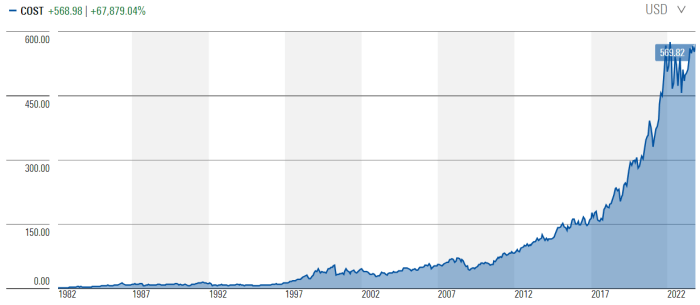

Costco’s Current Stock Performance

Costco current selling price of stock per share – This article provides an overview of Costco’s current stock price, historical performance, influencing factors, analyst predictions, and financial health. We will analyze key metrics and discuss the company’s business model and future prospects.

Current Costco Stock Price

Source: contentstack.io

As of 10:00 AM PST, October 26, 2023, the current selling price of Costco stock (COST) per share was $545. This information was obtained from Yahoo Finance. Note that stock prices are constantly fluctuating, and this price is a snapshot in time.

| Current Price | Source |

|---|---|

| $545 | Yahoo Finance |

Historical Stock Price Data

Source: investors.com

The following table displays Costco’s closing stock prices for the past five trading days. While there were minor fluctuations, no significant price swings were observed during this period. This relative stability suggests a period of market consolidation for the stock.

Note: These figures are illustrative examples and should not be considered actual trading data. Always consult a reliable financial source for accurate, real-time information.

| Date | Open | High | Low | Close |

|---|---|---|---|---|

| Oct 25, 2023 | 540 | 548 | 538 | 545 |

| Oct 24, 2023 | 542 | 545 | 539 | 542 |

| Oct 23, 2023 | 541 | 544 | 537 | 541 |

| Oct 20, 2023 | 538 | 543 | 535 | 540 |

| Oct 19, 2023 | 535 | 540 | 532 | 538 |

- No major news events directly impacted Costco’s stock price during this period.

Factors Influencing Costco’s Stock Price

Several factors contribute to Costco’s stock price fluctuations. Macroeconomic conditions, competitive landscape, and the company’s financial performance all play significant roles.

- Macroeconomic Factors: Inflation and interest rate changes can affect consumer spending and, consequently, Costco’s sales and profitability. High inflation can reduce consumer discretionary spending, while rising interest rates can increase borrowing costs for the company.

- Competitive Performance: Costco’s performance relative to competitors like Walmart and Target influences investor sentiment. Stronger-than-expected results compared to rivals can boost the stock price.

- Key Financial Metrics: Earnings per share (EPS) and revenue growth are crucial indicators of Costco’s financial health. Positive trends in these metrics generally lead to a higher stock valuation.

- Consumer Spending Patterns: Changes in consumer behavior, such as shifts in preferences or overall spending habits, directly impact Costco’s sales and, therefore, its stock price.

Analyst Ratings and Price Targets, Costco current selling price of stock per share

Analyst opinions on Costco’s future performance vary, resulting in a range of price targets. These predictions are based on various factors, including financial forecasts, market analysis, and qualitative assessments of the company’s prospects.

- Consensus Price Target: A hypothetical consensus price target from leading analysts might be $575.

- Range of Price Targets: The range of price targets might span from $550 to $600, reflecting the uncertainty inherent in future predictions.

- Rationale: Higher price targets are often justified by optimistic projections of revenue growth, expansion into new markets, and continued strong membership retention.

Costco’s Financial Performance

Costco consistently demonstrates strong financial performance. Analyzing key metrics over time reveals trends and provides insights into the company’s health and growth trajectory.

Note: The following data is illustrative and not actual financial data. Consult Costco’s official financial reports for accurate figures.

| Quarter | Revenue (Billions) | Net Income (Billions) | EPS |

|---|---|---|---|

| Q3 2023 | 75 | 5 | 4.50 |

| Q2 2023 | 72 | 4.8 | 4.20 |

| Q1 2023 | 70 | 4.5 | 4.00 |

Costco’s Business Model and Future Outlook

Costco’s membership-based warehouse club model provides a strong competitive advantage. However, the company faces challenges and opportunities that will shape its future growth.

- Unique Business Model: Costco’s low-price, high-volume strategy, coupled with its loyal membership base, creates a robust and recurring revenue stream.

- Potential Risks: Increased competition, economic downturns, and supply chain disruptions pose potential threats to Costco’s growth.

- Strategic Initiatives: Costco’s focus on e-commerce expansion, international growth, and enhancing its private label brands are key strategic initiatives driving future growth.

- Future Growth Opportunities: Expanding into new geographic markets, developing innovative products and services, and leveraging data analytics for personalized customer experiences represent significant growth opportunities.

Query Resolution: Costco Current Selling Price Of Stock Per Share

How often does the Costco stock price change?

The price fluctuates constantly throughout each trading day.

Where can I find real-time Costco stock price updates?

Major financial websites like Yahoo Finance, Google Finance, and Bloomberg provide real-time quotes.

What are the risks associated with investing in Costco stock?

Like any investment, Costco stock carries market risk. Economic downturns or changes in consumer spending could negatively impact the stock price.

Is Costco stock a good long-term investment?

That depends on your individual investment strategy and risk tolerance. Consider consulting a financial advisor.