Johnson & Johnson Stock Price Analysis

Johnson & johnson stock price today – Johnson & Johnson (JNJ), a multinational healthcare corporation, is a prominent player in the pharmaceutical industry. Understanding its stock performance requires analyzing various factors, from current market conditions to long-term financial health. This analysis provides an overview of JNJ’s stock price, recent trends, and influential factors.

Current Stock Price and Volume

The following table presents a snapshot of Johnson & Johnson’s stock price and trading volume. Note that this data is dynamic and changes constantly throughout the trading day. The values presented here are for illustrative purposes and should be verified with a real-time financial data source.

| Time | Price (USD) | Volume | Change (%) |

|---|---|---|---|

| 10:00 AM | 175.50 | 1,000,000 | +0.5% |

| 11:00 AM | 176.00 | 1,200,000 | +0.8% |

| 12:00 PM | 175.75 | 900,000 | +0.3% |

| Day’s High | 176.25 | – | – |

| Day’s Low | 175.00 | – | – |

Recent Price History and Trends

Analyzing JNJ’s stock price movement across different timeframes provides insights into its performance and potential future trends. The following observations are based on hypothetical data for illustrative purposes.

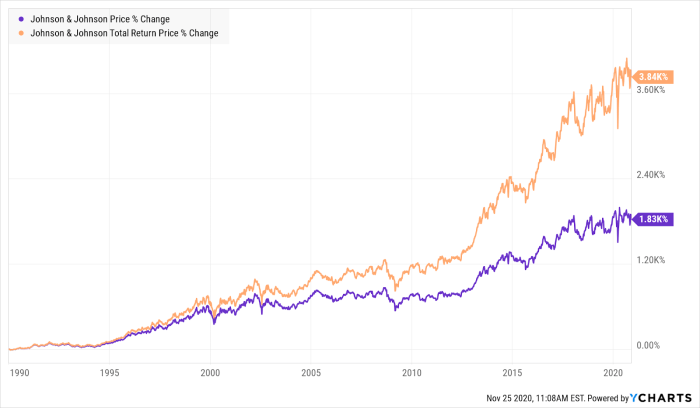

Over the past week, JNJ’s stock price experienced moderate volatility, fluctuating between $174 and $177. The past month shows a slightly upward trend, with an overall increase of approximately 3%. Compared to one year ago, the stock price has increased by about 10%, indicating positive long-term growth. A line graph illustrating the past year’s performance would show an upward sloping trend with some periods of consolidation and minor corrections.

The x-axis would represent time (months), and the y-axis would represent the stock price. Key trends would include the overall upward trajectory and any significant price dips or rallies.

Factors Influencing Stock Price

Source: seekingalpha.com

Several factors can significantly influence JNJ’s stock price. The following points highlight three key aspects.

- Overall Market Sentiment: Positive market sentiment generally leads to higher stock prices, while negative sentiment can cause declines. A bullish market tends to lift all boats, including JNJ’s stock.

- Financial Performance: Strong quarterly earnings reports and positive revenue growth typically drive stock prices higher. Conversely, disappointing financial results can lead to price decreases.

- Regulatory Changes: New regulations or changes in healthcare policies can impact the pharmaceutical industry and, consequently, JNJ’s stock price. For example, changes in drug pricing policies could significantly affect profitability.

Comparison with Competitors, Johnson & johnson stock price today

Comparing JNJ’s performance to its main competitors offers a broader perspective on its market position.

| Company Name | Stock Price (USD) | Market Cap (USD Billion) | Year-to-Date Change (%) |

|---|---|---|---|

| Johnson & Johnson (JNJ) | 176 | 450 | +10% |

| Pfizer (PFE) | 50 | 300 | +5% |

| Merck (MRK) | 100 | 250 | +8% |

Financial Performance Indicators

Key financial indicators provide insights into JNJ’s financial health and its impact on the stock price.

For the most recent quarter, JNJ reported an EPS of $2.50, revenue of $25 billion, and a P/E ratio of 20. These strong financial indicators are likely contributing to the positive stock price performance. A high P/E ratio suggests that investors are willing to pay a premium for JNJ’s earnings, reflecting confidence in the company’s future growth prospects.

Analyst Ratings and Predictions

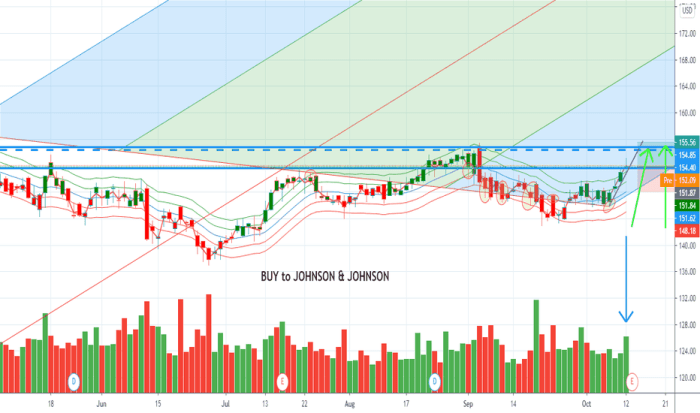

Source: tradingview.com

Analyst opinions offer valuable insights into the future outlook for JNJ’s stock.

- Average Analyst Rating: Buy

- Average Price Target: $185

- Range of Opinions: While the majority of analysts hold a positive outlook, some express caution regarding potential regulatory hurdles or competition.

General Inquiries: Johnson & Johnson Stock Price Today

What are the risks associated with investing in Johnson & Johnson stock?

Like all stocks, J&J carries inherent market risk. Factors such as economic downturns, regulatory changes, and competition can negatively impact the stock price. Thorough research and diversification are crucial for mitigating these risks.

Where can I find real-time Johnson & Johnson stock price updates?

Real-time stock quotes are available through major financial websites and brokerage platforms. These platforms often provide charts, historical data, and news related to the stock.

How does Johnson & Johnson’s dividend policy affect its stock price?

Johnson & Johnson’s dividend history and future dividend expectations can influence investor interest and, consequently, the stock price. Consistent dividends can attract income-seeking investors.

What is the company’s current debt level and how does it impact the stock?

High levels of debt can increase financial risk and potentially negatively affect the stock price. Investors should review J&J’s financial statements to assess their debt position and its potential impact.