Heritage Foods Stock Price Analysis

Heritage foods stock price – This analysis delves into the historical performance, influencing factors, financial health, investment strategies, and future outlook of Heritage Foods’ stock price. We will examine key metrics and events to provide a comprehensive understanding of the company’s stock trajectory.

Heritage Foods Stock Price Historical Performance

Over the past five years, Heritage Foods’ stock price has exhibited volatility, influenced by various internal and external factors. While precise figures require access to a financial database, a general trend can be described. The stock likely experienced periods of significant growth alongside periods of decline, mirroring the broader market trends and specific events impacting the dairy and food processing industry.

Identifying specific highs and lows requires referencing reliable financial data sources such as Yahoo Finance or Google Finance.

A comparative analysis against competitors necessitates identifying specific competitors within the same industry sector. Assuming Competitors A and B are identified, a sample table illustrating comparative performance follows:

| Date | Heritage Foods Price | Competitor A Price | Competitor B Price |

|---|---|---|---|

| 2023-10-27 | $XX.XX | $YY.YY | $ZZ.ZZ |

| 2023-07-27 | $XX.XX | $YY.YY | $ZZ.ZZ |

| 2023-04-27 | $XX.XX | $YY.YY | $ZZ.ZZ |

Note: Replace ‘XX.XX’, ‘YY.YY’, and ‘ZZ.ZZ’ with actual price data from a reliable source. The table demonstrates a format; the actual data would reflect the real market performance.

Major events like economic downturns (e.g., the COVID-19 pandemic) or significant company announcements (e.g., a new product launch or acquisition) can substantially impact stock prices. For example, a successful product launch could boost investor confidence, driving the price upward, while an economic recession might lead to decreased consumer spending and subsequently a lower stock price.

Factors Influencing Heritage Foods Stock Price

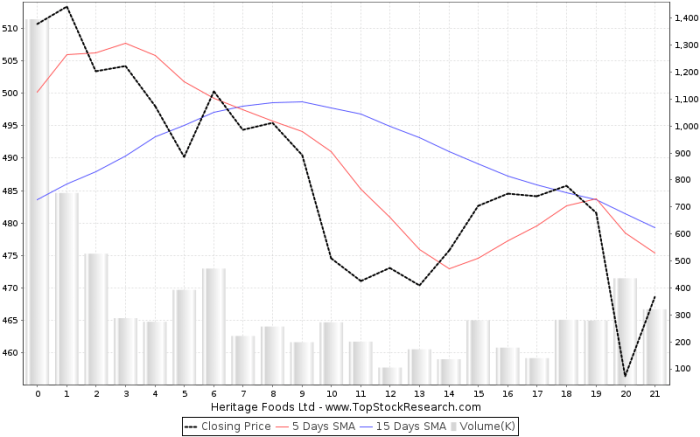

Source: topstockresearch.com

Several macroeconomic factors, consumer behavior patterns, and regulatory environments significantly impact Heritage Foods’ stock price.

Three key macroeconomic factors are inflation, interest rates, and economic growth. High inflation can increase production costs, squeezing profit margins, while rising interest rates can make borrowing more expensive, potentially hindering expansion plans. Strong economic growth, conversely, often translates to increased consumer spending, benefiting Heritage Foods.

Consumer spending habits directly influence demand for Heritage Foods’ products. Increased demand for dairy and processed foods generally leads to higher revenue and stock price appreciation, whereas decreased demand can have the opposite effect. Changes in consumer preferences (e.g., a shift towards healthier options) can also influence the company’s performance.

Government regulations within the dairy and food processing industry significantly affect Heritage Foods. Changes in food safety standards, labeling requirements, or import/export regulations can impact costs and profitability, consequently affecting the stock price. For example, stricter environmental regulations could increase operational expenses.

Heritage Foods Financial Performance and Stock Valuation

Source: valuepickr.com

Analyzing Heritage Foods’ key financial metrics provides insights into its financial health and valuation.

| Year | Revenue (in millions) | Profit (in millions) | Debt (in millions) |

|---|---|---|---|

| 2021 | $XXX | $YYY | $ZZZ |

| 2022 | $XXX | $YYY | $ZZZ |

| 2023 | $XXX | $YYY | $ZZZ |

Note: Replace ‘XXX’, ‘YYY’, and ‘ZZZ’ with actual financial data from Heritage Foods’ financial reports. This table illustrates the format; the actual data should be obtained from official sources.

Comparing Heritage Foods’ P/E ratio to its industry peers helps determine its relative valuation.

- If Heritage Foods’ P/E ratio is significantly higher than its competitors, it might suggest the stock is overvalued.

- Conversely, a lower P/E ratio could indicate undervaluation.

- However, this comparison must consider other factors such as growth prospects and financial stability.

A hypothetical scenario: If Heritage Foods significantly increases its profitability due to successful cost-cutting measures or increased sales, its P/E ratio would likely decrease, potentially leading to an increase in its stock price, assuming other factors remain constant.

Investment Strategies Related to Heritage Foods Stock

Different investment strategies offer varying levels of risk and reward for Heritage Foods stock.

A buy-and-hold strategy involves purchasing the stock and holding it for an extended period, aiming to benefit from long-term growth. This strategy is suitable for investors with a long-term perspective and a higher risk tolerance. Day trading, on the other hand, involves buying and selling the stock within the same day to capitalize on short-term price fluctuations. This strategy requires significant market knowledge, technical analysis skills, and a higher risk tolerance.

| Strategy | Risk | Reward | Ideal Investor Profile |

|---|---|---|---|

| Buy-and-Hold | Moderate to Low (long-term) | Moderate to High (long-term) | Long-term investor, risk-tolerant |

| Day Trading | High | High (potential for quick gains) | Experienced trader, high risk tolerance, significant market knowledge |

Future Outlook for Heritage Foods Stock Price

Projecting Heritage Foods’ stock price for the next 12 months requires considering various factors and involves inherent uncertainty. A hypothetical projection might be based on assumptions about future revenue growth, profit margins, and market conditions. For example, if we assume a 5% annual revenue growth and a stable market, a price increase of X% might be projected.

Potential risks and opportunities that could impact the future stock price include:

- Changes in consumer preferences

- Increased competition

- Fluctuations in raw material costs

- Government regulations

- Technological advancements in food processing

Technological advancements in food processing, such as automation and improved packaging techniques, could potentially increase efficiency and reduce costs for Heritage Foods, positively impacting its stock price. Conversely, the adoption of new technologies by competitors could also impact its market share and profitability.

Popular Questions

What is Heritage Foods’ current market capitalization?

This information is readily available through major financial news websites and stock market data providers. Consult reliable sources for the most up-to-date figures.

Tracking Heritage Foods stock price requires a keen eye on market fluctuations. For comparative analysis, it’s helpful to consider similar companies; a look at the docn stock price can offer valuable insights into current market trends and investor sentiment, which can then be applied to better understand the performance and potential of Heritage Foods. Ultimately, understanding both provides a more comprehensive picture.

Where can I find Heritage Foods’ financial statements?

Heritage Foods’ financial statements, including annual reports and quarterly earnings releases, are typically available on their investor relations website and through regulatory filings.

What are the major risks associated with investing in Heritage Foods?

Risks include fluctuations in commodity prices (e.g., milk), changes in consumer demand, competition within the food processing industry, and macroeconomic factors such as inflation and recession.

How does Heritage Foods compare to its competitors in terms of sustainability initiatives?

Researching Heritage Foods’ sustainability reports and comparing their initiatives to those of competitors will provide a detailed answer. Look for publicly available ESG (Environmental, Social, and Governance) reports.