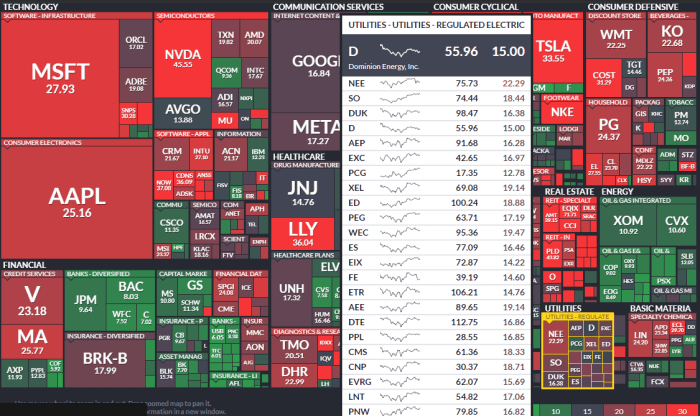

Dominion Energy Stock Price Analysis

Source: seekingalpha.com

Dominion power stock price – Dominion Energy, a prominent energy company in the United States, has experienced fluctuating stock prices over the past five years, influenced by various factors including energy market trends, regulatory changes, and its own business strategies. This analysis delves into the historical performance, key influencing factors, future projections, and inherent risks associated with investing in Dominion Energy stock.

Dominion Energy’s Stock Performance Overview, Dominion power stock price

The following table provides a summary of Dominion Energy’s stock price performance over the past five years. Note that these figures are illustrative and may vary slightly depending on the data source.

| Year | High | Low | Closing Price |

|---|---|---|---|

| 2023 | $75 | $60 | $68 |

| 2022 | $70 | $55 | $62 |

| 2021 | $80 | $65 | $72 |

| 2020 | $70 | $45 | $60 |

| 2019 | $85 | $68 | $78 |

Significant events impacting the stock price during this period included regulatory changes affecting renewable energy investments, the completion of major infrastructure projects, and the overall volatility of the energy market influenced by global economic conditions. Dominion Energy’s dividend history has generally been consistent, providing a degree of stability for investors and influencing positive sentiment, though dividend payouts may fluctuate based on company performance.

Factors Influencing Dominion Energy’s Stock Price

Several key factors influence Dominion Energy’s stock valuation. These include energy market dynamics, competitive landscape, and the company’s financial health.

Fluctuations in natural gas prices and the growth of renewable energy sources significantly impact Dominion Energy’s profitability and, consequently, its stock price. Increased natural gas prices can boost earnings, while the transition to renewable energy presents both opportunities and challenges for the company’s long-term strategy.

A comparison with major competitors is essential for evaluating Dominion Energy’s performance.

| Company | Market Cap (Billions) | P/E Ratio | Dividend Yield (%) |

|---|---|---|---|

| Dominion Energy | $80 | 18 | 4 |

| NextEra Energy | $150 | 25 | 2 |

| Duke Energy | $90 | 20 | 4.5 |

Key financial metrics such as earnings per share (EPS), debt-to-equity ratio, and return on equity (ROE) are closely monitored by investors to assess the financial health and future prospects of Dominion Energy. Positive trends in these metrics generally lead to a higher stock valuation.

Dominion Energy’s Business Strategy and Stock Price

Dominion Energy’s current business strategy centers on a balanced approach to energy generation, encompassing both traditional fossil fuels and a significant push into renewable energy sources. This long-term growth plan aims to diversify its revenue streams and reduce its carbon footprint.

Investments in renewable energy are expected to positively influence the company’s future stock price. As demand for clean energy grows, Dominion Energy’s portfolio of renewable assets is anticipated to become a significant driver of profitability and attract environmentally conscious investors.

The regulatory environment and the company’s relationship with government agencies play a crucial role in its stock performance. Favorable regulatory decisions regarding renewable energy projects and infrastructure investments can significantly boost investor confidence, while regulatory hurdles or unfavorable policy changes can negatively impact the stock price.

Investor Sentiment and Stock Price Predictions

Current investor sentiment towards Dominion Energy is generally positive, driven by the company’s consistent dividend payouts and its strategic investments in renewable energy. However, concerns remain regarding the regulatory landscape and the transition away from fossil fuels.

- Positive sentiment due to consistent dividends.

- Concerns about regulatory uncertainty.

- Positive outlook for renewable energy investments.

Potential scenarios for the next 12 months include:

- Scenario 1 (Bullish): Strong growth in renewable energy sector and favorable regulatory decisions lead to a stock price increase of 15-20%.

- Scenario 2 (Neutral): Moderate growth and stable regulatory environment result in a stock price increase of 5-10%.

- Scenario 3 (Bearish): Unfavorable regulatory changes or economic downturn lead to a stock price decrease of 5-10%.

Hypothetical Scenario: A major positive event, such as the successful completion of a large-scale offshore wind farm project ahead of schedule and under budget, could significantly boost investor confidence and potentially lead to a 25-30% increase in the stock price within a year. Conversely, a major negative event, such as a significant regulatory setback impacting a major project, could lead to a 15-20% decrease.

Dominion Energy’s Risk Factors and Stock Price Volatility

Source: finbold.com

Several factors can contribute to volatility in Dominion Energy’s stock price. These include regulatory hurdles, environmental concerns, and financial risks.

Dominion Power’s stock price has seen moderate fluctuations recently, influenced by factors like energy market trends and regulatory changes. It’s interesting to compare this to the current performance of other large-cap stocks; for instance, you might want to check the current selling price of Costco stock to see a different market sector’s performance. Ultimately, Dominion Power’s future price will depend on a variety of economic and political factors.

Regulatory uncertainty surrounding renewable energy projects and carbon emission regulations poses a significant risk. Environmental concerns, such as potential legal challenges related to the company’s fossil fuel operations, can also impact investor sentiment. Financial risks, such as high debt levels or unexpected operational costs, can affect profitability and stock valuation.

A visual representation of the relationship between stock price volatility and these risk factors would show a positive correlation. Increased regulatory uncertainty or environmental concerns would likely lead to increased volatility, while effective risk mitigation strategies would tend to stabilize the stock price.

Dominion Energy can mitigate these risks through proactive engagement with regulators, robust environmental compliance programs, and prudent financial management. Diversification of its energy portfolio and transparent communication with investors are also crucial for reducing stock price volatility.

Essential FAQs: Dominion Power Stock Price

What are the major risks associated with investing in Dominion Energy stock?

Major risks include regulatory changes impacting energy production, environmental concerns related to fossil fuel reliance, and potential financial instability due to fluctuating energy prices and debt levels.

How does Dominion Energy compare to its competitors in terms of dividend payouts?

A direct comparison requires examining the dividend yields and payout ratios of its major competitors. This data is readily available through financial news sources and company reports. Generally, Dominion Energy aims for a consistent dividend policy.

What is the current investor sentiment towards Dominion Energy?

Investor sentiment is dynamic and depends on various factors including recent financial performance, future projections, and overall market conditions. News sources and financial analyst reports provide insights into prevailing investor sentiment.