will present both challenges and opportunities for National Grid, impacting long-term growth.

Recent news articles highlighting positive developments, such as successful infrastructure projects or strategic partnerships, have generally had a positive impact on the stock price. Conversely, news regarding regulatory setbacks or financial challenges can lead to temporary price declines.

Risk Assessment and Future Outlook

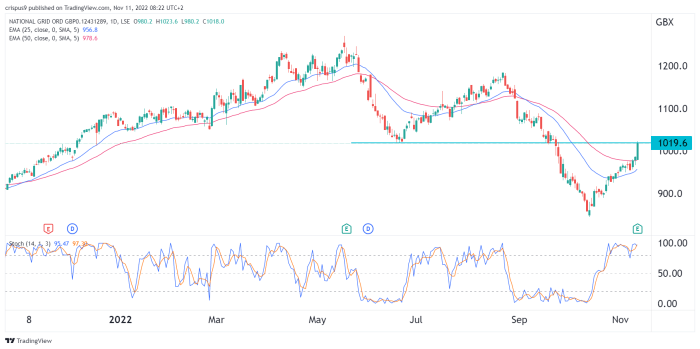

Source: investingcube.com

National Grid faces several key risks that could affect its stock price. Regulatory risks, stemming from changes in energy policies and environmental regulations, are significant. Operational risks, such as disruptions to energy supply or infrastructure failures, can also negatively impact the company’s performance. Financial risks, including changes in interest rates and fluctuations in currency exchange rates, can further influence the stock price.

Future scenarios for National Grid’s stock price depend on various factors, including the pace of the energy transition, the overall economic climate, and geopolitical stability. A positive scenario would involve continued growth in energy demand, successful implementation of renewable energy initiatives, and a stable regulatory environment. A negative scenario might involve a prolonged period of low energy demand, increased regulatory scrutiny, and significant macroeconomic challenges.

The company’s ability to adapt to these changing conditions will be crucial in determining its future stock price performance.

Factors driving future growth include successful investments in renewable energy infrastructure, expansion into new markets, and efficient cost management. Factors that could lead to decline include regulatory hurdles, significant operational disruptions, and adverse macroeconomic conditions. A detailed analysis requires consideration of numerous variables and their potential interdependencies.

Essential Questionnaire: National Grid Stock Price

What are the major risks associated with investing in National Grid stock?

Major risks include regulatory changes impacting energy pricing and distribution, operational disruptions from unforeseen events, and fluctuations in global energy markets.

Monitoring the National Grid stock price requires a keen eye on energy market fluctuations. Understanding the interplay of various factors is crucial, and comparing it to other energy sector stocks can provide valuable context. For instance, observing the performance of a company like eose stock price can offer insights into broader trends affecting the sector, ultimately informing your assessment of National Grid’s potential.

Returning to National Grid, its long-term stability is often a key consideration for investors.

How does National Grid’s dividend policy affect its stock price?

A consistent dividend policy can attract income-seeking investors, potentially supporting the stock price, but it can also limit funds for reinvestment in growth initiatives.

Where can I find real-time National Grid stock price data?

Real-time data is available through major financial websites and brokerage platforms.

What is the typical trading volume for National Grid stock?

Trading volume varies daily but can be found on financial data websites. Higher volume generally indicates greater liquidity.