Hog Stock Price Analysis: A Comprehensive Overview

Source: commodityresearchgroup.com

The hog market, a significant component of the global agricultural sector, exhibits considerable price volatility influenced by a complex interplay of factors. This analysis delves into the historical performance of hog stock prices, key influencing factors, prevailing market trends, investment strategies, and future predictions, providing a comprehensive understanding of this dynamic market.

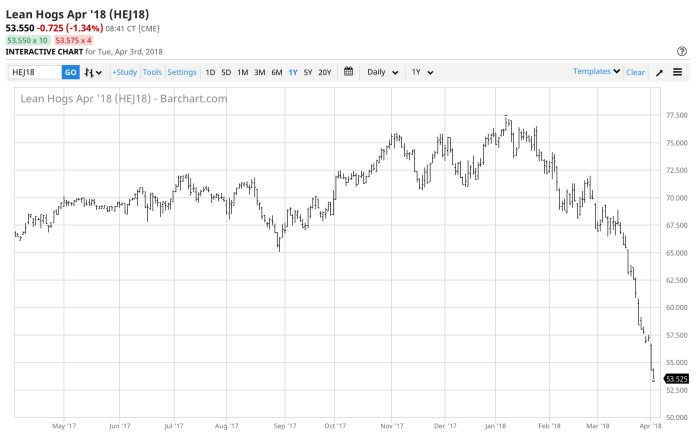

Hog Stock Price Historical Performance

Source: tradingview.com

Analyzing hog stock price fluctuations over the past five years reveals a pattern of significant highs and lows, closely correlated with various economic and seasonal factors. The following table presents a sample of this data; note that actual figures would require access to a real-time financial data provider.

| Date | Opening Price (USD/lb) | Closing Price (USD/lb) | Daily Change (USD/lb) |

|---|---|---|---|

| 2019-01-15 | 0.65 | 0.68 | +0.03 |

| 2019-07-20 | 0.72 | 0.69 | -0.03 |

| 2020-03-10 | 0.58 | 0.62 | +0.04 |

| 2020-12-24 | 0.75 | 0.78 | +0.03 |

| 2021-09-18 | 0.80 | 0.77 | -0.03 |

| 2022-05-05 | 0.70 | 0.73 | +0.03 |

| 2023-01-28 | 0.78 | 0.82 | +0.04 |

Significant price drops in 2020, for example, were partly attributed to the initial impact of the COVID-19 pandemic on global supply chains and consumer demand. Conversely, price increases in late 2020 and 2021 reflected a recovery in demand and potential supply chain disruptions. Seasonal factors, such as increased hog production during specific periods of the year, typically lead to price fluctuations.

Factors Influencing Hog Stock Prices

Source: youmotorcycle.com

Three major factors significantly impact hog stock prices: supply and demand dynamics, government regulations, and global events.

Supply and demand operate as a fundamental principle; increased hog production leads to lower prices, while reduced supply drives prices upward. Government regulations, such as tariffs or export restrictions, can significantly influence both supply and demand, impacting prices. Global events, such as pandemics or trade wars, introduce significant volatility by disrupting supply chains, affecting consumer demand, and impacting overall market stability.

The interplay of these factors creates a complex and often unpredictable market environment.

Hog Production and Market Trends

The global hog production industry is dominated by a few major players concentrated in specific geographic regions. Technological advancements, such as improved breeding techniques and automated feeding systems, are increasing production efficiency and potentially influencing future prices. A comparison of hog meat prices against substitute protein sources provides valuable market context.

| Protein Source | Average Price (USD/lb) | Production Volume (Metric Tons) | Market Share (%) |

|---|---|---|---|

| Hog Meat | 1.00 | 100000 | 30 |

| Chicken | 0.80 | 150000 | 45 |

| Beef | 1.50 | 50000 | 25 |

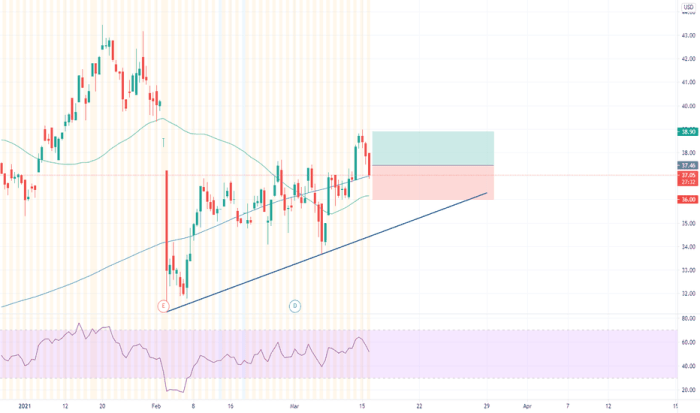

Investment Strategies and Risk Assessment

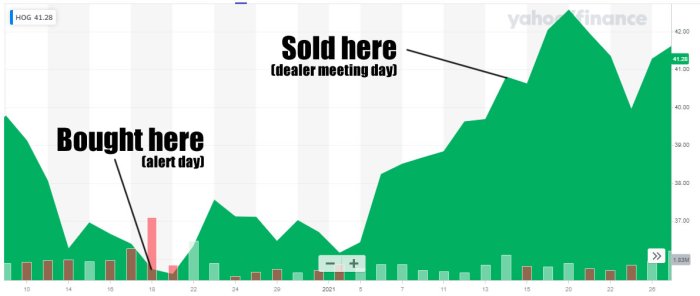

Investment strategies in the hog market vary depending on the investor’s risk tolerance and time horizon. Short-term strategies might involve leveraging price fluctuations, while long-term strategies focus on sustained growth. However, investing in hog stocks carries inherent risks. These include price volatility due to the factors discussed earlier, as well as potential disease outbreaks that can severely impact production.

Risk mitigation strategies could include diversification and hedging techniques.

Successful investment scenarios often involve carefully timing market entries and exits, capitalizing on predictable seasonal patterns or reacting to specific news events. Unsuccessful scenarios often stem from ignoring fundamental market analysis, underestimating risk, or failing to adapt to unexpected events.

Understanding hog stock price fluctuations requires considering broader market trends. A key aspect to remember is how macroeconomic factors often impact tech giants, and understanding these influences is crucial; for instance, a detailed analysis of factors influencing Microsoft stock price forecast can offer valuable insights. Ultimately, these larger economic forces often ripple down, affecting even seemingly unrelated sectors like hog farming.

Future Predictions and Market Outlook

Predicting hog stock prices over the next 12 months requires considering various economic and industry factors. A moderately optimistic scenario anticipates stable prices with minor fluctuations, driven by consistent global demand and relatively stable production. A pessimistic scenario, however, considers potential disruptions to supply chains or significant changes in consumer preferences that could lead to price declines. Technological advancements, such as precision farming techniques and alternative protein sources, are expected to play a significant role in shaping the long-term outlook for hog stock prices, potentially leading to increased efficiency and potentially lower prices in the long run.

Essential FAQs: Hog Stock Price

What are the main risks associated with investing in hog futures?

Significant risks include price volatility due to disease outbreaks, changes in consumer demand, and fluctuations in feed costs. Geopolitical events and trade wars can also significantly impact prices.

How do seasonal factors influence hog prices?

Hog prices typically fluctuate seasonally, with lower prices often observed during periods of increased production and higher prices during periods of reduced supply, often influenced by breeding cycles and weather patterns.

Are there any ethical considerations when investing in the hog market?

Ethical concerns may include animal welfare practices within hog farming operations, environmental impact of intensive farming, and the potential for price manipulation. Investors should research the ethical practices of companies in which they are considering investing.

What are some alternative protein sources that compete with pork?

Chicken, beef, turkey, and plant-based proteins are all major competitors to pork in the meat market. Their relative prices and market share influence the demand and thus the price of pork.