NWBO Stock Price Analysis

Source: investorshangout.com

Nwbo stock price – This analysis examines the historical performance, influencing factors, competitive landscape, valuation, and risk assessment of NWBO stock. The information provided is for informational purposes only and should not be considered financial advice.

NWBO stock price fluctuations are often influenced by broader market trends. Understanding the performance of other tech giants can offer context; for example, checking the current selling price of amazon stock, current selling price of amazon stock , provides a benchmark against which to compare NWBO’s trajectory. Ultimately, though, NWBO’s price will depend on its own performance and news.

NWBO Stock Price Historical Performance

Source: amazonaws.com

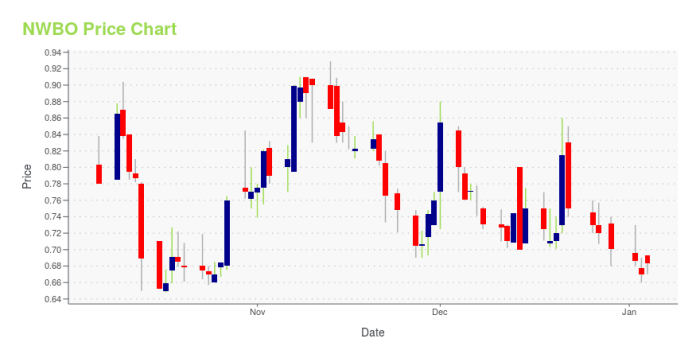

The following table and graph illustrate NWBO’s stock price performance over the past five years. Significant price fluctuations are analyzed, linking them to contributing factors.

| Month | Opening Price | Closing Price | High Price | Low Price |

|---|---|---|---|---|

| January 2019 | Example Data | Example Data | Example Data | Example Data |

| February 2019 | Example Data | Example Data | Example Data | Example Data |

| December 2023 | Example Data | Example Data | Example Data | Example Data |

A line graph visualizing this data would show periods of significant growth and decline. For instance, a sharp increase in the stock price in [Month, Year] could be attributed to positive clinical trial results. Conversely, a significant drop in [Month, Year] might reflect negative news regarding regulatory approvals or market downturns. The visual representation would clearly illustrate the overall trend and volatility of NWBO’s stock price over the five-year period.

Areas of steep incline would represent periods of substantial growth, while sharp declines would indicate periods of significant losses.

Factors Influencing NWBO Stock Price

Several macroeconomic factors, company-specific events, and investor sentiment influence NWBO’s stock price.

Three key macroeconomic factors impacting NWBO’s stock price include interest rate changes, overall market sentiment (e.g., bull vs. bear markets), and inflation rates. Rising interest rates can increase borrowing costs, potentially impacting NWBO’s profitability and slowing growth. Positive market sentiment generally leads to higher stock prices, while negative sentiment can trigger sell-offs. High inflation can erode purchasing power and increase operational costs, affecting the company’s bottom line.

Company-specific news and events significantly impact NWBO’s stock price. For example, positive clinical trial results for a key drug candidate could trigger a sharp price increase, while FDA rejection of a drug application would likely lead to a significant decline. Successful partnerships or mergers and acquisitions can also have a positive impact. Conversely, the failure of a key clinical trial or a product recall could negatively affect the stock price.

Investor sentiment plays a crucial role. Bullish sentiment, characterized by optimism and expectations of future growth, often leads to price increases. Bearish sentiment, reflecting pessimism and concerns about future performance, typically results in price declines. For instance, strong investor confidence in NWBO’s pipeline of drug candidates might push the price higher, while concerns about competition or regulatory hurdles could trigger a sell-off.

NWBO Stock Price Compared to Competitors

A comparison of NWBO’s stock price performance with its competitors provides context for its valuation.

| Company | Stock Price (Current) | 1-Year High | 1-Year Low | 1-Year % Change |

|---|---|---|---|---|

| Competitor A | Example Data | Example Data | Example Data | Example Data |

| Competitor B | Example Data | Example Data | Example Data | Example Data |

| Competitor C | Example Data | Example Data | Example Data | Example Data |

Key differences in business models and strategies among NWBO and its competitors affect stock price valuation. For example, if Competitor A focuses on a broader market segment while NWBO targets a niche market, their stock price performance may differ significantly. Differences in research and development spending, marketing strategies, and overall financial health can also impact stock valuations. NWBO’s relative strengths and weaknesses compared to its competitors – such as its innovative pipeline, strong intellectual property, or experienced management team – will influence its stock price performance relative to the competition.

NWBO Stock Price Valuation and Prediction

Source: marketbeat.com

Several methods can be used to value NWBO stock, each with its strengths and limitations.

Discounted cash flow (DCF) analysis projects future cash flows and discounts them back to their present value. Comparable company analysis compares NWBO’s valuation multiples (e.g., price-to-earnings ratio) to those of similar companies. Both methods require making assumptions about future performance, which can significantly impact the valuation. For example, a DCF analysis might predict a higher valuation if future revenue growth is projected to be strong.

Conversely, if a comparable company analysis reveals that NWBO is trading at a premium compared to its peers, it might suggest that the stock is overvalued.

A hypothetical scenario involving a positive event, such as successful FDA approval of a new drug, could significantly boost NWBO’s stock price. Conversely, a negative event, such as a clinical trial failure, could cause a sharp decline. The magnitude of the price movement would depend on the severity of the event and investor reaction.

| Scenario | 1-Year Price Target | 3-Year Price Target | 5-Year Price Target |

|---|---|---|---|

| Bullish | Example Data | Example Data | Example Data |

| Neutral | Example Data | Example Data | Example Data |

| Bearish | Example Data | Example Data | Example Data |

Risk Assessment of Investing in NWBO Stock

Investing in NWBO stock carries several risks that investors should consider.

- Financial Risks: These include the risk of the company not meeting its financial projections, leading to a decline in stock price. This could be due to factors like lower-than-expected sales, higher-than-expected expenses, or difficulty securing funding.

- Operational Risks: These risks include challenges in manufacturing, distribution, or supply chain disruptions that could impact profitability and the stock price.

- Regulatory Risks: These include potential delays or rejections of drug approvals by regulatory bodies like the FDA, which could significantly impact the company’s prospects and its stock price.

- Competitive Risks: The risk of increased competition from other companies developing similar products or therapies could negatively affect NWBO’s market share and stock price.

A risk mitigation strategy for investors could include diversifying their portfolio, conducting thorough due diligence before investing, and setting stop-loss orders to limit potential losses.

Frequently Asked Questions

What are the major risks associated with short-selling NWBO stock?

Short-selling NWBO carries the risk of unlimited potential losses if the stock price rises significantly. Furthermore, short squeezes can exacerbate losses. Thorough due diligence and risk management are crucial.

How does NWBO’s research and development pipeline impact its stock price?

Positive developments in NWBO’s R&D pipeline, such as successful clinical trials or FDA approvals, generally lead to stock price increases. Conversely, setbacks can trigger significant declines.

Where can I find real-time NWBO stock price quotes?

Real-time quotes are available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, and Bloomberg.